By InvestMacro Research

The fourth quarter of 2025 is underway and earnings reports are coming in. I wanted to highlight some of the top companies that have been added to our Cosmic Rays Watchlist in the past couple of weeks.

Quick Overview:

The Problem: Finding Stock Ideas to fill out a diversified portfolio of different Sectors, Industries amid the various Market Caps.

What is our Watchlist: The Cosmic Rays Watchlist is the output from our proprietary fundamental analysis algorithm. This list scans dividend-paying companies every quarter (from the NYSE & Nasdaq stock exchanges) and analyzes numerous fundamental metrics to weigh these stocks against their peers and sectors. The ones that come out with a 50 point score or more are then added to our watch list. From there, we do a deeper dive, focusing on their story, their potential for future earnings, and momentum. We also use a trend-following trading strategy or other technical analytics to help us buy and sell at the appropriate times.

Be aware the fundamental system does not take the stock price as a direct element in our rating so one must compare each idea with their current stock prices (i.e., this is not a timing tool).

Most studies are consistently showing overvalued markets and that has to be taken into consideration with any stock market idea. As with all investment ideas, past performance does not guarantee future results. A stock added to our list is not a recommendation to buy or sell the security.

Here we go with 5 of our Top Stocks scored in Q3 2024:

Taiwan Semiconductor Manufacturing Company Limited (TSM):

Taiwan Semiconductor Manufacturing Company Limited (Symbol: TSM) was recently added to our Cosmic Rays WatchList. TSM scored a 67 in our fundamental rating system on October 20, 2025.

At time of writing, only 4.31% of stocks have scored a 60 or better out of a total of 14,496 scores in our earnings database. This stock has made our Watchlist a total of 5 times and rose by 10 system points from our last update.

TSM is a Mega Cap stock and part of the Technology sector. The industry focus for TSM is Semiconductors.

TSM has beaten its earnings-per-share estimates for the past four quarters and currently pays a 1% dividend with a 32% payout ratio. TSM’s stock price has had a banner year with over a 45% gain year-to-date.

Company Description (courtesy of SEC.gov):

Taiwan Semiconductor Manufacturing Company Limited, together with its subsidiaries, manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Company Website: https://www.tsmc.com

Asset vs Sector Benchmark: *P/E Ratio (TTM) *52-Week Price Return – Stock: Taiwan Semiconductor Manufacturing Company Limited (TSM) 30.36 48.45 – Benchmark Symbol: XLK 41.44 30.6

* Data through October 27, 2025

América Móvil, S.A.B. de C.V. (AMX):

América Móvil, S.A.B. de C.V. (Symbol: AMX) was recently added to our Cosmic Rays WatchList. AMX scored a 80 in our fundamental rating system on October 16, 2025.

At time of writing, only 0.61% of stocks have scored a 80 or better out of a total of 14,496 scores in our earnings database. This stock has made our Watchlist a total of 4 times and rose by 87 system points from our last update.

AMX is a Large Cap stock and part of the Communication Services sector. The industry focus for AMX is Telecommunications Services.

AMX has narrowly missed its last two quarterly earnings per share expectations while AMX currently pays a 2.5% dividend with a 60% payout ratio. AMX’s stock price has made a huge leap this year in its year-to-date gain.

Company Description (courtesy of SEC.gov):

América Móvil, S.A.B. de C.V. provides telecommunications services in Latin America and internationally. The company offers wireless and fixed voice services, including local, domestic, and international long-distance services; and network interconnection services. It also provides data services, such as data centers, data administration, and hosting services to residential and corporate clients; value-added services, including Internet access, m

Company Website: https://www.americamovil.com

Asset vs Sector Benchmark: *P/E Ratio (TTM) *52-Week Price Return – Stock: América Móvil, S.A.B. de C.V. (AMX) 18.42 36.93 – Benchmark Symbol: XLC 20.42 31.1

* Data through October 27, 2025

Community Trust Bancorp, Inc. (CTBI):

Community Trust Bancorp, Inc. (Symbol: CTBI) was recently added to our Cosmic Rays WatchList. CTBI scored a 54 in our fundamental rating system on October 17, 2025.

At time of writing, only 7.60% of stocks have scored a 50 or better out of a total of 14,496 scores in our earnings database. This stock is on our Watchlist for the first time and rose by 28 system points from our last update.

CTBI is a Small Cap stock and part of the Financial Services sector. The industry focus for CTBI is Banks – Regional.

This stock currently has a 4% dividend with a payout ratio around 40%. CTBI has beaten its earnings per share estimates three out of the past four quarters, with the last quarter narrowly missing. Latest research opinions are mixed, with a Buy opinion, a Bullish opinion, and a few Neutrals. CTBI is up by approximately 1% year-to-date.

Company Description (courtesy of SEC.gov):

Community Trust Bancorp, Inc. operates as the bank holding company for Community Trust Bank, Inc. that provides commercial and personal banking services to small and mid-sized communities. The company accepts time and demand deposits, checking accounts, savings accounts and savings certificates, individual retirement accounts and Keogh plans, and money market accounts.

Company Website: https://www.ctbi.com

Asset vs Sector Benchmark: *P/E Ratio (TTM) *52-Week Price Return – Stock: Community Trust Bancorp, Inc. (CTBI) 9.57 0.82 – Benchmark Symbol: XLF 19.62 13.0

* Data through October 27, 2025

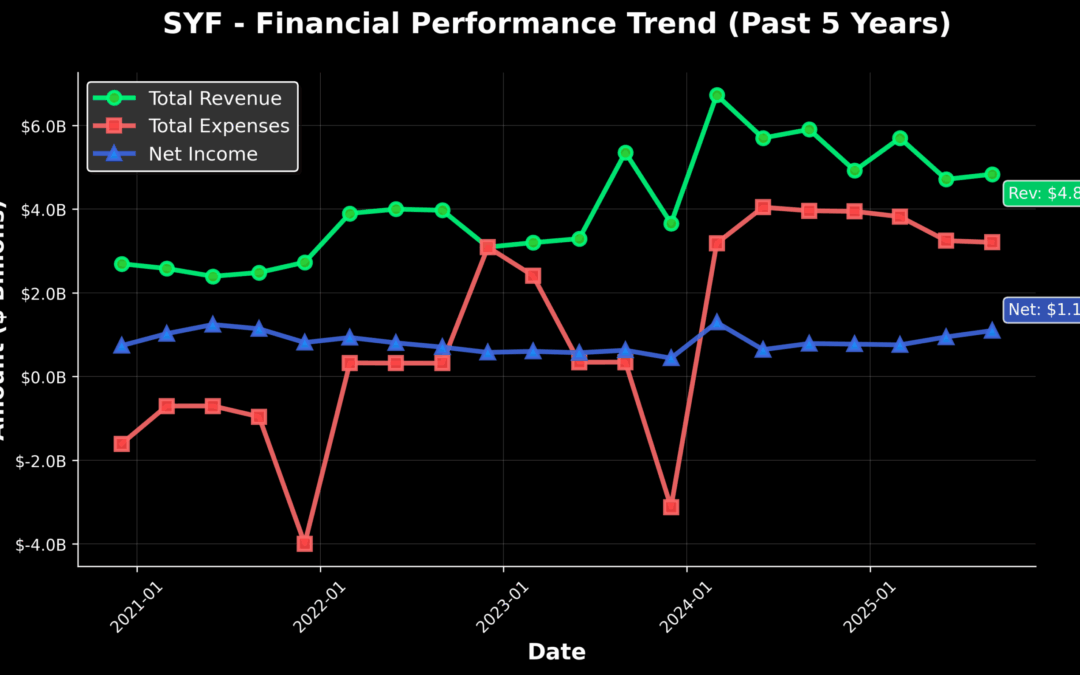

Synchrony Financial (SYF):

Synchrony Financial (Symbol: SYF) was recently added to our Cosmic Rays WatchList. SYF scored a 82 in our fundamental rating system on October 17, 2025.

At time of writing, only 0.61% of stocks have scored a 80 or better out of a total of 14,496 scores in our earnings database. This stock has made our Watchlist a total of 10 times and rose by 20 system points from our last update.

SYF is a Large Cap stock and part of the Financial Services sector. The industry focus for SYF is Financial – Credit Services.

This stock has a 1.65% dividend with an approximate payout ratio of 13%. Overall, SYF has beaten its earnings per share estimates three out of the last four quarters, with the last quarter narrowly missing. Analyst research opinions are mixed, with a Buy opinion, a Bullish opinion, and a few Neutrals.

Company Description (courtesy of SEC.gov):

Synchrony Financial, together with its subsidiaries, operates as a consumer financial services company in the United States. It provides credit products, such as credit cards, commercial credit products, and consumer installment loans.

Company Website: https://www.synchrony.com

Asset vs Sector Benchmark: *P/E Ratio (TTM) *52-Week Price Return – Stock: Synchrony Financial (SYF) 8.08 36.21 – Benchmark Symbol: XLF 19.62 13.0

* Data through October 27, 2025

Telefonaktiebolaget LM Ericsson (ERIC):

Telefonaktiebolaget LM Ericsson (publ) (Symbol: ERIC) was recently added to our Cosmic Rays WatchList. ERIC scored a 63 in our fundamental rating system on October 16, 2025.

At time of writing, only 4.31% of stocks have scored a 60 or better out of a total of 14,496 scores in our earnings database. This stock is on our Watchlist for the first time and rose by 60 system points from our last update.

ERIC is a Large Cap stock and part of the Technology sector. The industry focus for ERIC is Communication Equipment.

Ericsson has an approximate dividend of 3% with a payout ratio near 40%. Ericsson has beaten its earnings per share estimates for the last three quarters running.

Company Description (courtesy of SEC.gov):

Telefonaktiebolaget LM Ericsson (publ), together with its subsidiaries, provides communication infrastructure, services, and software solutions to the telecom and other sectors. It operates through four segments: Networks, Digital Services, Managed Services, and Emerging Business and Other. The Networks segment offers radio access network solutions for various network spectrum bands, including integrated high-performing hardware and software. Thi

Company Website: https://www.ericsson.com

Asset vs Sector Benchmark: *P/E Ratio (TTM) *52-Week Price Return – Stock: Telefonaktiebolaget LM Ericsson (publ) (ERIC) 14.77 12.25 – Benchmark Symbol: XLK 41.44 30.6

* Data through October 27, 2025

By InvestMacro – Be sure to join our stock market newsletter to get our updates and to see more top companies we add to our stock watch list.

All information, stock ideas and opinions on this website are for general informational purposes only and do not constitute investment advice. Stock scores are a data driven process through company fundamentals and are not a recommendation to buy or sell a security. Company descriptions provided by sec.gov.

- GBP/USD Finds a Floor at 1.3200 After Fed-Induced Sell-Off Oct 30, 2025

- A Key Day for EUR/USD as the Fed Decision Looms Oct 29, 2025

- The British Index UK100 hit a new all-time high. The Australian dollar strengthened, reaching a three-week high Oct 29, 2025

- The US and China representatives reached a preliminary trade agreement. Saudi Arabia is once again leaning towards increasing oil production Oct 28, 2025

- Gold Rebounds to 4,000 USD Mark Oct 28, 2025

- USD/JPY Tests Key February Highs Oct 27, 2025

- US stock indices set price records amid soft inflation data Oct 27, 2025

- US government shutdown enters fourth week. Oil jumps amid new sanctions against Russia Oct 24, 2025

- EUR/USD Consolidates Ahead of Potential Further Losses Oct 24, 2025

- Oil prices surged following new sanctions against top Russian oil companies. The Mexican peso remains in demand Oct 23, 2025