India’s consumer landscape is shifting in various ways which keeps retailers on toes. Recently released Household Consumption Expenditure Survey data showed Indians are spending less on food, particularly staples like rice and wheat, and more on discretionary items such as processed food, as well as durables like televisions and fridges. Already a premiumisation trend is sweeping across categories for the past few years.

Charting out shifts in India’s retail sector, a joint study by Boston Consulting Group (BCG) and Retailers Association of India (RAI) brings good news as well as bad news for Indian retailers. The good news is Indian retailers have a vast business growth opportunity to capture. India continues to be a bright spot among top global economies with a robust GDP growth of 7% in 2023. It is projected to overtake Germany & Japan to claim the 3rd spot by 2030. Private consumption at the same time remains strong. India retail is expected to reach $2 trillion in the next 10 years and presents a large opportunity for retailers, says the report titled ‘Unlocking the $2Tn retail opportunity in the next decade’.

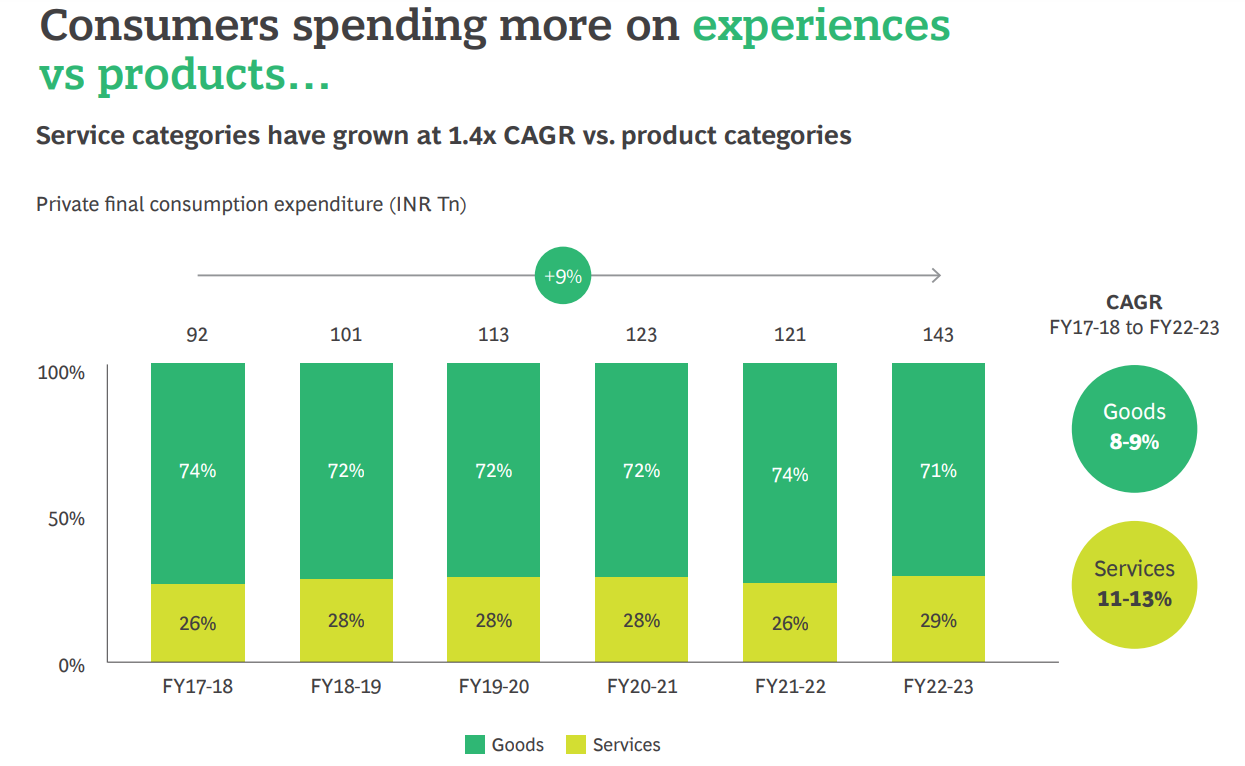

As retail is going through key shifts, the pace of growth is influenced by several factors such as steady growth in disposable incomes, return of store expansion, momentum through small formats, increase in affluence impacting categories differentially, varied mix of volume and average selling price, steady increase in urbanization and relatively slower growth for e-commerce versus recent past. One worrying trend is a discernible shift in spending to experiences and increased savings, says the report. Indian consumers are increasingly spending more on experience than on products, creating an ‘experience economy’ which poses a challenge to consumer good retailers despite a vast growth potential ahead.What is the ‘experience economy’?

The term ‘experience economy’ was popularised by B. Joseph Pine II and James H. Gilmore who wrote in Harvard Business Review in 1998 about the emerging consumer trend in the US.

Pine II and Gilmore described this shift in consumer preference over a long period of time with the example of a cake. “The entire history of economic progress can be recapitulated in the four-stage evolution of the birthday cake,” they wrote. “As a vestige of the agrarian economy, mothers made birthday cakes from scratch, mixing farm commodities (flour, sugar, butter, and eggs) that together cost mere dimes. As the goods-based industrial economy advanced, moms paid a dollar or two to Betty Crocker for premixed ingredients. Later, when the service economy took hold, busy parents ordered cakes from the bakery or grocery store, which, at $10 or $15, cost ten times as much as the packaged ingredients. Now, in the time-starved 1990s, parents neither make the birthday cake nor even throw the party. Instead, they spend $100 or more to “outsource” the entire event to Chuck E. Cheese’s, the Discovery Zone, the Mining Company, or some other business that stages a memorable event for the kids—and often throws in the cake for free. Welcome to the emerging experience economy.”

In India, the experience economy has been unleashed by millennials who would rather choose to go for adventure travel than buying an expensive pair of sneakers.

Today, a recent college grad is likely more interested in a backpacking trip to Machu Picchu or a week on a beach rather than acquiring luxury goods. Experiential spending also got a big boost from the pandemic when people were locked into homes but yearned for experiences when the pandemic faded.

Indians moving from product to experience

The BCG and RAI report shows that service categories have grown at 1.4x CAGR against product categories in the past three years. Product categories include food, beverages & tobacco (fresh food & dairy, staples, packaged foods & beverages, tobacco); clothing & footwear; housing & household products, and health (health goods), while services include medical and health services, transport & communication, education, holidays/entertainment, eating out/ordering food, leisure travel, activity classes, and other services such as insurance premiums and personal care.

Another related challenge for retailers is an increasing share of income on savings/investments. The report points out 28% increase in SIP contribution, 30% growth in demat accounts and 3 percentage point increase in health insurance penetration in the past three years.

In India, the experience economy has been growing for the past few years. A Mastercard Economic Institute report titled ‘Travel 2022: Trends & Transitions’, had highlighted that travellers have begun spending more on experiences than material things. A Deloitte Touche Tohmatsu India LLP report too had pointed out the trend in 2021. After spending over a year and a half within the confines of their homes due to the pandemic, Indian consumers were living in the moment and indulging in luxury and experience-oriented spending. The analysis indicated that despite inflation, consumers were prioritising personal care and well-being as the world gradually adjusts itself to a life after the pandemic.

It said 85 per cent consumers planned to spend on leisure travel in the next four weeks; 50 per cent respondents were spending more on experiences than on goods; and 65 per cent consumers felt safe to take a flight and stay in a hotel.

Last year, a Redseer report too had pointed out consumer spending shifting to experiences. Despite pandemic-driven setbacks in the recent past, India’s private consumption has been growing stronger since 2019 and reflects an increasing tendency to spend in categories that are driven by prosperity, said the report. It pointed out that Indians were less willing to spend on home upkeep items than splurging on travel.

Probably in response to this trend, Indian retailers are emphasizing on experience while selling goods to consumers. Retailers across categories are opening bigger bricks-and-mortar stores along with expanding their existing stores as consumers are increasingly looking for a better experience in physical retail, real estate services firm Anarock had said a few months ago. According to Anarock data, the share of stores smaller than 2,000 square feet declined to 52% in the first half of 2023-24, as against 61% a year ago. The share of stores sized 2,000-5,000 sq ft increased during this period, to 21% from 19%, as did that of those sized 5,000-10,000 sq ft (11% from 9%) and 10,000-15,000 sq ft (13% from 9%).

“Store is now more about experience than merchandising. Brands have realised that and by expanding the store they are expanding the offering,” Pankaj Renjhen, COO and joint MD, Anarock Retail, had said.