London based Retail FX and CFDs broker ActivTrades has released its financial results for 2023, indicating a continued slide in both top and bottom line results which began in the second half of 2022.

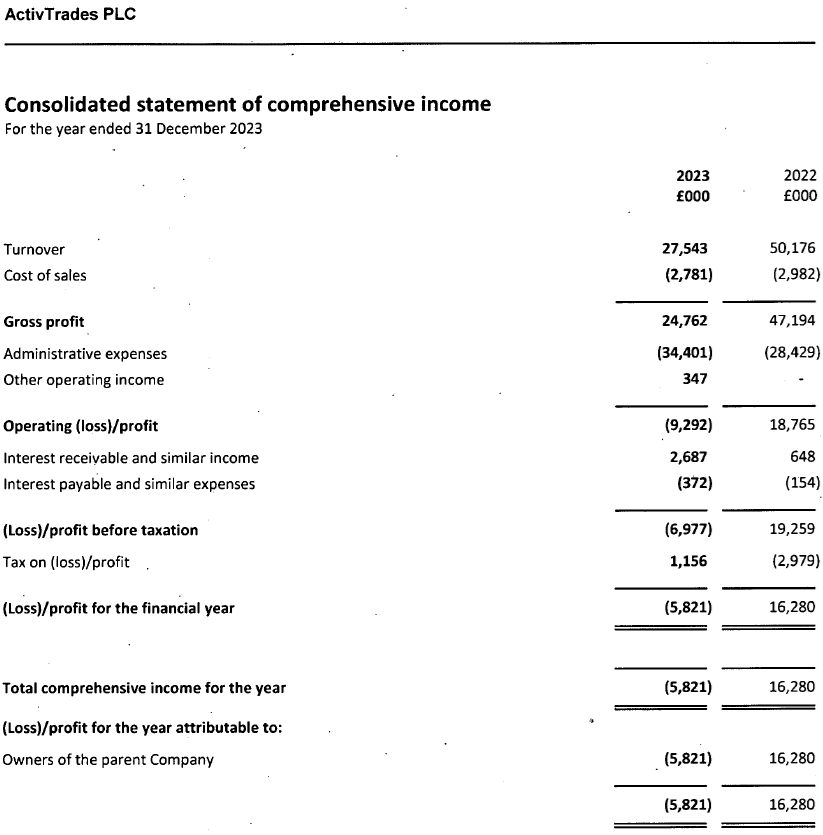

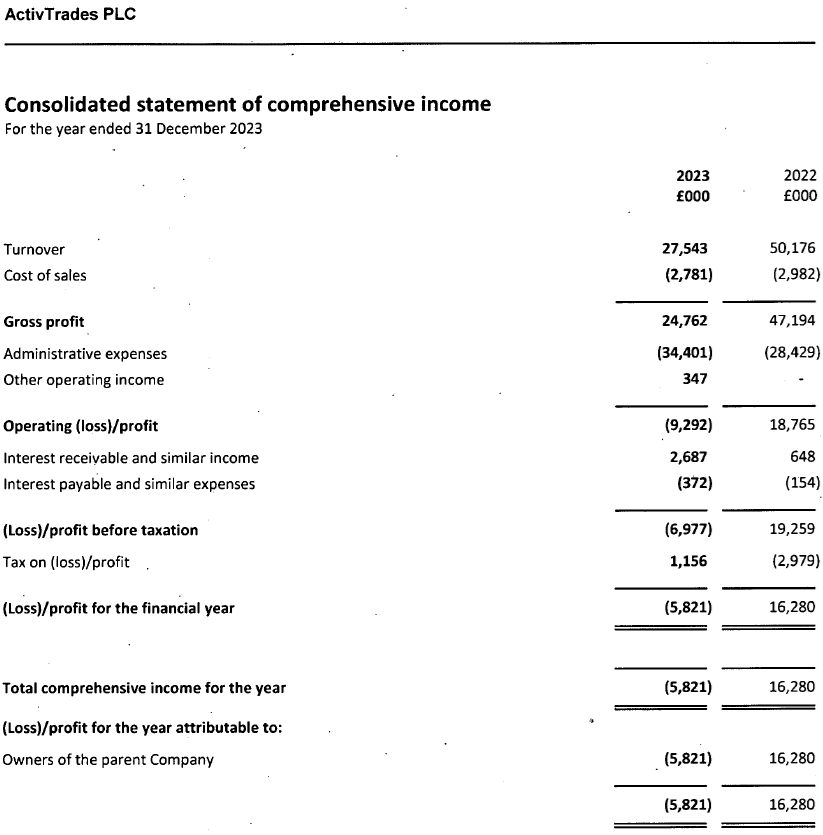

After reporting record first half 2022 Revenues of £32 million but then second half 2022 Revenues of just £18 million, ActivTrades continued on a downward trend in 2023 reporting full year 2023 Revenues of just £27.5 million (USD $35 million), down 45% from 2022’s £50.2 million. The drop in Revenues occurred despite healthy Interest Income which increased in 2023 by 350% to £2.7 million (2022: £0.6m), accounting for fully 10% of ActivTrades’ overall Revenues in 2023.

The drop in Revenues was accompanied by a Net Loss of £5.8 million in 2023 at ActivTrades, down from a Profit of £16.3 million the previous year.

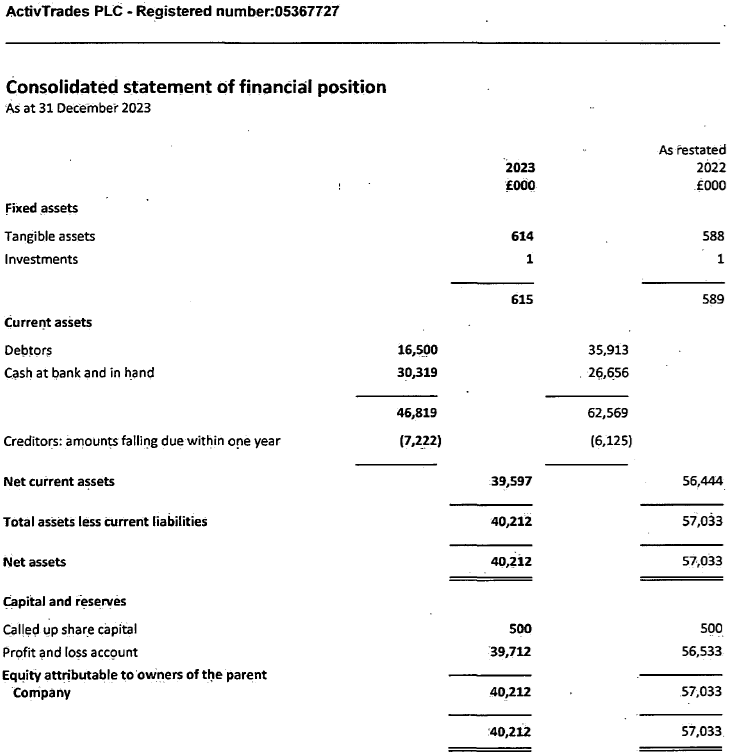

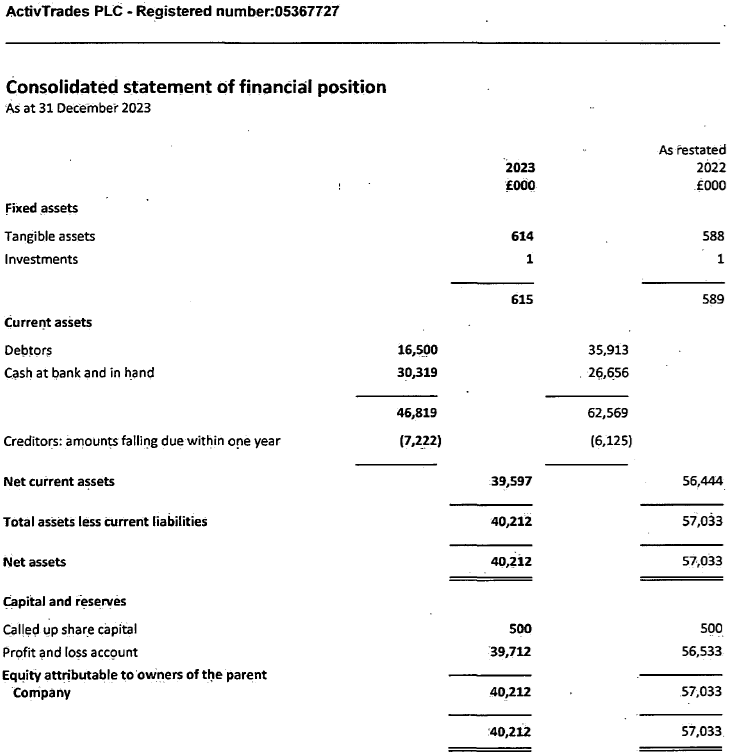

Despite the drop in Revenues and large loss, ActivTrades paid out a fairly hefty dividend of £11 million in 2023 to its shareholders, with another £641,000 dividend paid out in March 2024. As we reported last year as well, the company seems to be effectively diverting resources to StreamBank, a new online lender and savings bank in the UK being launched by ActivTrades’ controlling shareholder Alex Pusco.

StreamBank PLC, a separate legal entity outside the ActivTrades Group, received its authorisation with restrictions from the Bank of England in June 2022. StreamBank was originally named ActivTrades Loans PLC, but a decision was made to launch the business separately brand-wise from the ActivTrades CFDs / spreadbetting operation. Regulatory filings indicate that StreamBank received capital injections of £30.95 million in June 2022, £5 million in December 2022, and another £3.1 million in January 2024, with the majority of those funds effectively transferred from ActivTrades.

ActivTrades expenses

Despite the severe drop in Revenues, ActivTrades reported that its total administrative expenses rose by 17% in 2023 to £33.6m (2022: £28.6m), representing the continued expanding operations of the business. The notable rise in its expenses primarily stems from enhanced marketing efforts. ActivTrades said it has been actively exploring new markets and expanding its customer base, which necessitated a higher investment in marketing activities.

Client activity and trading volumes

The Group said it identified 206,690 new potential clients in 2023, of which 14,623 became customers with funded accounts through the year, an 80% rise from 2022. The Group had 27,943 clients actively trading at the end of the year. This was up 37% from 20,339 at the end of 2022.

During 2023, total deposits from clients equaled £103.4m (2022: £103.1m) and total withdrawals £80.8m (2022: £55.9m). This leaves net deposits 52% down in 2023 at £22.6m (2022: £47.3m).

Monthly trading volume, measured as the total notional value traded by Group’s customers, averaged 56.4 yards (USD bn) for 2023, 9% up on 2022.

Internationally, ActivTrades said its customer base has become more spread out across the world and as demand has continued to grow, the Group has established entities outside of its headquarters in London. It has previously established operations in the Bahamas (2018), Luxembourg (2021) and Portugal (2022), and is now ready to start trading in Brazil.

ActivTrades target customers

ActivTrades said it targets customers who are financially literate individuals with middle to high income, ages 25-65. Within this group ActivTrades seeks to attract investors and speculators with sufficient disposable income or wealth to speculate on a leveraged high-risk product where capital is at risk who either:

- do not want to use traditional investment vehicles and wish to put part of their savings in high risk financial products; or

- have an interest in stock markets and other investments with capital at risk and are willing to diversify their exposures to other high risk speculative financial products either for gain or recreational purposes.

Historically, the Group has had a high market share in occidental European countries. In the last few years, the Group has invested more heavily in acquiring clients from within newer markets, in particular Latin America, in order to develop the opportunities in these markets to their full potential.

ActivTrades’ 2023 income statement and balance sheet follow.