The Adani Group is all set to sign a definitive agreement to refinance $3.5 billion of loans taken for last year’s acquisition of ACC Ltd and Ambuja Cement, people aware of the discussions told ET.

At least 18 global banks have agreed to join the consortium led by Barclays, Deutsche Bank and Standard Chartered among others, for refinancing the debt that helped fund the biggest M&A in India’s building-materials industry.

The loan agreement was expected to be signed late Thursday night, said a person aware of the matter. As part of new terms, the promoter Adani family will prepay around $300 million. This will also be the largest refinancing exercise across Asia Pacific this fiscal.

The exercise is expected to help the Adanis save about a quarter of a billion dollars over a three-year period, said sources aware of the finer aspects of the loan’s pricing.

ET had reported on March 28 that the Adani Group was seeking to renegotiate the terms of acquisition financing of ACC and Ambuja Cements.

Disbursals Expected to start Next Week

The Adani Group had begun negotiations with lenders to extend the tenor of loans from the existing 18-month period — due to end in February next year — to a longer duration, ET had reported then.

To be sure, the group has so far repaid close to $2 billion of Ambuja and ACC loans, which included $1 billion of promoter advances taken from three foreign banks as a loan against shares (LAS) facility.

The refinancing includes a consortium of 18 lenders and is being led by three Japanese banks — MUFG, Mizuho and SMBC. Other Asian and European banks participating in the deal are DBS, First Abu Dhabi Bank, Standard Chartered Bank, Barclays, Deutsche Bank, ING, BNP Paribas, and Qatar’s QNB, among others.

Bigger Loan Stakes

Most of these lenders were part of the original financing round, while seven banks, led by MUFG, Standard Chartered Bank, Deutsche Bank and Barclays, are raising their exposures by a cumulative $750 million, said the people cited above.

Actual disbursals are expected to start as early as next week.

The Adani Group was due to pay back these loans, of varying tenors, in March 2024. Instead, it is prepaying them six months prior, to provide further confidence to the banking system.

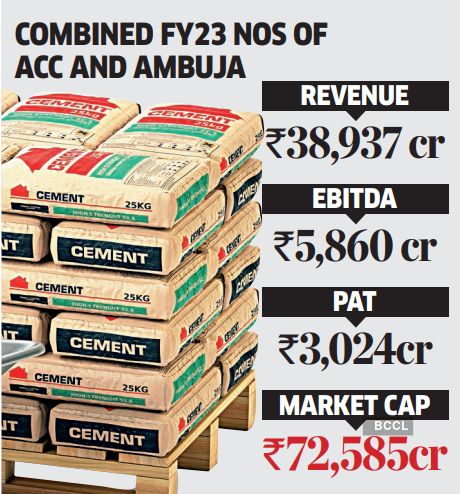

Besides pushing back the payment timelines until 2027, the exercise will not only bring down the borrowing costs but also improve the group’s credit rating. The refinancing will also help the Adanis expand cement capacity, now the country’s second biggest, and fund an asset-building plan that seeks to raise installed output to 140 million tonnes per annum (MTPA) by 2027. The current Adani Group capacity is about 110 MTPA, including about 40 MTPA under implementation.

Money Matters

The total acquisition financing for the August 2022 transaction was $6.5 billion. Of this, $1.25 billion was equity and $5.25 billion was debt. The debt had three components — a $750-million facility from banks such as JPMorgan, Barclays, Deutsche Bank and SMBC, as a bridge loan against shares to fund part of the equity for the deal.

There was also another $1 billion structurally subordinated debt taken for 24 months from banks such as Standard Chartered, Deutsche Bank and Barclays,

A third tranche of $3.5 billion was taken as senior debt from lenders including Deutsche Bank, Barclays DBS, SMBC, MUFG and Mizuho, FAB, Qatar National Bank, BNP Paribas. In total, $500 million of this facility was for six months, while the remaining $3 billion was an 18-month facility.

Following the Hindenburg short seller report on the group earlier this year that led to the sudden pullout of the proposed FPO of Adani Enterprises after triggering a $150-billion wealth erosion, the entire $750 million bridge loan facility was paid back in February by the group to calm market volatility. This was followed by another $500 million of the $3.5 billion senior debt getting paid back in March. The following month, another $200 million of the subordinated $1 billion facility was paid back. Thus, the Adani Group was left with $3 billion of senior debt and $800 million of subordinated structured debt — a total of $3.8 billion.

Spokespeople for Adani Group and Standard Chartered declined to comment. Deutsche Bank and DBS refused to comment on specific client transactions or discussions. Mails sent to Barclays, MUFG, SMBC and Mizuho did not generate a response till press time.

Simplified Terms

Under the current refinancing exercise, the group has decided to simplify the two tiers of senior and junior (subordinated) credit by collapsing it into one single, three-year term loan facility for the entire $3.5 billion with a bullet payment in the end. The residual $300 million is being brought in by the Adani family as sponsor financing.

With average rates of 4.3% above the Secured Overnight Financing Rate (SOFR), the refinancing is leading to a near 200-basis point saving, translating to $85 million cost savings annually, leading to a total saving of $250 million over the tenure of the loan.

The current rates are 6.5-7% above SOFR, the dollar-denominated, stable interest-rate benchmark that is not subject to the vulnerabilities of the London Interbank Offered Rate (LIBOR). While LIBOR was unsecured and based upon quotations provided by a group of banks, SOFR uses US Treasury bonds for collateral and is data-derived.

After acquiring three major cement companies, Ambuja, ACC and Sanghi, in the past less than 12 months, Adani Group has held discussions with industrialist CK Birla to acquire his promoter stake in listed Orient Cement.

Market leader UltraTech, of the Aditya Birla Group, has an existing capacity of 140 MTPA, and the company is seeking to raise that to 200 MTPA.