Solar energy-producer Adani Green Energy Ltd. is discussing the planned transaction with a group of foreign banks, including a US firm, according to people familiar with the matter, who asked not to be identified because the matter is confidential. The sale, expected later this year, is yet to be finalized and the terms may still change.

A spokesman for Adani declined to comment.

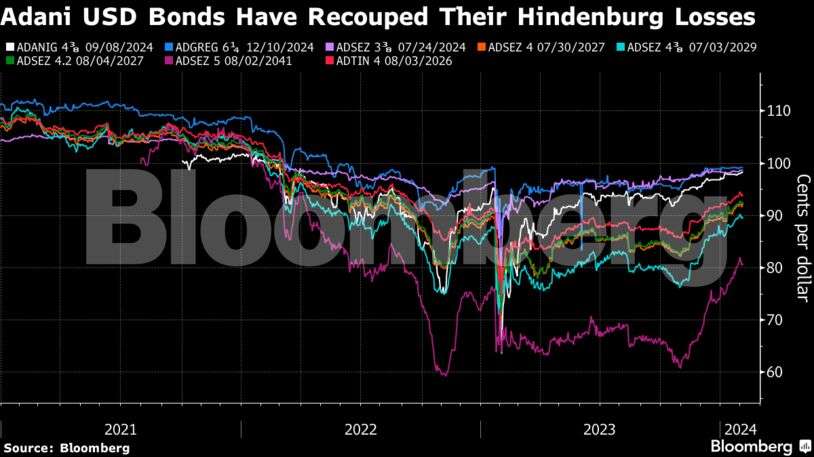

The conglomerate’s finances have drawn close scrutiny ever since Hindenburg Research accused it of fraud and stock manipulation, claims Adani has repeatedly denied. The bombshell report triggered a rout in the group’s shares and bonds, suggesting it would have to pay dearly when next raising capital.

While talks to refinance debt taken out for the purchase of Ambuja Cements Ltd. and ACC Ltd. stalled after the allegations were made public in January 2023, Adani successfully completed the $3.5 billion funding package later in the year.

The sprawling ports-to-power empire has trimmed debt, pared founders’ share pledges and landed major projects over the past year, helping to rebuild confidence among investors and lenders. Its stocks and bonds have recouped losses, and the group also won fresh equity capital from marquee investors including GQG Partners LLC. and Qatar Qatar Investment Authority.