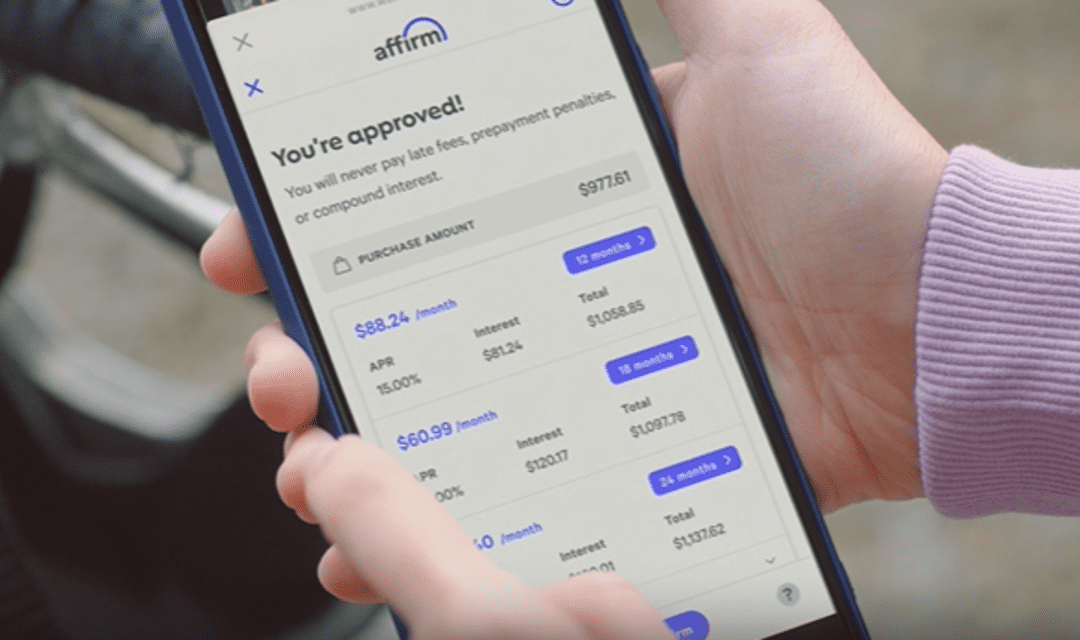

Shares of Affirm Holdings Inc. soared toward the highest prices seen in nearly two years after the provider of buy-now-pay-later payment options said it has expanded its services with discount retail giant Walmart Inc. to include self-checkout purchases.

“Expanding our partnership with Walmart and bringing Affirm’s transparent monthly pay-over-time options to their self-checkout kiosks in the U.S. will help even more consumers increase their purchasing power during the holiday shopping season and beyond,” said Pat Suh, senior vice president of revenue at Affirm.

Affirm

AFRM,

said its flexible service will now be available at self-checkout kiosks at more than 4,500 Walmart

WMT,

stores in the U.S. In addition to being available at stores and for online purchases, buy-now-pay-later will also be an option at Walmart Vision and Walmart’s auto centers.

Affirm’s stock shot up 14% in morning trading, putting it on track for its highest close since Feb. 2, 2022. Walmart shares slipped 0.4%.

The rally in Affirm’s stock was providing a boost to other buy-now-pay-later service providers.

Shares of Block Inc.

SQ,

climbed 4.5% toward their highest close since Aug. 1. Susquehanna analyst James Friedman reiterated on Tuesday his positive rating on the stock and his price target of $100, which is tied for the highest target of the 50 analysts surveyed by FactSet, on the belief that profitability could “materially increase.”

And shares of PayPal Holdings Inc.

PYPL,

rallied 2.5% toward a three-month high.

Affirm’s stock surge on Tuesday comes a day after it fell 0.6%, as Morgan Stanley analyst James Faucette downgraded it to underweight from equal weight on valuation concerns. His stock-price target of $20 implies 60% downside from current levels.

While Faucette acknowledged that Affirm has been executing well on a number of initiatives, he said “the current valuation looks untenable,” as the risk-versus-reward profile is “skewed to the downside.”

Shares in the company, which went public in January 2021, have rocketed fivefold year to date, up 415%, as inflation has fueled buy-now-pay-later usage into the holiday shopping season. The stock has snapped back after plummeting 90.4% in 2022 as rising interest rates hurt consumer spending.

Read: Affirm’s stock wins over a former skeptic as buy-now-pay-later trends seem to be improving

Meanwhile, J.P. Morgan’s Reginald Smith said Monday that following a blowout earnings report in November, the stock deserves a “premium” valuation given the company’s sustained growth, improving profitability and strong credit performance.

But Smith kept his rating at neutral, saying he believes the stock is “likely due for a breather,” as its big rally raises valuation concerns.