After Kotak and the Chinese spy twist, more details have emerged in the Adani-Hindenburg saga. As per the latest details, the US short-seller had shared an advance copy of its report against Adani group with New York-based hedge fund manager Mark Kingdon about two months before publishing it and profited from a deal to share spoils from share price movement, according to Sebi.

In a 46-page show cause notice to Hindenburg, Sebi said, “It was observed that around November 30, 2022, Hindenburg shared a draft of Hindenburg Report on the Adani Group, seen to be substantially the same as the subsequently published Hindenburg Report, exclusively with its client, Kingdon Capital Management, pursuant to a Research Agreement dated May 26, 2021 (“Research Agreement”) signed between Hindenburg and Kingdon Capital. “

The notice also mentioned how the US short seller, the New York hedge fund and a broker tied to Kotak Mahindra Bank benefited from the over USD 150 billion routs in the market value of Adani group’s 10 listed firms post-publication of the report.

Sebi notice includes extracts of time-stamped chats between an employee of the hedge fund and Kotak Mahindra Investments Limited traders for selling future contracts in Adani Enterprises Ltd.

According to the Sebi letter, Mark Kingdon, who held a controlling stake in KMIL’s K-India Opportunities Fund Ltd, had an agreement to share 30% of the profits from trading in securities based on Hindenburg’s report. This profit-sharing arrangement was later adjusted to 25% due to the additional time and effort required to execute trades through the K India fund.

Sebi also noted that Kingdon transferred USD 43 million in two installments to establish short positions in AEL. Simultaneously, the K India fund acquired short positions for 850,000 shares before the report’s release and closed these positions shortly after its publication.

According to Sebi, Hindenburg published a report titled ‘Adani Group: How the World’s 3rd Richest Man is Pulling The Largest Con in Corporate History’ on January 24, 2023 (United States time – January 25, 2023, according to IST) during pre-market hours.

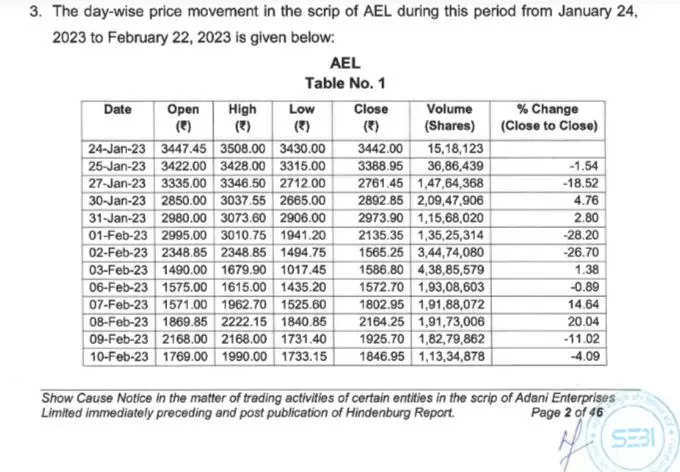

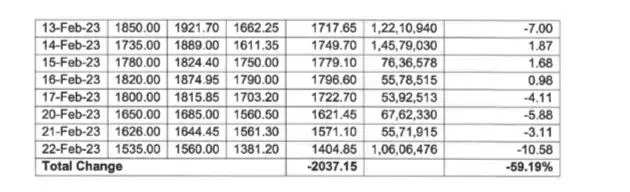

The chronology of events related to the scrip of AEL around the release of the Hindenburg report (as shared by Sebi)

“Prior to the release of the Hindenburg Report, concentration in short-selling activity was observed in the derivatives of Adani Enterprises Ltd,” it said. “Pursuant to the release of the said report, the price of AEL fell by around 59 per cent during the period from January 24, 2023 to February 22, 2023” — from Rs 3,422 to Rs 14,04.85 per share.

Sebi said K India Opportunities Fund Ltd – Class F (KIOF Class F) opened a trading account and started trading in the scrip of AEL just a few days prior to the publication of the report and then squared off its entire short position post-publication of the Hindenburg Report, making significant profits of Rs 183.23 crore (USD 22.25 million).

“The net profit after trading and legal expenses comes to USD 22.11 million,” Sebi said.

As part of the deal, Kingdon owned Hindenburg USD 5.5 million, of which USD 4.1 million had been paid as of June 1, the notice said.

Kingdon’s response to Sebi

In its response to Sebi, Kingdon Capital said it had got legal option that it could “enter into a research services agreement with a third-party firm that publicly releases short reports on companies, pursuant to which Kingdon Capital would be given a draft copy of the report before it is made publicly available and would have the opportunity to accordingly made investments before the report’s public dissemination”.

Kotak Mahindra Bank has stated that Kingdon “never disclosed that they had any relationship with Hindenburg nor that they were acting on the basis of any price-sensitive information”.

A show-cause notice typically precedes formal legal actions, which could entail financial penalties and restrictions from participating in the Indian capital market.

Sebi has granted Hindenburg a period of 21-day to provide its response to the allegations.

Sebi’s notice to Hindenburg

The Indian market regulator had charged Hindenburg of making “unfair” profits from “collusion” to use “non-public” and “misleading” information and induce “panic selling” in Adani Group stocks.

Hindenburg, which made public the Sebi notice, in its response, has described the show cause as an attempt to “silence and intimidate those who expose corruption and fraud perpetrated by the most powerful individuals in India” and revealed that the vehicle used to bet against Adani’s flagship firm Adani Enterprises Ltd belonged to Kotak Mahindra (International) Ltd, a Mauritius-based subsidiary of Kotak Mahindra Bank Ltd.

KMIL’s fund placed bets on Adani Enterprises Ltd for its client Kingdon’s Kingdon Capital Management.

Hindenburg’s attack on Sebi

Hindenburg, which published the Sebi notice on its website, in its response stated that it made just USD 4.1 million from its declared positions on Adani stocks and criticised the regulator for not focusing its investigation into the January 2023 report “providing evidence” of the conglomerate creating “a vast network of offshore shell entities” and moving billions of dollars “surreptitiously” into and out of Adani public and private entities.

It said that while Sebi was seeking to claim jurisdiction over a US-based investor, the regulator’s notice “conspicuously failed to name the party that has an actual tie to India: Kotak Bank,” which created and oversaw the offshore fund structure used by Hindenburg’s investor partner to bet against Adani.

The regulator “masked the “Kotak” name with the acronym “KMIL”, it added.

KMIL refers to Kotak Mahindra Investments Ltd, the asset management company.

China’s hand behind Adani rout?

Senior lawyer Mahesh Jethmalani, who had in the past spoken for the Adani group, in a post on X claimed that Kingdon had a Chinese link.

Kingdon is married to “Chinese spy” Anla Cheng, he claimed.

“Accomplished Chinese spy Anla Cheng, who along with her husband Mark Kingdon, hired Hindenburg for a research report on Adani, engaged the services of Kotak to facilitate a trading account to short sell Adani shares; made millions of dollars from their short selling; eroded Adani market cap enormously,” he alleged.

Adani-Hindenburg saga

Sebi — which last year told a Supreme Court-appointed panel that it was investigating 13 opaque offshore entities that held between 14 per cent and 20 per cent across five publicly traded stocks of the Adani group — has sent notices not just to Hindenburg but also to KMIL, Kingdon and Hindenburg founder Nathan Anderson.

(With PTI inputs)