For some homeowners and renters, HOA fees are unavoidable yearly expenses. Depending on the home and location, HOA fees may be a steep cost at hundreds of dollars or as much over $1,000 each month for certain high-end communities. With such a big cost associated with homeownership, this leaves many asking, “Are HOA fees tax deductible?”

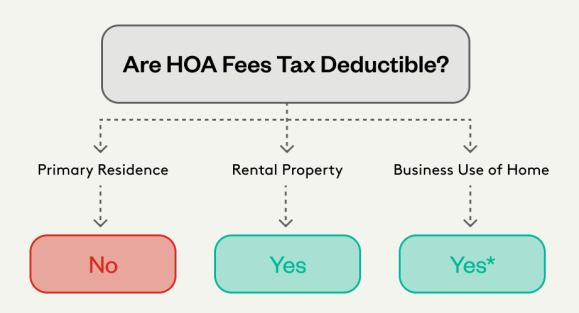

The answer is it depends. For the most part, HOA fees are not tax deductible. But in some cases, you may be able to write them off. So, how do you know where you fall?

We’ve created this guide to help you get a better understanding of what to expect when it comes to how they’ll affect your taxes and whether your HOA fees are tax deductible.

What are HOA fees, and what do they cover?

An HOA, or homeowners association, is an organization that governs and regulates a community, like an apartment complex or neighborhood. Not only do these groups create and enforce rules for their community, but they also handle shared needs, like building maintenance or landscaping.

In exchange, each home within the HOA is required to pay a fee, typically on a monthly basis. These fees can range from tens to thousands of dollars, depending on the community and its specific needs. Unfortunately, these fees simply cannot be avoided; they’re a requirement of living in the community.

If you live in an HOA, it’s understandable that you’d want to inquire whether homeowners association fees are tax-deductible to help with the burden of the extra cost that adds up over the year.

Are HOA fees tax deductible on federal income taxes?

So, are HOA fees deductible from your taxes? The short answer is: it depends. There are many factors that go into determining whether your HOA fees are eligible for a tax deduction. In short, the rule is that HOA fees are deductible from your taxes only if the associated home functions as a business rather than as a residence (your primary or secondary).

Let us elaborate by breaking down the circumstances that apply in each scenario.

For your primary residence

If your home is your primary residence that you live in year-round, you can’t deduct your HOA fees from your taxes. That’s because your HOA fees are standard living expenses, much like your gas and electricity bills.

That said, there are a few circumstances in which you may be able to deduct your HOA fees from your taxes; more on that below.

For rental properties

As mentioned above, you may be able to deduct your HOA fees from your taxes in the event that the property functions as a business. That means that your home is at least partially a source of income. In these cases, your HOA fee doesn’t become a standard living expense, but a business expense.

One potential circumstance in which you would be able to deduct your HOA fees is if your home, whether it’s your only home or a second home, is a rental property for either a portion of or all of the year. Whether you have year-round renters or do short-term rentals on Airbnb or a similar site, HOA fees associated with rental properties are tax deductible.

If the home is both a private residence and available as a rental, the homeowner can only deduct the HOA fees that apply when it is rented out. This applies to a second home as well, not just your primary residence.

In the case that you use your home as a primary residence for a portion of the year and rent it out for the remaining months, only the HOA fees (or a percentage of the fees) associated with the months that the home is used as a rental property may be tax deductible. The HOA fees associated with months that it functions as a primary residence won’t be deductible.

For homes used for business

What if you use your home to conduct business? If you’re a business owner, freelancer, or the like and have a designated work space, HOA fees may be tax deductible, too.

In this case, deductions associated with these expenses are calculated the same way that deductions associated with rent or utilities are. You can deduct part of your HOA bill that is proportional to the amount of your home that is designated for work.

There are two ways to calculate how much you can write off, the regular method or simplified method. Let’s quickly walk through each.

For the simplified method, you can use a rate of $5 per square foot for the portion of your home used for business purposes. Note that, with the simplified method, you’re limited to a maximum of 300 square feet total.

Ex: Your workspace is 100 square feet. With the simplified method, your write-off would be $500.

On the other hand, with the regular method, you’ll need to determine the portion of the house used for business, then take that percentage and multiply it by your annual HOA fee. Here’s how to calculate the write-off using the regular method:

- Determine the square footage of your designated work space.

- Ex: Your designated workspace is 10 ft by 10 ft, making it 100 square feet.

- Determine the square footage of your home.

- Ex: Your home is 1,000 square feet.

- Calculate the percentage of your home that is designated work space.

- Ex: 100 square feet / 1,000 square feet = 10%

- Multiply your monthly HOA fee by 12 months to find your yearly HOA fee.

- Ex: $100/month HOA fee x 12 months = $1,200

- Multiply the percentage by your yearly HOA expenses to find the deductible amount.

- Ex: 10% of your home x $1,200 HOA fee = $120

In this example, you can deduct $120 in HOA fees from your yearly taxes.

For those with businesses and investment rental properties, an HOA may be one of several of their deductible expenses throughout the course of a year. For example, if you’re running a short-term rental, you could potentially also write off expenses like cleaning, marketing, mortgage interest and insurance, furnishing, and more.

Are HOA fees tax deductible on your state income taxes?

Income tax rules vary from state to state. In the case of HOA fees, many have chosen to follow the same rules as federal taxes.

If you meet the federal requirements for deducting HOA fees from your taxes, it’s likely your state will allow you to do the same. Nonetheless, it’s a good idea to check with your state tax authority to learn more about whether your HOA fees are deductible from your state taxes.

Where do you list HOA fees on your taxes?

When you’re preparing your taxes, where HOA fees are filed on your taxes will depend on the type of activity.

Generally, if you own real estate that you rent out to tenants – including rental income from renting out the home you reside in – it would be reported on a Schedule E under the category “Other” on line 19. The Schedule E should be attached to your tax return.

On the other hand, if you provide a range of services to your tenants or manage the rental properties like a business activity, then the IRS may require you to file a Schedule C rather than a Schedule E. This is because the IRS considers that activity to be self-employed and requires you to file a Schedule C for that business activity and the HOA fees associated with the business would be a business expense.

Are there other ways can homeowners save on their taxes?

Looking for other ways to save on your taxes as a homeowner? The IRS offers many different opportunities for homeowners to save. The Residential Energy Credit is one such credit available to homeowners. Some other common write-offs for homeowners include:

- State and local property taxes

- Mortgage discount points

- Mortgage interest

Explore tax deductions, which lower the amount of your income that you must pay tax on, as well as tax credits, which can be directly subtracted from the amount of tax you owe.

For more tax advice, as well as tax tips for landlords and homeowners, TurboTax is here for you.