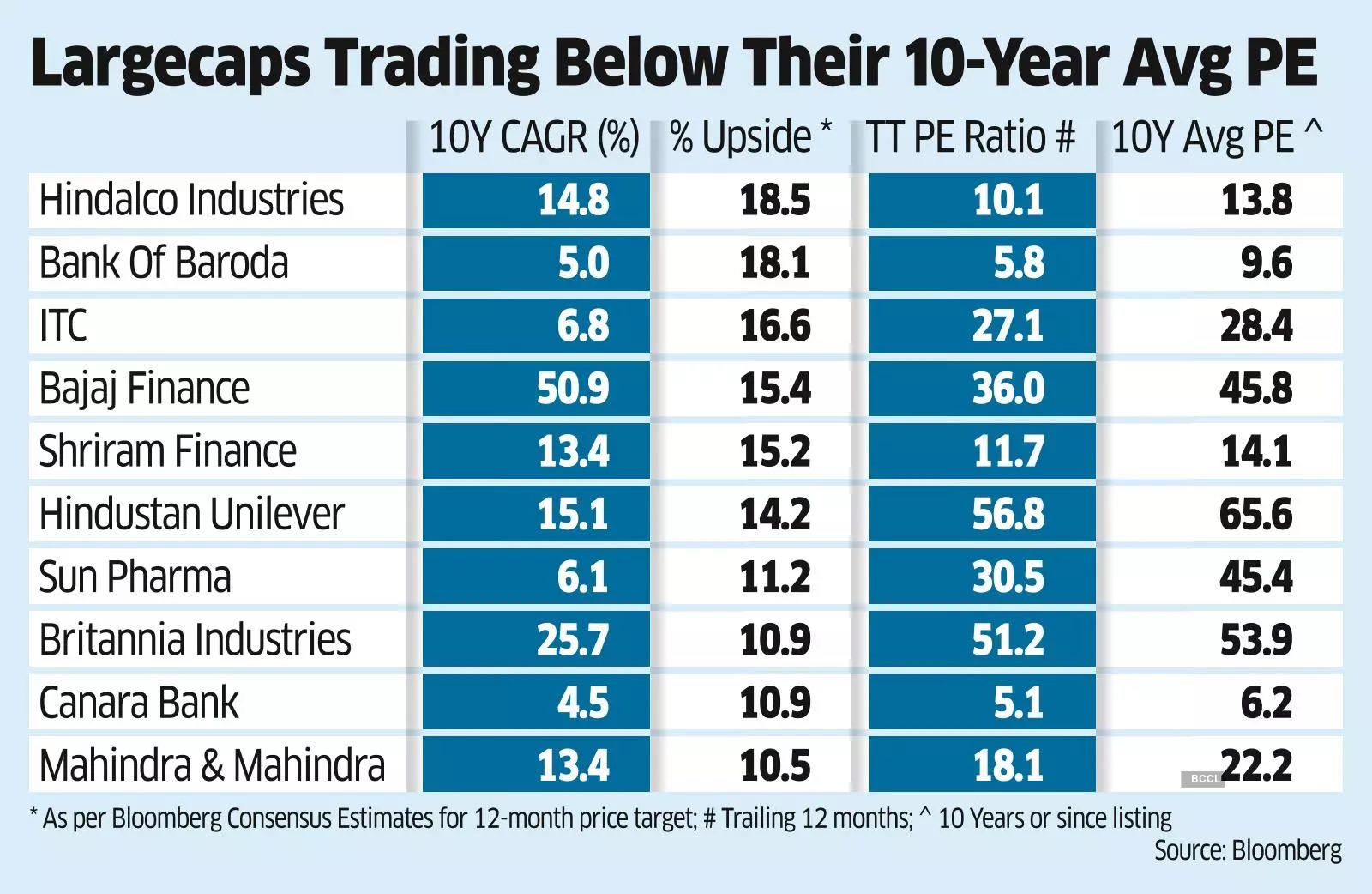

Mumbai: Several Indian large-cap stocks including HDFC Bank, ICICI Bank, HUL, ITC and Bajaj Finance among others are trading below their 10-year average price-earnings (PE) ratio, presenting an attractive alternative to overvalued small and mid-caps. Some of these blue chips are approaching all-time low valuations.

Sun Pharma, Mahindra & Mahindra, Grasim, Dr Reddy’s and Eicher are other large-cap stocks trading below their 10-year average valuations.

These stocks could also give potential returns of up to 29% over the next 12 months, according to Bloomberg Consensus Estimates.

Small and mid-cap indices plunged on Friday as retail investors fled overvalued stocks amid heightened geopolitical concerns, a surge in US bond yields, and likely further rate increases by the US Federal Reserve. Nifty Smallcap 250 index dropped 3.8% giving up a part of the gains of more than 36% in the last year.

Nifty Midcap 150 up 25%

The Nifty Midcap 150 fell 2.7% but is still up 25% from a year earlier. In contrast, the Nifty 50 index has risen 9.7% over the past year.

In the past decade, HDFC Bank and ICICI Bank have enjoyed 17% compounded annual growth (CAGR). They are currently trading at valuations lower than their 10-year average PE ratios. HDFC Bank is near its 10-year-low price-earnings multiple and up only 4.7%.

According to Bloomberg Consensus Estimates, both stocks have the potential to yield returns of around 28% in the next 12 months.

Experts said Dalal Street is poised for the upcoming phase of stock rotation with investors moving into the safety of attractively valued large-cap stocks from stretched mid and small-caps.

“The small and midcap valuations have been higher than the valuations of Nifty50 for many months now, and this anomaly was waiting for a trigger to correct,” said V K Vijayakumar, chief investment strategist, Geojit Financial Services. “Without a doubt, the safety now is in large-caps, particularly, the banking majors are attractively valued.”

Despite a 33% rally over the past year, consumer-to-tobacco giant ITC is trading at a PE ratio of 27.1, slightly lower than its 10-year average PE of 28.4. Analysts expect another 16% upside in the stock over the next 12 months.

“Many defensive large-cap stocks, particularly those in the FMCG and pharmaceutical sectors, which were trading at premium valuations, have (seen a decline in their) PE multiples over the past few years, amid growing earnings,” said Siddarth Bhamre, head of research, Religare Broking. “Given the uncertain global environment, increasing exposure to large-cap stocks could potentially offer a favourable risk-adjusted investment strategy.”

Mahindra & Mahindra, which rallied 25% in the past year, is trading at a PE of 18 times its trailing 12-month earnings compared with its 10-year average of 22.5. The stock has yielded 13% CAGR over the past decade.

Similarly, Bajaj Finance, boasting a remarkable 51% CAGR over a decade, along with IndusInd Bank at 18% CAGR, Shriram Finance at 37% CAGR, Britannia at 26% CAGR, and HUL at 15% CAGR, are currently trading below their 10-year average PE ratios.