- Asian equities extend rebound ahead of key data

- Japanese GDP, Aussie jobs and Chinese indicators on the agenda

- Any upsets could roil the fragile sentiment

A cautious rebound for stocks

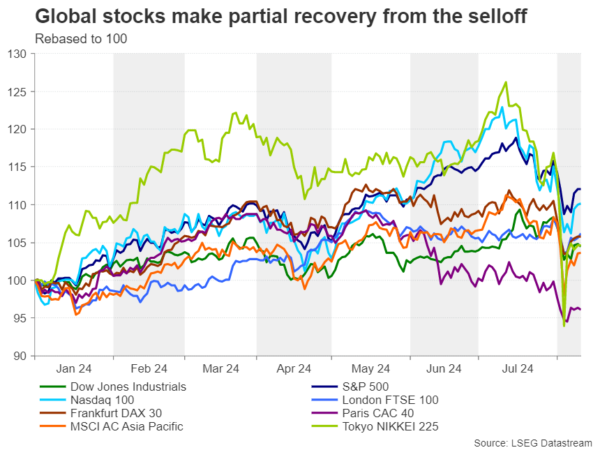

Stock markets in Asia have not been immune to the global selloff in August amid the unwinding of the yen carry trade and renewed fears about a US recession. Japanese stocks, in particular, were hit hard by the sudden surge in the yen; the Nikkei 225 Index tumbled by almost 20% between July 31 and August 5.

But a recovery is underway, with the Nikkei recouping about 50% of its losses, while the MSCI AC Asia ex Japan Index has gone a step further and reached the 61.8% Fibonacci retracement of its decline.

However, markets remain quite jittery and it’s been a cautious recovery, not just in Asia, but on Wall Street too. A lot is riding on the latest CPI and retail sales reports out of the US due on Wednesday and Thursday, respectively, to further calm market nerves. But it’s not just concerns about the US economy that’s weighing on risk sentiment.

Asian tigers no longer roaring

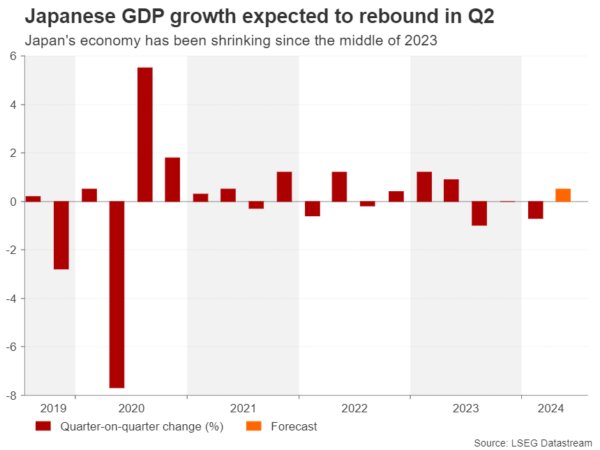

The Chinese economy seems to be stuck in a rut, while Japan’s economy has been shrinking since the third quarter of 2023. GDP figures for the latter are out on Wednesday (23:50 GMT) and analysts expect positive growth of 0.5% quarter-on-quarter for the second quarter.

An in-line or somewhat softer-than-projected reading would probably help ease concerns that the Bank of Japan is proceeding too rapidly with policy normalization, potentially boosting both the Nikkei and the yen. But a much stronger-than-expected rebound in GDP could spur a negative reaction as it would increase bets that the BoJ will hike interest rates again this year.

RBA’s next move more likely to be down

Next doing the rounds will be the Australian employment report on Thursday at 01:30 GMT. Australia’s labour market likely added 20k jobs in July, down from the prior 50.2k. The unemployment rate is expected to have held steady at 4.1%. Figures released earlier this week showed that wage growth was unchanged at a near historical high of 4.1% y/y in Q2, supporting the case for no rate cuts anytime soon.

Worries about the economy have kept the Reserve Bank of Australia on the sidelines despite persistently high inflation. But there’s been some progress more recently on reducing inflation and investors no longer see any chance of an RBA rate hike this year. That could easily change, though, if the jobs numbers point to an improving labour market.

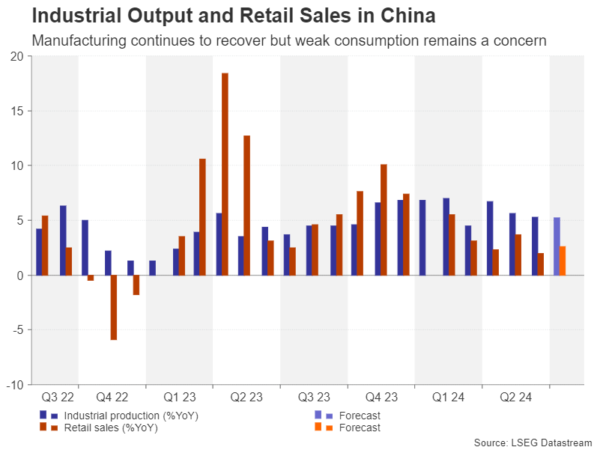

Chinese consumers still not spending

The Australian dollar could certainly benefit from some upbeat data as it’s still down by about 9% against its US counterpart from its July peak. However, just as significant for the aussie will be China’s latest stats on industrial output and retail sales coming up 30 minutes later.

Although Chinese industrial production continues to grow at a satisfactory pace in spite of all the challenges, sluggish consumer spending poses a dilemma for authorities who seem opposed to big fiscal stimulus packages. Retail sales were up just 2.0% y/y in June and are expected to have picked up slightly to 2.6% y/y in July.

Risk of increased volatility

If the incoming data are mostly positive and contribute to brightening the market mood, the aussie, stocks and other risk assets could enjoy a further bounce back over the next few days, though the yen might suffer a pullback unless it can find support in the Japanese GDP numbers.

On the whole, it’s more likely that the data will add to the choppiness in the markets, amid all the uncertainties and thinner trading volumes during the peak summer holiday season, with the primary focus remaining on Fed expectations and US recession risks.