By RoboForex Analytical Department

The Australian dollar (AUD) is witnessing a rise against the US dollar (USD) for the second consecutive day, reaching 0.6629. This upward movement is bolstered by the Reserve Bank of Australia’s (RBA) current policy stance. RBA Governor Michelle Bullock emphasized today that discussions on interest rate cuts are premature despite some easing in inflationary pressures.

Inflation, according to Governor Bullock, remains uncomfortably high, with expectations for it to settle within the target range of 2-3% only towards the end of next year. This viewpoint underpinned the RBA’s decision last week to maintain the official cash rate at 4.35%, marking the sixth consecutive hold. The RBA cites ongoing economic stability and persistent inflation risks as key reasons for their cautious approach.

This stance starkly contrasts with other major central banks, including the Reserve Bank of New Zealand (RBNZ), which have been more open to adjusting rates. However, the RBA’s consistent and factual communication strategy has minimized speculative market reactions, contributing to a more stable forex forecast for the AUD.

Technical analysis of AUD/USD

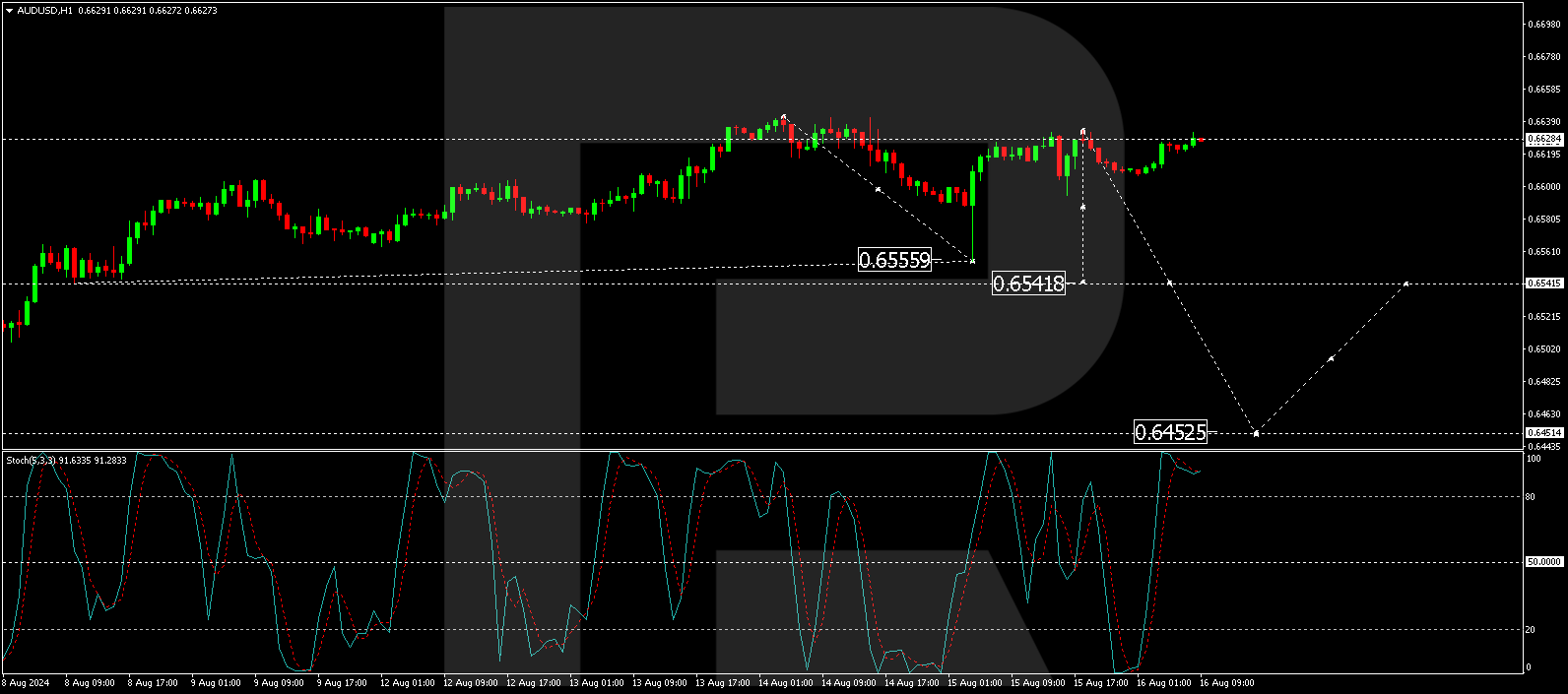

The AUD/USD pair has reached a peak at 0.6640 and is now showing signs of consolidating below this level. Should the pair break downwards from this consolidation, a decline to 0.6450 could be anticipated. Following this potential drop, a rebound to 0.6545 for a retest from below might occur before a further descent towards 0.6200. This bearish outlook is supported by the MACD indicator, which shows the signal line retreating from highs and gearing towards a downturn.

On the hourly chart, after a decline to 0.6555, the AUD/USD pair corrected upwards to 0.6628. A consolidation below this level is expected, which could lead to a new downward wave aiming for 0.6540. This bearish prediction aligns with the Stochastic oscillator readings, where the signal line is poised to move from above 80 downwards to 20, indicating potential selling pressure ahead.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- AUD/USD climbs as RBA maintains firm stance on interest rates Aug 16, 2024

- Indices rise amid lower inflation in the US. Oil returned to decline due to reduced tension in the Middle East Aug 15, 2024

- FXTM’s CHINAH: On breakout watch ahead of key events Aug 14, 2024

- RBNZ unexpectedly decreased the rate by 0.25%. Today the focus of investors is directed to the data on the inflation of the US and the UK Aug 14, 2024

- USD/JPY Sees Retreat Amid US Dollar Weakness Aug 14, 2024

- WTI crude oil prices rise for the 5th day in a row. Australian dollar rises amid strong economic data Aug 13, 2024

- UK100: Set for more wild price swings? Aug 13, 2024

- Brent Crude Oil Faces Demand Concerns Despite Recent Gains Aug 13, 2024

- European gas prices jump to an 8-month high. Canada’s labor market is cooling down Aug 12, 2024

- NZD/USD gains momentum ahead of RBNZ meeting Aug 12, 2024