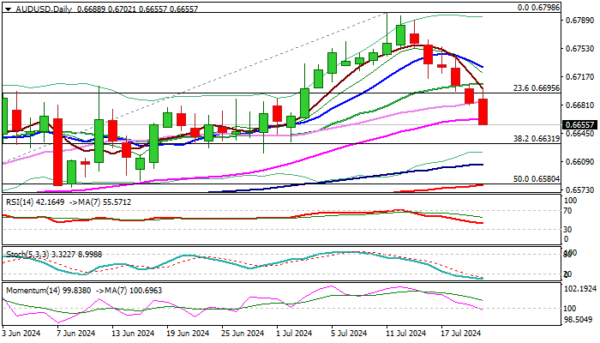

AUDUSD hit three-week low on Monday after recovery attempts overnight were short-lived and bears regained full control.

The pair remains in a steep downtrend for the sixth straight day and retraced so far 61.8% of 0.6575/0.6798 rally.

Last week’s 1.3% fall left large bearish candle (the first week in red after five consecutive weeks of rally) and generated reversal signal on weekly chart.

Weakening daily studies (south-heading 14-d momentum is about to break into negative territory / 10/20/30 MA’s in bearish configuration) favor further downside, as Aussie dollar was hurt by falling copper price and rise in USCNY, following PBOC loan prime rate cut by 10 basis points.

Bears eye next significant supports at 0.6642/31 (top of thick daily cloud / Fibo 38.2% retracement of larger 0.6362/0.6798 uptrend) which are likely to produce strong headwinds, along with oversold daily studies.

Limited upticks should be ideally capped by 20DMA / last Friday’s top (0.6708) to keep bears intact.

Res: 0.6663; 0.6683; 0.6708; 0.6729.

Sup: 0.6642; 0.6631; 0.6605; 0.6580.