By RoboForex Analytical Department

The AUD/USD pair has climbed to a new peak, reaching 0.6815, marking the highest level since 28 December of the previous year. This strength in the Australian dollar is partly due to the aggressive rate cuts by the US Federal Reserve, which has spurred expectations that other central banks might also ease monetary policies, enhancing the economic outlook and fuelling a rally in riskier assets.

This week, Australian employment data significantly outperformed expectations, showing a 47.5k increase in jobs for August, far exceeding the forecasted 25.0k. This robust job growth has kept the unemployment rate steady at 4.2%. Despite this positive economic indicator, the main expectation is that the Reserve Bank of Australia (RBA) will maintain its interest rate at the current level in its upcoming meeting, with analysts predicting no changes to monetary policy until at least December and possibly not until Q2 of next year. The RBA’s cautious approach to inflation underscores its strategy of not taking decisive action until there is apparent necessity.

Given the current favourable risk environment, the AUD could reach even higher levels soon.

AUD/USD technical analysis

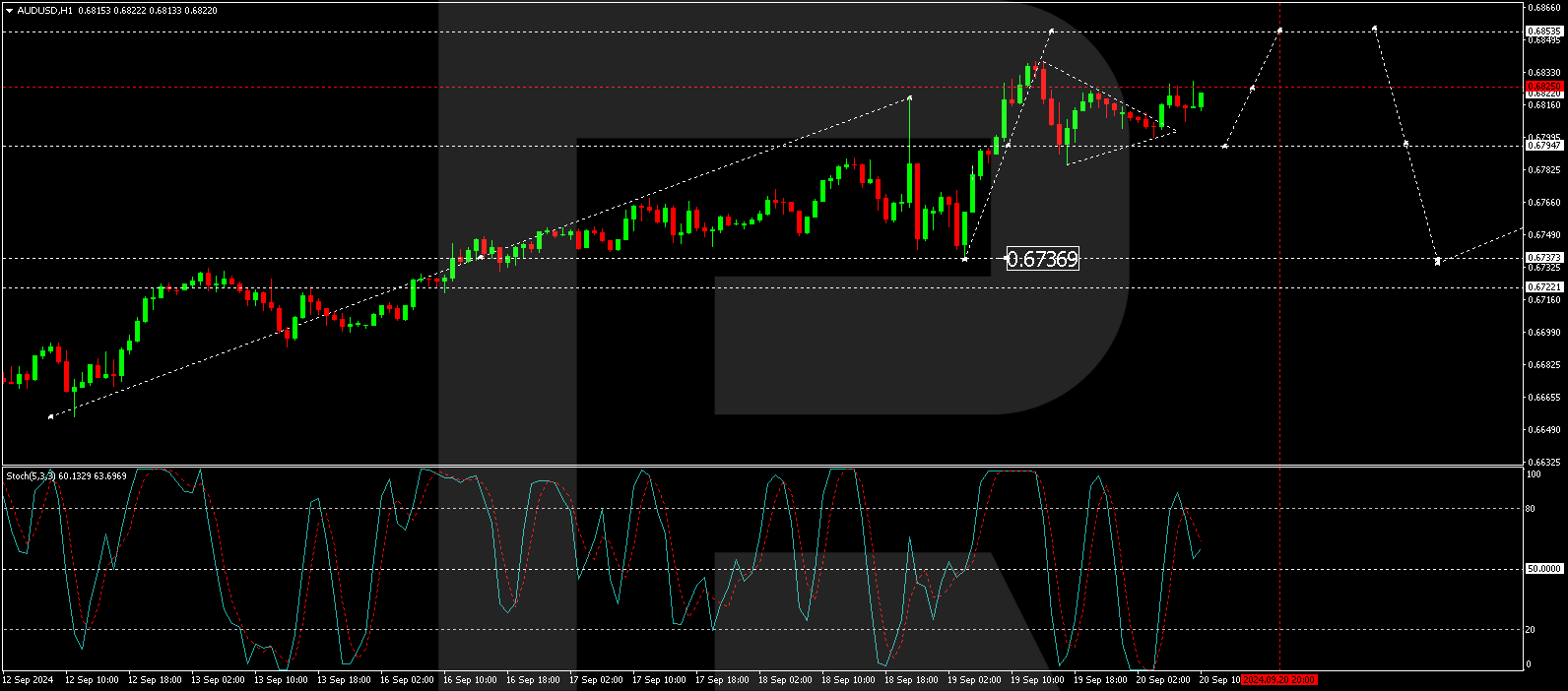

The AUD/USD market is advancing in the fifth wave of growth towards 0.6855. This target will likely be reached soon, followed by a corrective movement to 0.6790, testing it from above. This could define the upper boundary of a new consolidation range. Should the pair break below this range, a further decline to 0.6736 might ensue, potentially signalling the start of a new downward trend towards 0.6640, with a continuation to 0.6590. The MACD indicator, currently at its highs and directed upwards, supports this bullish scenario in the short term.

On the H1 chart, AUD/USD is forming a growth structure towards 0.6855. A short rise to 0.6848 is expected, followed by a slight decline to 0.6825. Upon completion of this minor correction, another growth phase towards 0.6855 is anticipated, which could exhaust the potential of the current growth wave. The Stochastic oscillator, with its signal line above 50 and pointing upwards, corroborates the likelihood of continued upward movement before any significant pullback.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- AUD/USD Reaches New Heights as Risk Sentiment Improves Sep 20, 2024

- Brent Crude Oil Rebounds Amid Monetary Easing and Market Dynamics Sep 19, 2024

- The US Fed surprised the market with a sharp rate cut. Australia’s labor market remains resilient Sep 19, 2024

- The US Federal Reserve will begin its rate-cutting cycle today. In the UK, inflation figures were unchanged Sep 18, 2024

- USDJPY Experiences Renewed Decline as Market Adjusts Expectations Sep 18, 2024

- Countdown to Fed decision enters final hours Sep 18, 2024

- Gold (XAUUSD) Holds Near Record Highs Amid Anticipation of Fed Rate Cut Sep 17, 2024

- EUR/USD Gains as Fed Meeting Approaches Sep 16, 2024

- The US Federal Reserve may start the rate-cutting cycle with a 0.5% move. Silver reached a 2-month high Sep 16, 2024

- COT Metals Charts: Speculator Bets led by Platinum Sep 14, 2024