By RoboForex Analytical Department

The Australian dollar strengthened notably against the US dollar, with the AUD/USD pair reaching 0.6684. Australia’s May economic indicators from MI remained unchanged at zero compared to the previous value. Meanwhile, Australia’s weighted average consumer price index increased to 4.0% y/y from the last 3.6%, surpassing the less ambitious forecast of 3.8%.

Earlier statistics from Westpac also showed a rise in Australia’s consumer sentiment index in June, climbing by 1.7%, following a 0.3% decline in May.

At the Australian Banking Association conference, RBA Assistant Governor Chris Kent indicated that the Reserve Bank of Australia is not overly concerned about the growing interest in private loans among consumers. Kent highlighted the significant role that private credit plays in the market and underscored that the RBA is closely monitoring developments. However, the regulator is not overly concerned about growth in this area, as it is not particularly large in Australia.

Meanwhile, business investment is on the rise. Kent drew attention to a notable disparity between business confidence, business conditions, and consumer sentiment. The latter position appears to be below average levels.

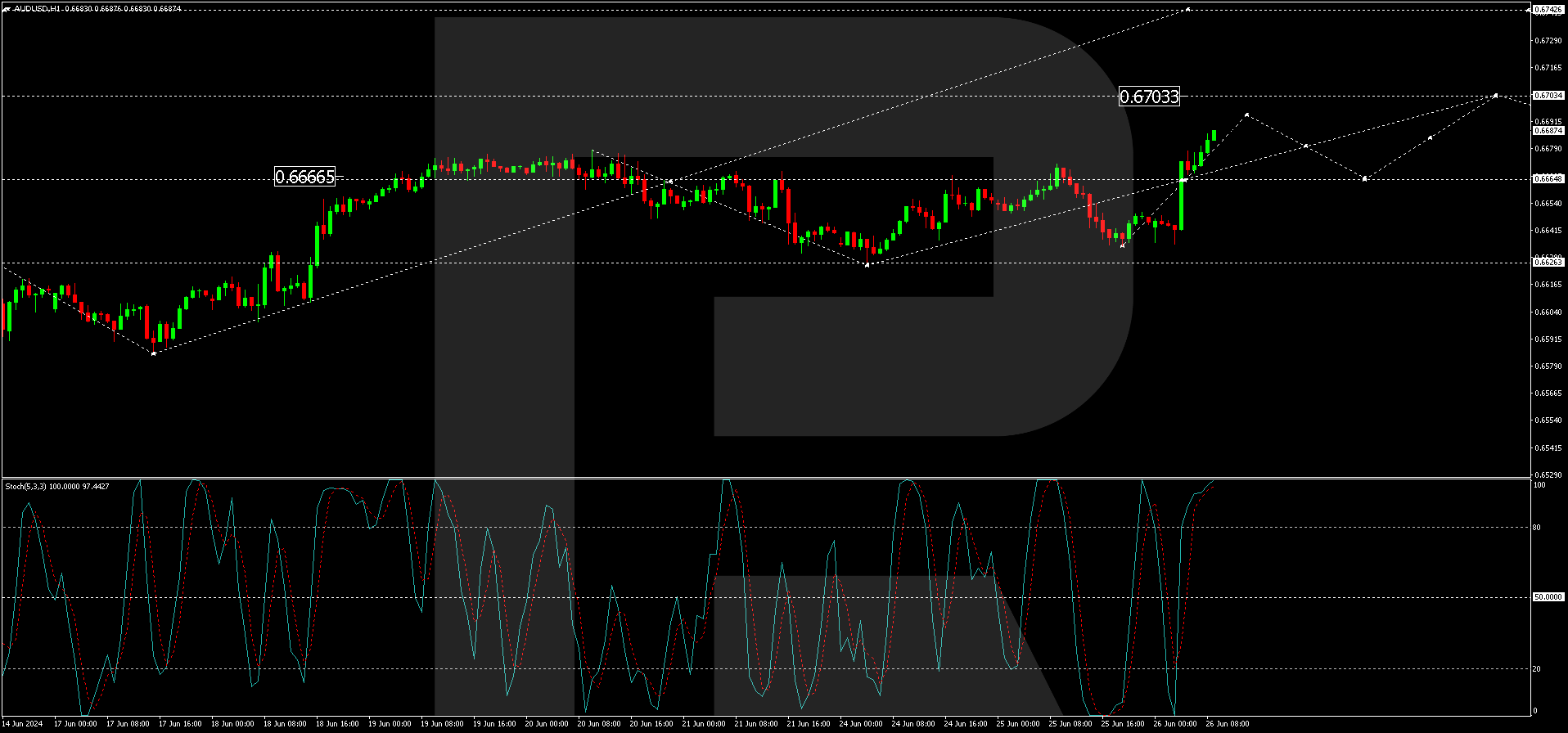

AUDUSD technical analysis

On the H4 chart of AUD/USD, the market ended the correction at 0.6577. Today, we consider a consolidation range forming around the level of 0.6666. With an upside exit, we will consider the probability of another growth structure to the level of 0.6703 with the prospect of continued growth to 0.6744. A correction link to the level of 0.6666 (test from above) is possible, followed by potential growth towards 0.6750. Technically, the MACD indicator supports this scenario. Its signal line is above the zero mark and is directed strictly upwards.

On the H1 chart of AUD/USD, a correction to 0.6626 is executed. Today, the market broke upwards to 0.6666 and continues growing towards 0.6694 with the prospect of continuing the development of the wave structure to 0.670, the local target. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is above the level of 80. We expect the beginning of the decline to the level of 20.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- AUD/USD surged, buoyed by RBA confidence and inflation growth Jun 26, 2024

- RBA may raise rates amid price hikes. BoC is likely to postpone rate cuts amid inflationary pressures Jun 26, 2024

- Brent crude oil hits two-month high amid geopolitical tensions Jun 25, 2024

- RBA and RBNZ have no plans to cut rates this year. Oil is trading at a 2-month high Jun 25, 2024

- FXTM’s Corn: Lingers near 3-month low Jun 25, 2024

- Commodity markets are under pressure from the US dollar growth. New geopolitical risks in the Middle East are on the agenda Jun 24, 2024

- DELL and NVDA are jointly building an artificial intelligence factory. SNB cuts rate for the second time in a row Jun 21, 2024

- The yen is falling again: the devaluation scenario remains the main one Jun 21, 2024

- The pound froze ahead of the Bank of England meeting: what will the Central Bank decide? Jun 20, 2024

- PBoC left interest rates unchanged. New Zealand has left the recession territory Jun 20, 2024