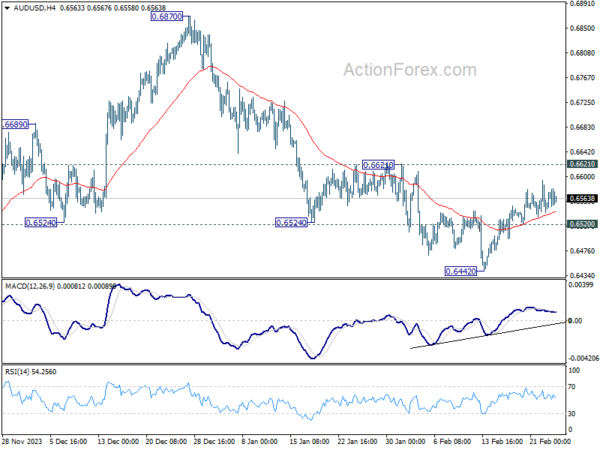

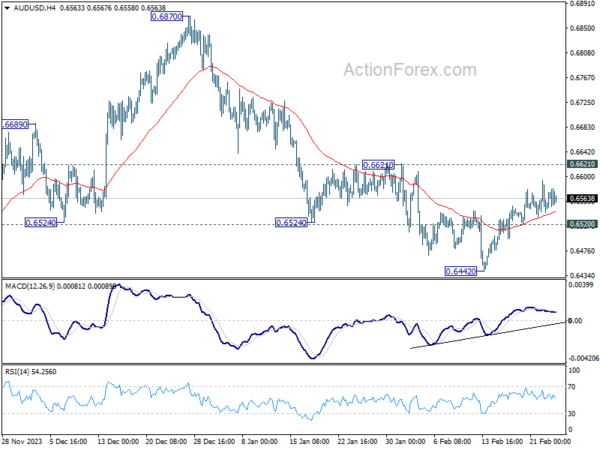

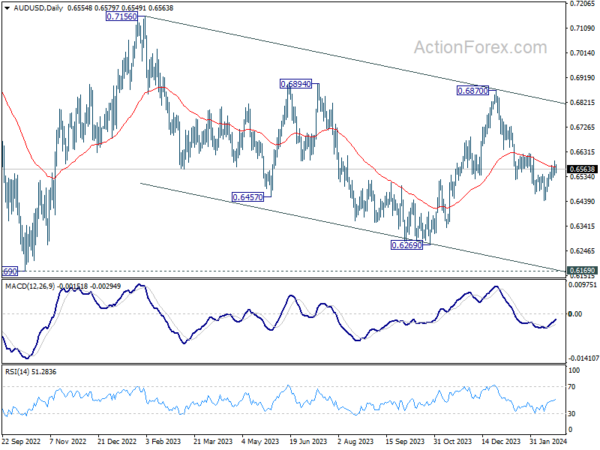

AUD/USD’s recovery from 0.6442 continued last week but upside was capped well below 0.6621 resistance so far. Initial bias remains neutral this week first and outlook stays bearish. On the downside, below 0.6520 minor support will turn bias to the downside for retesting 0.6442. Nevertheless, considering bullish convergence condition in 4H MACD, decisive break of 0.6621 will turn near term outlook bullish for 0.6870 resistance instead.

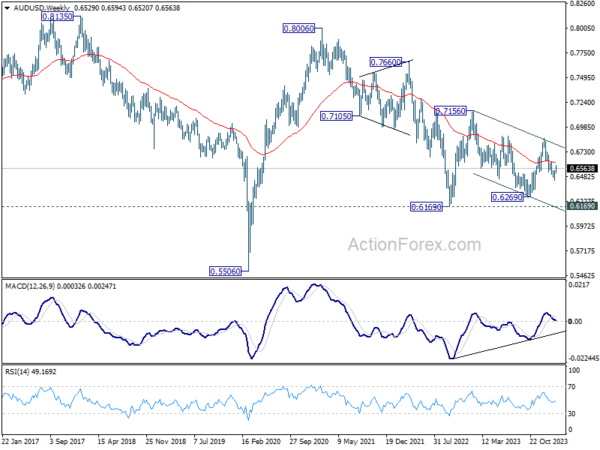

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

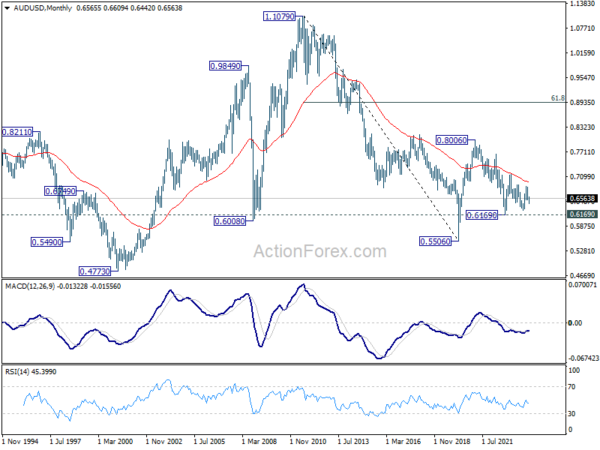

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen the second leg of the pattern. Hence, in case of deeper decline, strong support should emerge above 0.5506 to bring reversal.