- AUDCAD rebounds and breaks above 0.9125

- Overall, it remains above a prior upside channel

- The advance may continue towards the 0.9230 zone

- A dip below 0.9000 could signal a bearish correction

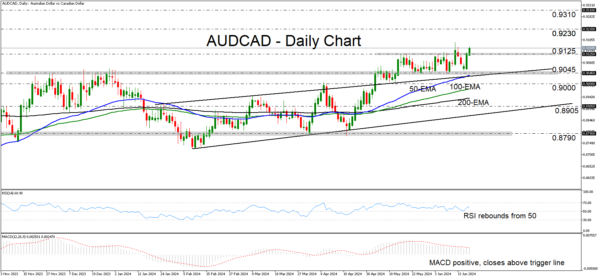

AUDCAD rebounded strongly on Tuesday, extending its recovery above the key resistance zone of 0.9125. Overall, the pair is trading above the upper bound of a prior upward sloping channel and above all three of the plotted exponential moving averages (EMA). This paints a positive picture.

The daily momentum indicators corroborate the bullish outlook. The RSI rebounded from near its 50 line and it is pointing up, while the MACD, already positive, has just poked its nose above its trigger line.

On June 12, the pair broke above the 0.9125 zone, but the bulls were unable to maintain momentum, resulting in a false breakout. If they are stronger this time around and decide to stay in charge, they may push the action up to the 0.9230 zone, marked by the highs of March 22 and 23, 2023. A break higher could pave the way towards the 0.9310 zone, defined as resistance by the highs of February 20 and 21, 2023.

On the downside, a dip back below the round figure of 0.9000 may confirm the pair’s return within the aforementioned channel and thereby allow a larger bearish correction. However, for the bigger picture to turn negative, a dip below 0.8905 may be needed.

To recap, AUDCAD rebounded strongly yesterday, with the rebound extending above 0.9125, which suggests that further advances may be on the cards.