- AUDUSD falls back within a range

- RSI and MACD support further declines

- Dip below 0.6575 could carry larger bearish implications

- Rebound above 0.6690 may invite more bulls.

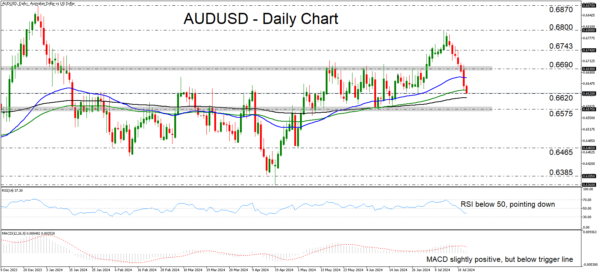

AUDUSD has been trading in a free-fall mode since July 15, while yesterday, the bears cleared the key barrier of 0.6690. Now, the pair is back within the sideways range that contained most of the price action between May 3 and July 3. As long as the pair remains within that range, the outlook could be considered neutral.

The RSI is lying below 50, pointing down, while the MACD, although still slightly positive, it is running below its trigger line. Both indicators suggest that the tumble may continue for a while longer, perhaps until the lower bound of the range, at around 0.6575.

For the picture to start being considered bearish, the price may need to fall below that barrier. Such a move may encourage more sellers to jump into the action and perhaps drive the battel towards the 0.6465 zone, marked as support by the low of May 1.

On the upside, a decisive rebound back above the range’s upper end, at around 0.6690 may allow advances towards the high of July 18 at 0.6743, the break of which could carry extensions towards the peak of July 11, at 0.6800.

To recap, AUDUSD has been tumbling since July 15, returning within the sideways range between 0.6575 and 0.6690. For the outlook to be considered bearish, the price may need to fall below the range’s lower end.