Australian Dollar weakened broadly during Asian session as its recent rally lost momentum. Despite RBA minutes revealing that a rate hike was considered earlier this month, which should have been supportive for the Aussie, this positive sentiment was countered by weak consumer sentiment readings. Additionally, Aussie seemed to be weighed down by a pullback in regional stock markets, particularly with the retreat in Hong Kong’s HSI.

Meanwhile, Japanese Yen continued its broad-based decline, albeit at a slow pace. Japanese Finance Minister Shunichi Suzuki reiterated that foreign exchange rates should be determined by market fundamentals and move in stable manner. He also explained the government’s aim to achieve wage growth that outpaces inflation, a challenging goal if prices keep rising strongly. This highlights Japan’s cautious stance against a steep depreciation of Yen, which would increase import prices and inflation pressures.

In contrast, British Pound and Euro are currently the strongest performers of the day, followed by a recovering Dollar. New Zealand Dollar and Canadian Dollar are among the weakest, trailing behind Aussie and Yen, while Swiss Franc is positioned in the middle.

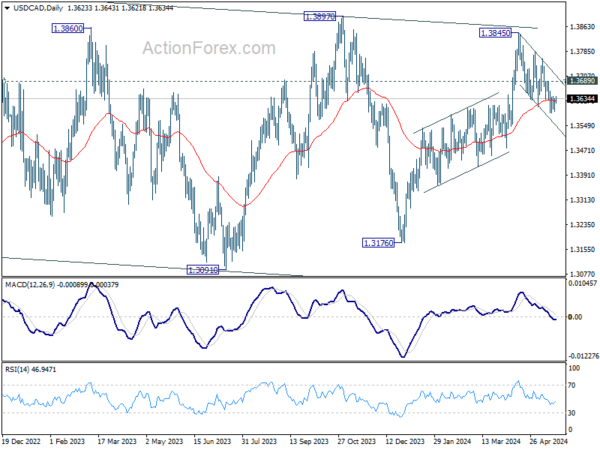

The focus today is on Canadian Dollar with release of Canadian CPI data. This data will be crucial in determining the likelihood of a rate cut by BoC in June. From a technical perspective, USD/CAD is struggling around 55 D EMA for now. Strong boucne from current level, followed by break of 1.3689 resistance, will retain near term bullishness. Rise from 1.3176 could then be ready to resume through 1.3845. However, sustained break of 55 D EMA will argue that rise from 1.3761 has completed, and turn near term outlook bearish. The upcoming CPI data will likely provide the market with a clearer direction.

In Asia, at the time of writing, Nikkei is down -0.05%. Hong Kong HSI is down -2.05%. China Shanghai SSE is down -0.41%. Singapore Strait Times is down -0.35%. Japan 10-year JGB yield is up 0.0017 at 0.981. Overnight, DOW fell -0.49%. S&P 500 rose 0.09%. NASDAQ rose 0.65%. 10-year yield rose 0.017 to 4.437.

Fed officials express caution on inflation, uncertainty over rate cuts

Fed Governor Philip Jefferson issued a cautious message in a speech last night, stating that while April’s inflation data was “encouraging,” it remains “too early to tell” if the recent slowdown in disinflation will be “long lasting.” He described current monetary policy as restrictive and declined to predict whether rate cuts will happen this year. He emphasized the importance of continuing to closely monitor incoming economic data, the outlook, and the balance of risks.

Separately, Cleveland Fed President Loretta Mester told Bloomberg Television that she is reconsidering her earlier forecast of three interest rate cuts this year. Although not her “base case,” Mester noted that if progress on reducing inflation stalls or reverses, Fed is “well positioned” to increase rates if necessary.

San Francisco Fed President Mary Daly also shared her views, expressing doubt about achieving the 2% inflation target in the near term. Daly highlighted that while there are expectations for improvement in shelter inflation, the progress is not expected to be rapid.

RBA minutes highlight debate over rate hike

RBA minutes from May 7 meeting reveal that a rate hike was considered but ultimately, the decision was made to hold cash rate target steady at 4.35%. The board emphasized that recent data indicated that “risks around inflation had risen somewhat,” acknowledging the considerable uncertainty and the difficulty in “ruling in or ruling out” future changes in interest rate.

The minutes detailed that raising the cash rate could be appropriate if the board believed that the staff forecasts were “overly optimistic” about the forces driving down inflation, leaving the balance of risks tilted to the upside. Additionally, a higher cash rate might be necessary even with ongoing weakness in aggregate demand if “other factors slowed the pace of disinflation.”

Conversely, the decision to hold the cash rate steady was based on the view that, although there had been significant updates on the economy since the last meeting, these updates were “not sufficient to warrant a change in the stance of monetary policy.” Inflation was still declining towards the target, and the new information “did not materially alter its trajectory.”

Australian Westpac consumer sentiment falls -0.3% mom amid budget disappointment

Australia Westpac Consumer Sentiment index fell by -0.3% mom to 82.2 in May. Westpac highlighted that the primary takeaways from the May survey are “no let-up in the weak consumer environment” and the cautious mindset of consumers. Consumers are more inclined to use funds from fiscal measures to repair their finances rather than go on spending sprees, which aligns with RBA’s efforts to bring inflation back to target.

The May survey, conducted during budget week, provided a clear comparison of sentiment before and after the budget announcement. Sentiment among those surveyed before the budget was relatively optimistic, with an index reading of 86.8, marking a 5.3% increase from April. However, sentiment plummeted to 76.6 after the budget announcement, reflecting a 7% decline from April. This -11.8% drop in sentiment post-budget contrasts with a -7.4% decline observed last year.

Looking ahead

German PPI, Eurozone current account and trade balance, will be released in European session. Later in the day, Canadian CPI will take center stage.

AUD/USD Daily Report

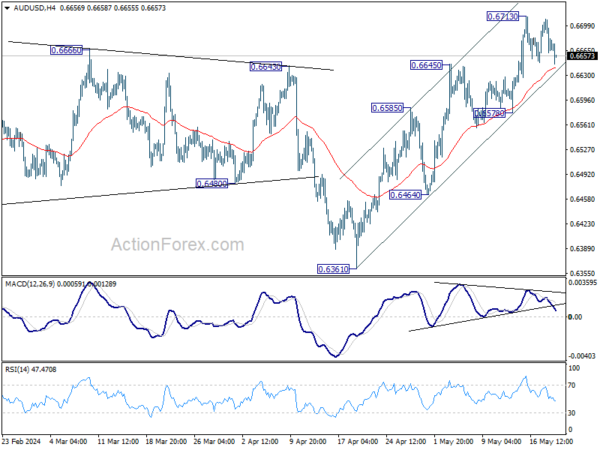

Daily Pivots: (S1) 0.6650; (P) 0.6679; (R1) 0.6697; More…

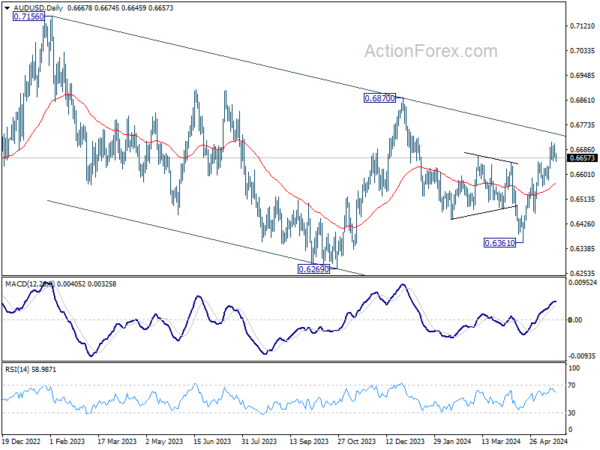

AUD/USD dips mildly today as consolidation from 0.6713 continues. Intraday bias stays neutral for the moment. Further rally is expected as long as 0.6578 support holds. As noted before, fall from 0.6870 has probably completed with three waves down to 0.6361 already. Above 0.6713 will target 0.6870 resistance next.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could have completed at 0.6269 already. Rise from there is seen as the third leg which is now trying to resume through 0.6870 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Westpac Consumer Confidence May | -0.30% | -2.40% | ||

| 01:30 | AUD | RBA Minutes | ||||

| 06:00 | EUR | Germany PPI M/M Apr | 0.10% | 0.20% | ||

| 06:00 | EUR | Germany PPI Y/Y Apr | -3.20% | -2.90% | ||

| 08:00 | EUR | Eurozone Current Account (EUR) Mar | 30.2B | 29.5B | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Mar | 19.9B | 17.9B | ||

| 12:30 | CAD | CPI M/M Apr | 0.50% | 0.60% | ||

| 12:30 | CAD | CPI Y/Y Apr | 2.80% | 2.90% | ||

| 12:30 | CAD | CPI Median Y/Y Apr | 2.70% | 2.80% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Apr | 2.90% | 3.10% | ||

| 12:30 | CAD | CPI Common Y/Y Apr | 2.80% | 2.90% |