By RoboForex Analytical Department

The AUD/USD pair is experiencing upward momentum for the second consecutive day, reaching a one-week high near 0.6453 on Tuesday. This positive movement comes after a period of rapid decline and is supported by encouraging economic data from Australia.

The latest manufacturing PMI report for April significantly contributed to the Australian dollar’s appreciation. It showed an increase to 49.9 points, up from 47.3 the previous month. This improvement brings the manufacturing sector close to the critical 50.0 threshold, distinguishing between the industry’s growth and contraction. Additionally, the services PMI reported the most robust expansion in the last three months, and the private sector experienced its fastest growth in two years during April.

These robust economic reports not only indicate a resilient economy but also carry pro-inflationary implications. They bolster the outlook that the Reserve Bank of Australia (RBA) may maintain higher interest rates for an extended period to manage inflationary pressures effectively.

Investors will also pay attention to the upcoming release of inflation statistics later in the week, which will provide further insights into the economic factors influencing the RBA’s monetary policy decisions.

Moreover, the Australian dollar’s gains were further supported by a reduction in investor concerns over geopolitical risks in the Middle East, contributing to a more favourable risk environment.

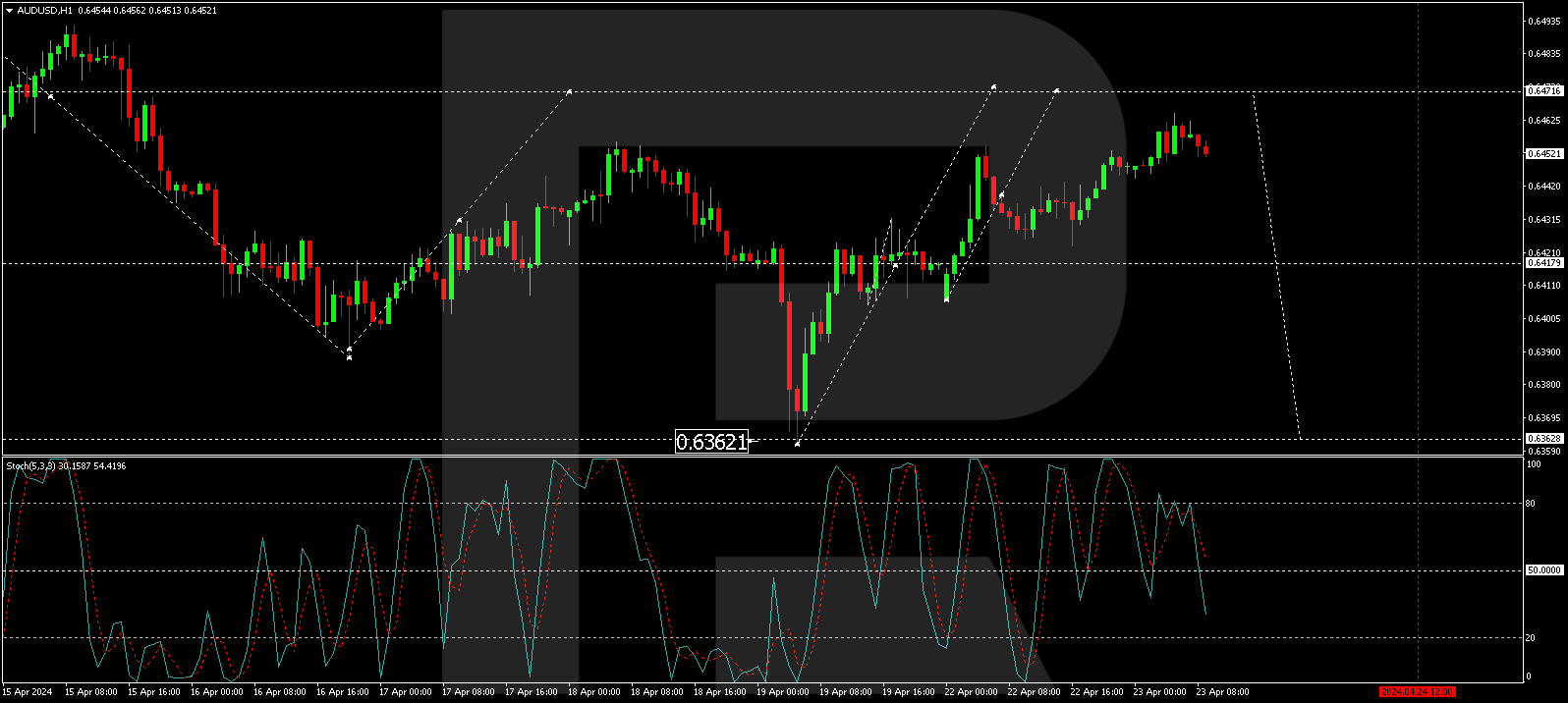

Technical analysis of AUD/USD

On the H4 chart, the AUD/USD pair completed a declining wave to 0.6362. A corrective movement towards 0.6471 is underway. Upon completion of this correction, a continuation of the downward trend towards 0.6300 is anticipated. The MACD indicator supports this bearish outlook despite its signal line being above zero, which typically suggests growth potential.

On the H1 chart, a consolidation range has been formed around 0.6417. A breakout above this range could lead to a rise towards 0.6471. Following this peak, a new downward wave to 0.6363 is expected. Breaking below this level may pave the way to reach 0.6300. The Stochastic oscillator, with its signal line currently below 80 and pointing downwards, confirms this potential downward trajectory.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- Australian dollar rises on strong economic indicators Apr 23, 2024

- Geopolitical risks in the Middle East are declining. China kept interest rates at lows Apr 22, 2024

- Brent crude dips to four-week low amid easing geopolitical tensions Apr 22, 2024

- COT Metals Charts: Speculator bets led by Copper & Silver Apr 20, 2024

- COT Bonds Charts: Speculator bets led by 10-Year Bonds & Fed Funds Apr 20, 2024

- COT Stock Market Charts: Speculator bets led by S&P500-Mini Apr 20, 2024

- COT Soft Commodities Charts: Speculator bets led by Soybean Meal & Lean Hogs Apr 20, 2024

- 3 Signs of Developing U.S. Economic Slowdown Apr 19, 2024

- Israel has retaliated against Iran. Investors run to safe assets Apr 19, 2024

- Gold hits record high amid growing geopolitical tensions Apr 19, 2024