Axis Bank informed its customers via email and SMS that their banking services might be interrupted on the internet banking and mobile banking platforms as they are in the last stages of the transition of Citi’s consumer business in India to Axis Bank.

According to the Axis Bank post on social media platform X, “As we are in the final stage of the transition of Citi’s consumer business in India to Axis Bank, certain banking services will be affected on the Internet Banking & Mobile Banking platforms. We urge you to plan your banking needs in advance. Please refer to the thread for details.”

According to the Axis Bank website, “As an existing Axis Bank customer, we strongly urge you to plan your banking requirements across both the platforms well in advance, as per the availability of services. Rest assured, upon completion of the migration, you will be able to use all the services on Axis Bank platforms from 12 am (midnight), 15th July, 2024.”

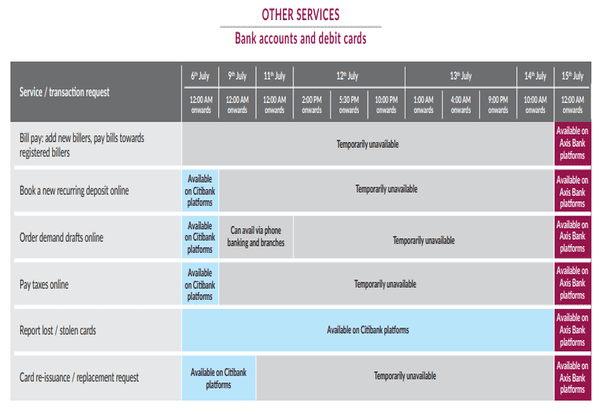

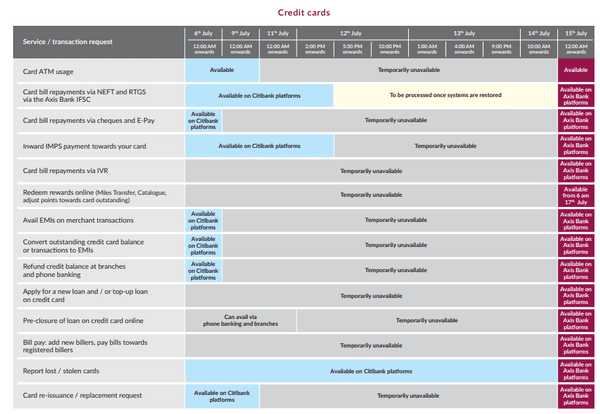

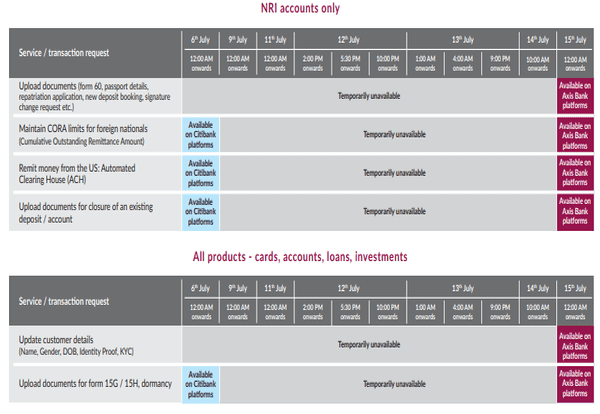

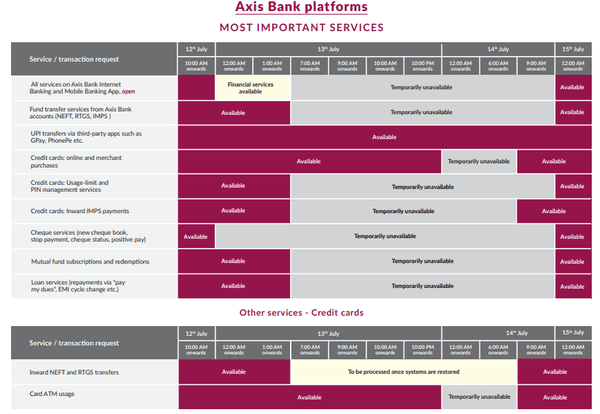

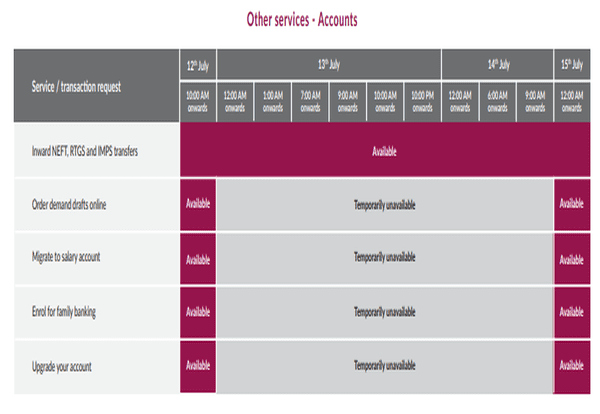

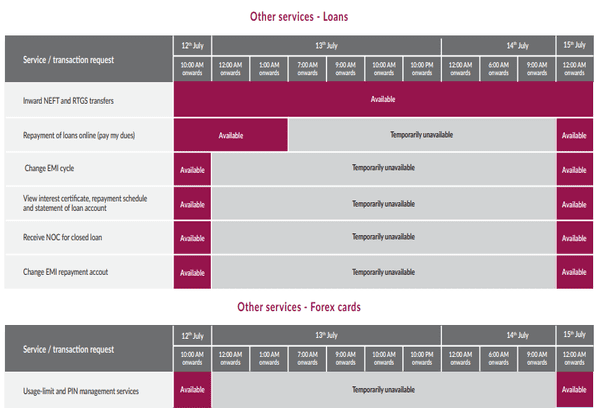

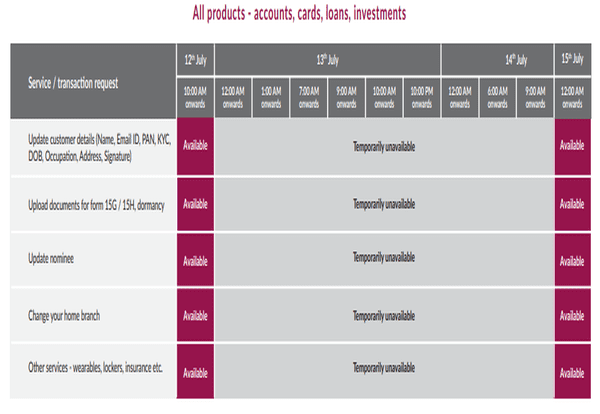

Here is a quick reference of some of the most important services and transactions which will be affected (all timings in IST):

CITIBANK PLATFORMS THAT WILL BE IMPACTED

AXIS BANK PLATFORMS IMPACTED

How do I access my card post the completion of migration? Will I be able to access my card with Citibank Online Account / Citi Mobile® App credentials?

Until the migration takes place, you may continue to use Citibank Online Account and Citi Mobile’ App for accessing your card(s). Post-migration, if you are an existing Axis Bank customer, you may continue to use your existing Axis Bank credentials to log in to Axis Bank Mobile App, open or Internet Banking to access your card. If you are not an existing Axis Bank customer, please register for Axis Bank Internet Banking/ Mobile App using existing Citibranded Card credentials.What fees and charges will be applicable on my credit card after migration?

You can access the detailed list of charges in the Axis Bank MITC (Most Important Terms and Conditions) through the following link:

Please note:

o Interest for the statement generated after migration will be as per Axis Bank rates (please refer MITC for details). However, in case there is an interest amount pertaining to a billing cycle prior to migration, same will be calculated using the applicable Citi interest rates and billed to you post migration if applicable.

o There have been changes to the forex markup levied on transaction reversals, late payment charges, cash advance fees, fuel surcharge waiver, and payment .

Also read: HDFC Bank scheduled downtime: Many HDFC Bank services to be down for almost 14 hours on July 13; full list of services you can, cannot do this Saturday

After migration, will there be any change in annual fee charged on my Citi-branded Card(s)?

No, there will be no change in the annual fees on your Citi-branded Card post-migration. In case there are no annual fees applicable on your card, it will continue as-is even after the migration. In case there are any changes, we will inform you in advance.

I paid my annual fees before the migration. Will I be charged again, and will my renewal benefits change?

You will only be charged an annual fee in line with your existing annual fee cycle, i.e. a year after your last payment. You can continue to enjoy renewal benefits hassle-free. In case of any change, the same will be communicated in advance.