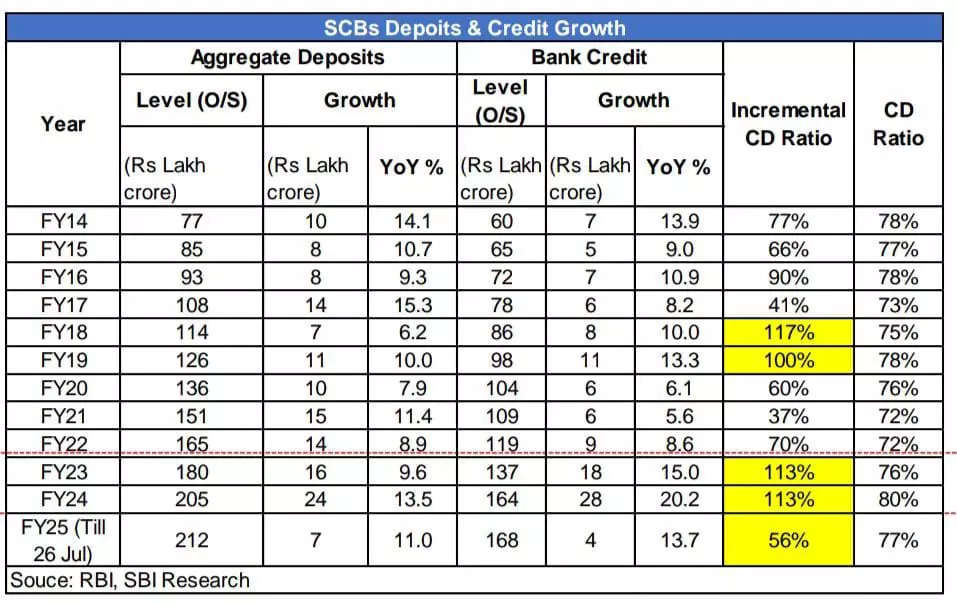

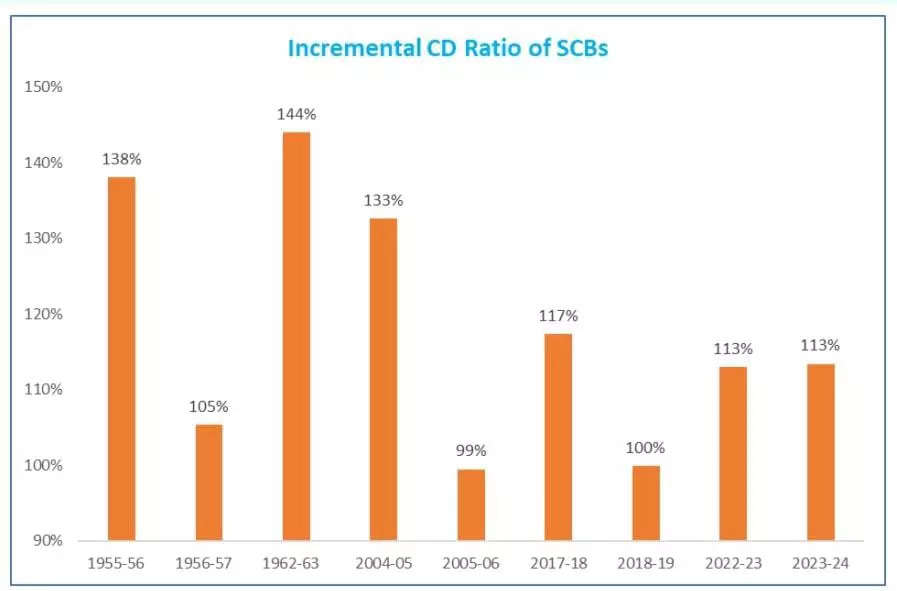

In FY23, all scheduled commercial banks (ASCBs) had registered the highest amount of growth in deposits and credit since 1951-52. Deposits grew by Rs 15.7 lakh crore and credit by Rs 17.8 lakh crore, which has pushed the incremental CD Ratio to 113 per cent. The same story continued in FY24, and deposits grew by Rs 24.3 lakh crore and credit by Rs 27.5 lakh crore. The incremental CD ratio again surpassed 100 per cent and stood at 113 per cent, revealed a latest report by the State Bank of India.

The myth of a flagging deposit growth is only a statistical myth with credit growth outpacing deposit growth being tom-tommed as a deceleration in deposit growth. Incremental deposit growth at Rs 61 trillion has outpaced incremental credit growth at Rs 59 trillion since FY22, what is thus important is the pricing of deposits and not the quantum, the report further said.

| During FY14 to FY25 (till July 2024), all scheduled commercial banks’ deposits grew by Rs 144 lakh crore, while credit by Rs 116 lakh crore, with a CD ratio of 79.9 per cent. |

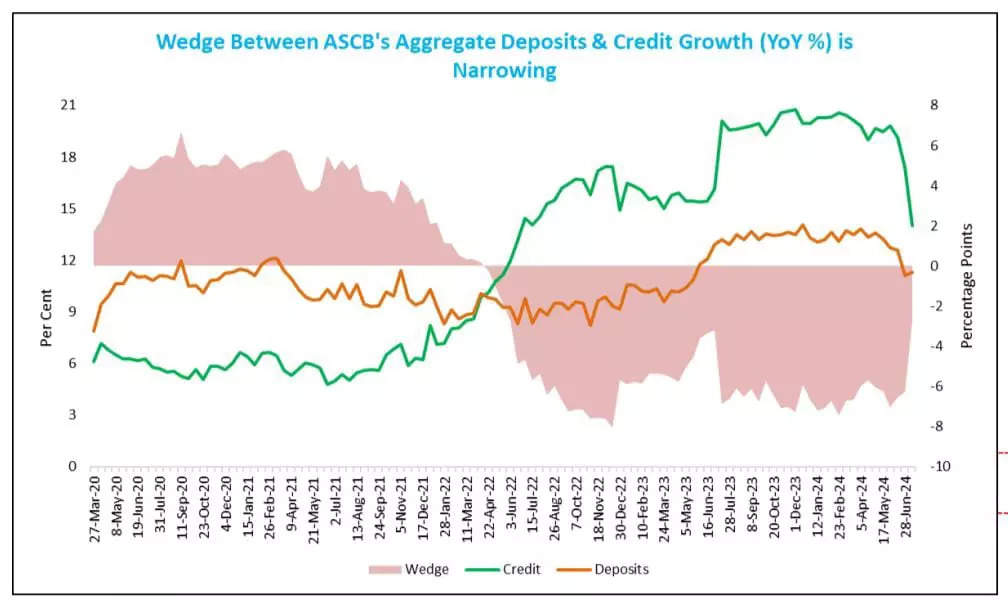

There have been episodes of credit and deposit growth divergence persisting for 2 to 4 years. As per RBI study, we are in the 26th month of credit and deposit divergence as on June 24, going by past data, taking the outer limit, the end of the divergence cycle could be June 2025 –October 2025.

The report further revealed that beyond such time, deposit growth could inch up and credit growth significantly decelerating, this would also mean a rate reversal cycle and a growth slowdown.

ALSO READ| How risk-based premiums for bank deposits can lead to financial system stability

Does higher CD Ratio Leads to Rise in Interest Rates?

Since 1950-51, there are 8 instances/year, when the incremental CD ratio has crossed 100 per cent and in 2005-06 it touched 99 per cent. As bank financed the increasing credit needs of the Economy through other resources, it is expected that both deposits and landings rates should increase, highlighted the report.

However, the interest rates in all the years shows a mixed results. During 2017-18 and 2018-19, incremental CD ratio crossed 100 per cent but interest rates of deposits declined first and then increased, which is in line with the movement in policy repo rate and RBI’s stance on liquidity.

While, in FY23 and FY24, both deposits and lending rates increased, despite RBI’s repo rate remaining constant at 6.5 per cent since February 2023. This may be due to the rise in CRR by RBI to reduce the money supply.

Compositional change in CASA & bank deposits

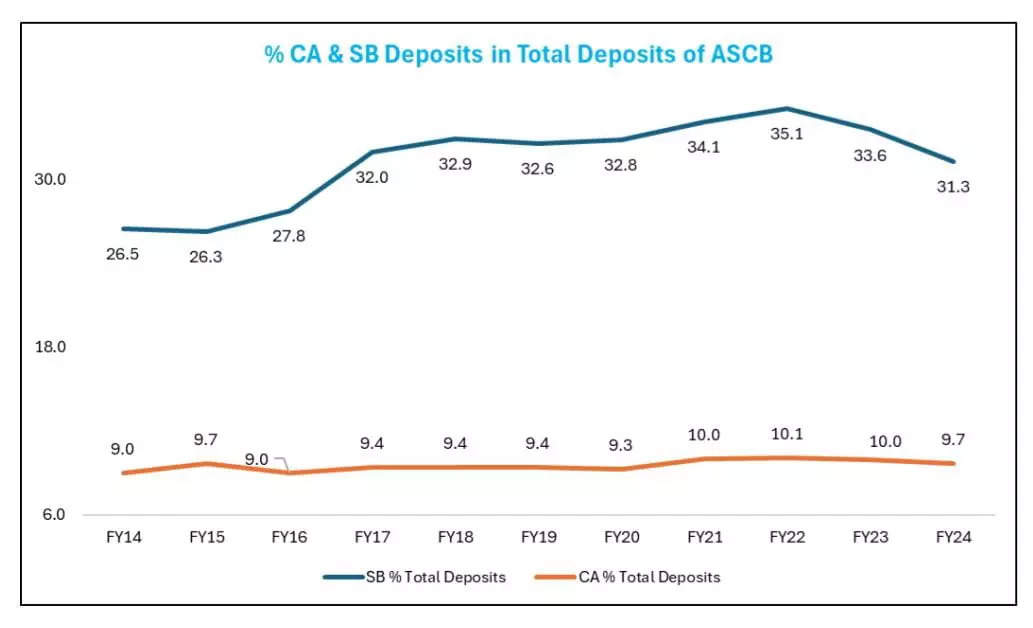

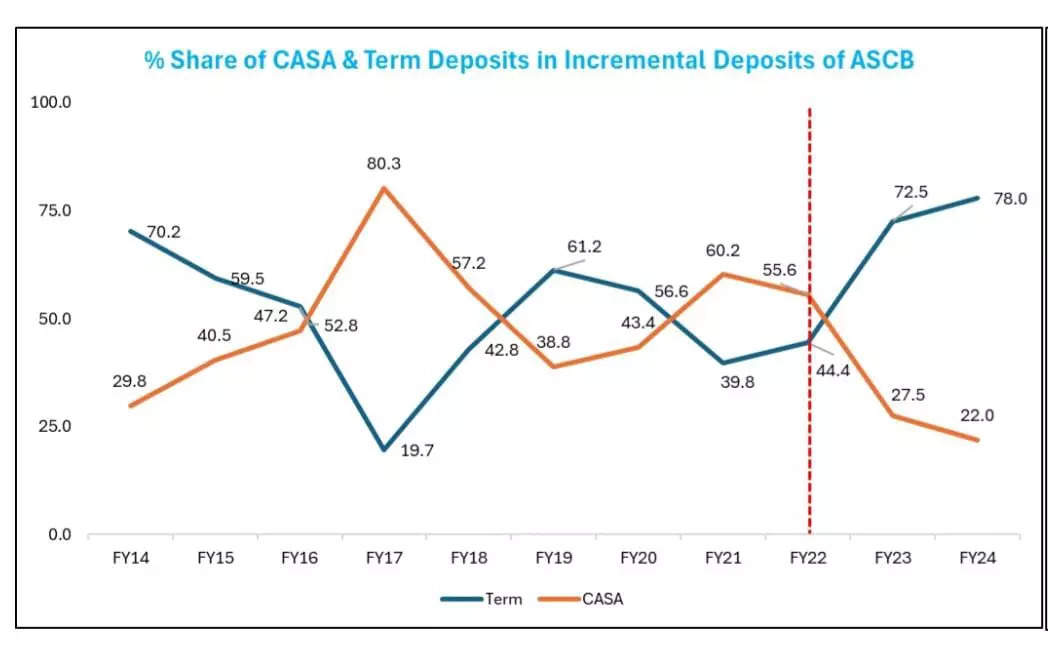

CASA deposits declined to 41 per cent in FY24 from 43.5 per cent in FY23, mostly due to the 2.5 per cent decline in SB deposits (savings account deposits) during the same time. However, the 41 per cent share is marginally adrift of the pre pandemic level at 42 per cent, the report said.

CA share in total deposits remained almost flat at 9.7 per cent while the share of SB deposits in total deposits has increased 4.8 per cent to 31.3 per cent in FY24 from FY14.

Within CASA deposits, the share of SB per cent of CASA deposits has increased by 1.6 per cent to 76.3 per cent in FY24 from 74.7 per cent in FY14. PMJDY deposits of Rs 2.3 lakh crore also helped banks in rising savings bank deposits, the report added.

Rising return on term deposits has been driving the compositional shift in bank deposits — the share of term deposits in total deposits increased to 59 per cent in FY24 from 56.5 per cent in FY23. On the other hand, CASA deposits declined to 41 per cent in FY24 from 43.5 per cent in FY23.

On an incremental basis, term deposits accounted for nearly 78 per cent of the total deposits in FY24 and the shares of CASA deposits has declined, this is obvious as in an increasing interest rate scenario, CASA moves to time deposits, the report stated.

ALSO READ| Explainer: NII, NIM, CRR — what do these key banking terms mean?

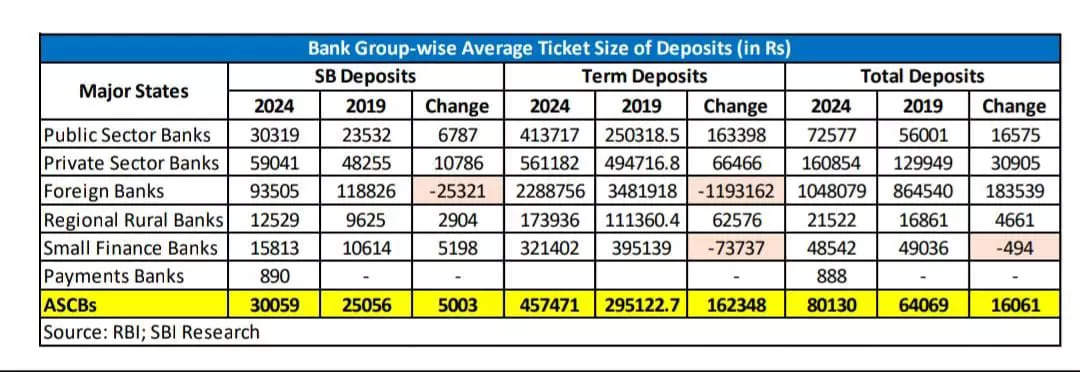

PSBs at forefront of mobilizing small-ticket deposits

Government has made a strong pitch recently for banks to find novel ways to attract deposits, advocating a return to the ‘old-fashioned approach’ of raising small sums from many savers rather than pursuing bulk corporate deposits that might constitute ‘very lazy’ banking habits eventually.

The average ticket size of SB/Term deposits of public sector banks are Rs 72,577 as against Rs 1.60 lakhs of private sector banks and Rs 10.5 lakhs for foreign banks. Thus PSBs are at the forefront of mobilizing low ticket deposits across the banking spectrum, said the report.

The rural and semi-urban (RUSU) areas have almost 60 per cent of total bank branches, with PSBs have the largest chunk in it. RUSU region is where most small ticket deposits are garnered by banks.

The average ticket size of rural and semi-urban region is approximately 25 per cent and 50 per cent of urban region, respectively. Same trend is visible in the case of female depositors also, the report added.