Bank of America reported its first-quarter 2024 financial results today.

The Global Markets segment saw net income of $1.7 billion. Excluding net DVA, net income was $1.8 billion in the first three months of 2024.

Global Markets revenue for the first quarter of 2024 amounted to $5.9 billion, up 5% from the year-ago quarter, driven by higher investment banking fees and sales and trading revenue.

Noninterest expense of $3.5 billion increased 4%, driven by investments in the business, including technology.

Sales and trading revenue of $5.1 billion increased less than 1%; excluding net DVA.

Fixed Income, Currencies and Commodities (FICC) revenue decreased 6%, to $3.2 billion, driven by a weaker trading environment in macro products, partially offset by improved trading in mortgages. Equities revenue increased 14%, to $1.9 billion, thanks to strong trading performance in derivatives.

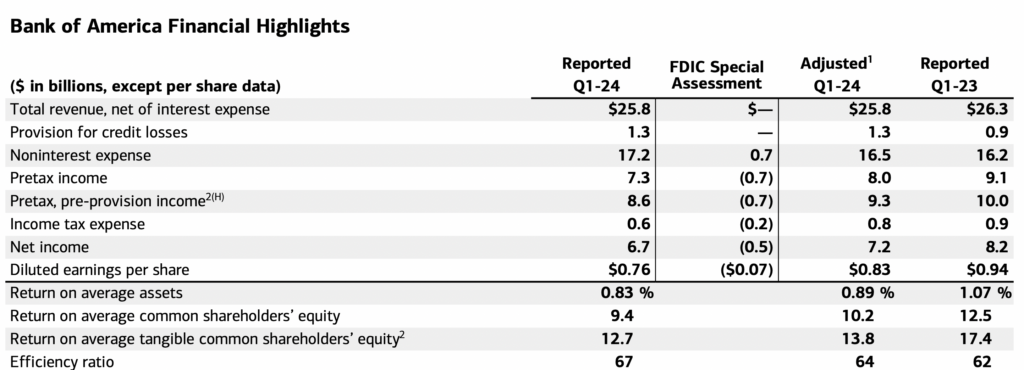

Across all segments, Bank of America reported net income of $6.7 billion, or $0.76 per diluted share, compared to $8.2 billion, or $0.94 per diluted share in Q1-23.

Adjusted net income for the period was $7.2 billion (excluding FDIC special assessment).

Revenue, net of interest expense, of $25.8 billion decreased $440 million, or 2%, including higher investment banking and asset management fees, as well as sales and trading revenue, and lower net interest income (NII).

NII decreased 3% to $14.0 billion ($14.2 billion FTE), as higher deposit costs more than offset higher asset yields and modest loan growth.

Chair and CEO Brian Moynihan commented:

“We reported a strong quarter as our businesses performed well, adding clients and deepening relationships. We reached 36.9 million consumer checking accounts, with 21 consecutive quarters of net checking account growth. Our Wealth Management team generated record revenue, with record client balances, and investment banking rebounded. Bank of America’s sales and trading businesses continued their strong 2023 momentum this quarter, reporting the best first quarter in over a decade. Continued strong earnings and strong expense management both position our company to continue to drive our market leading positions across our businesses.”