- Canadian inflation has been moving in right direction this year

- Investors have assigned a more than 80% probability of a June cut

- But will the BoC move before the Fed; decision is due Wednesday, 13:45 GMT

The race to cut may be reaching the final hurdle

As the race to cut rates reaches fever pitch, much of the attention has been centred on the US Federal Reserve and the European Central Bank. However, the Bank of Canada may well steal the spotlight over the coming week by beating both central banks in cutting first. After finding itself in a similar situation as the Fed in the second half of 2023 when the progress in reducing inflation stalled, the Bank of Canada has had better luck in 2024.

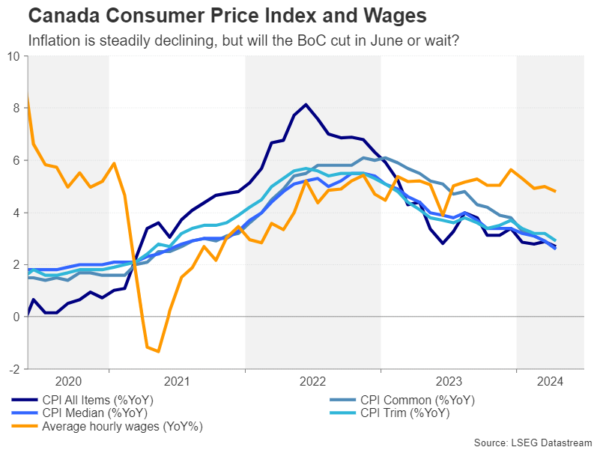

Headline inflation fell to a three-year low of 2.7% in April, while all three underlying measures watched by policymakers also declined to fresh lows, dropping below 3.0%. Wage growth has been somewhat stickier, but seems to be heading downwards, albeit very gradually. Nevertheless, with the unemployment rate creeping upwards over the past year, wage pressures are likely to ease further in the coming months.

More broadly, economic growth has regained some momentum in the last couple of quarters but overall remains tepid amid still subdued consumption, and whilst the housing market seems to be on the mend, it’s unlikely to pose a significant risk to stability.

Will the BoC make the first move?

All this could potentially provide policymakers with the green light they’re looking for to slash rates. In the April policy statement, the Bank had said it will be seeking evidence that the downward momentum in inflation is sustained and that certainly appears to have been the case.

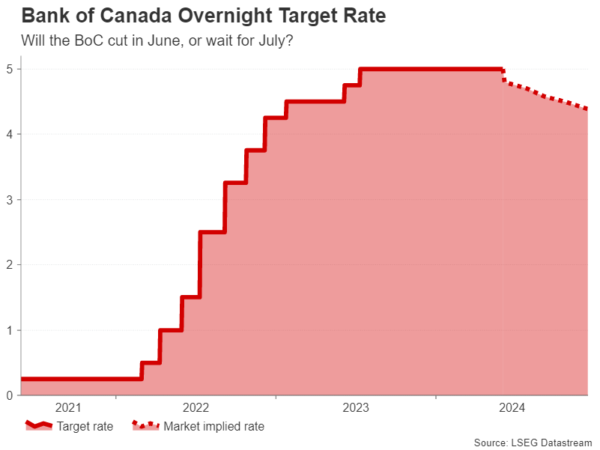

The question for investors is whether or not the progress since the April meeting has been substantial enough for the BoC to start lowering rates as early as June, or will it proceed more carefully and instead flag a cut in July. The odds for easing policy in June rose above 60% following the softer-than-expected April CPI report before reaching 80% after the disappointing Q1 GDP data. A cut in July remains fully priced in.

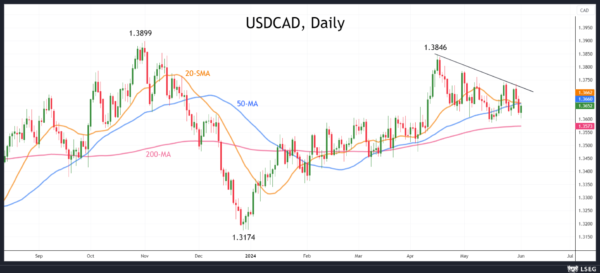

Loonie’s uptrend is on shaky grounds

Should the BoC reduce its overnight rate by 25 basis points on Wednesday, it would likely pressure the Canadian dollar against its US counterpart, endangering the six-week-old uptrend. The loonie could revisit the April low of 1.3846 per US dollar.

However, if the Bank stands pat in June, there could be scope for a rebound towards the 200-day moving average around 1.3570. The risk in this scenario is that should policymakers explicitly signal a cut for the following meeting in July, the loonie is again bound to face selling pressure.

Will the Fed derail a BoC cut

One reason why the BoC might decide to wait until the July meeting or even later is that, apart from wanting to see a further decline in inflation, the Fed is not in a position to do the same. As things currently stand, the US central bank might not start easing before December.

BoC policymakers would probably be wary of moving faster than the Fed and might therefore proceed cautiously as well so as not to hurt the loonie. However, neither would the BoC want to put its easing plans on hold for too long so cutting before the Fed might be inevitable and the most likely outcome is that policymakers will make only modest cuts until the Fed joins the rate-cutting club.