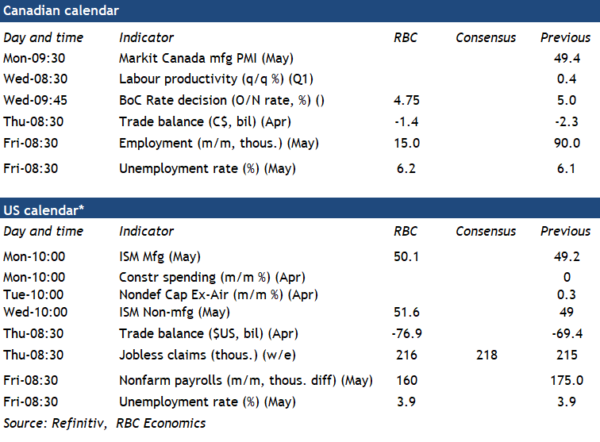

All ducks appear to be in a row for the Bank of Canada to kick-start the policy easing cycle and lower the overnight rate by 25 basis points to 4.75% on Wednesday. The move follows cuts from the Swiss National Bank and the Riksbank (central bank of Sweden) in recent weeks and comes after the overnight rate was held at a restrictive 5% for about a year (the last rate hike was July 2023).

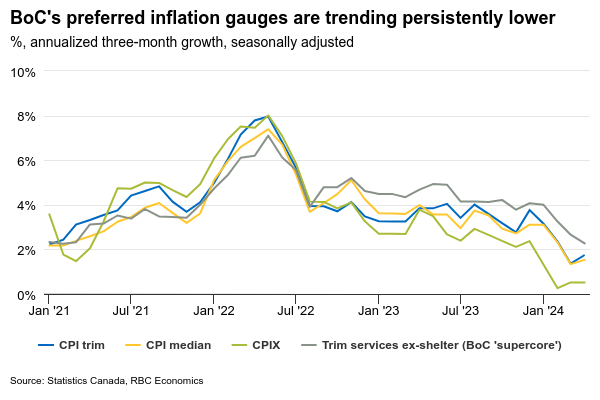

Evidence has continued to build that the current high level of interest rates is no longer needed. The Canadian economy has softened significantly. Gross domestic product per capita posted another decline in Q1 this year. Inflation pressures have also slowed with the closely watched three-month growth rate (annualized) in the BoC’s preferred median and trim core consumer price index measures both running below the 2% inflation target in April. The slowing economic backdrop is raising confidence that lower inflation readings will continue despite signs of a reacceleration in the stronger U.S. economy. At the last interest rate decision, Governor Tiff Macklem said the conditions for lower interest rates appeared to be in place but that the central bank wanted to see more evidence that inflation pressures are trending lower. The two CPI reports since then have both surprised on the downside and should provide the BoC with enough evidence.

Still, while the case for interest rate cuts in Canada is relatively clear—the BoC will likely maintain a cautious tone about the pace of additional cuts after next week. Governor Macklem has mentioned a few areas where price pressures could still resurface. That includes higher energy prices driven by global geopolitical conflicts, and faster increases in wages and/or home prices domestically.

So far, there’s little sign of domestic price pressures reaccelerating. Labour market conditions have continued to cool over the spring as hiring demand slows. We expect next week’s labour market data will show more softening in May with a small 15,000 gain in employment and another tick higher in the unemployment rate to 6.2%. Housing market conditions, in the meantime, have remained weak as buyers continue to be challenged by higher borrowing costs and a lack of affordability. Wary of those risks, the BoC will likely continue to suggest that the pace of additional easing will be slow and gradual. Still, we expect that, ultimately, a softer economy will keep inflation pressures moving lower in Canada. Contingent on that outlook, we look for 100 basis points of interest rate cuts this year that will leave the overnight rate at a still restrictive 4% by the end of 2024.

Week ahead data watch

U.S. employment likely went up by 160,000 in May, slowing from the 175,000 in the prior month. Much of that growth came from health care and social assistance sector, offsetting the weaknesses from manufacturing and information sectors. We expect the unemployment rate to be unchanged from April, at 3.9%.

We look for the April Canadian trade balance to have narrowed to $-1.4B, from the $-2.3B in March. Exports likely increased by 1.4%, with higher oil prices pushed energy trade balance higher. Imports should look little changed from March.

April advance trade report showed goods trade deficits widened by $7.1B in the U.S., with imports (+3.1%) growing at a faster pace than exports (+0.5%) from March. We expect the overall trade deficit to widen as well, from $-69.4B to $-76.9B in April.