- We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 5.25% on 1 August. We stress that it is a very close call not least due to the very limited amount of communication from the MPC over the past months.

- Overall, we expect the BoE to deliver a dovish twist to its forward guidance priming markets for a forthcoming start to a cutting cycle.

- We expect EUR/GBP to drop upon announcement but that the dovish communication in the statement and press conference will limit the downside potential.

We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 5.25% on 1 August. Consensus expects a 25bp cut to 5.00% and markets currently price -12bp for the meeting. We expect the vote split to be very tight with the majority voting for an unchanged decision. The close call is further amplified by new member Clare Lombardelli (replacing Ben Broadbent) joining the committee for her first meeting. Note, this meeting will include updated projections and a press conference following the release of the statement.

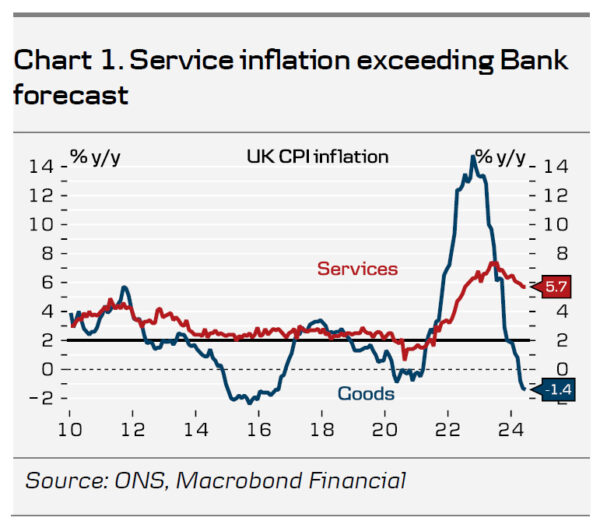

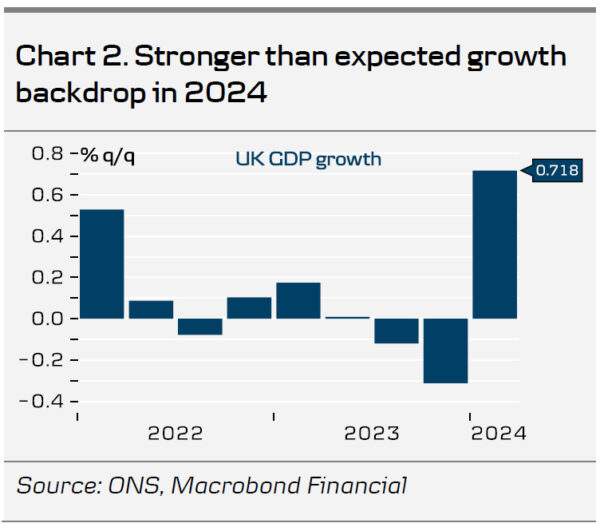

Overall, we expect the MPC to add a dovish twist to its previous guidance, priming the markets for a forthcoming start to a cutting cycle. We expect them to retain much of its wording in terms of forward guidance, repeating that “monetary policy could remain restrictive even if Bank Rate were to be reduced, given that it was starting from an already restrictive level and that “the policy decision at this meeting was finely balanced” for some members. Since the last monetary policy decision in May, data has overall been stronger than expected across both inflation, activity and partly labour markets. Activity picked up in Q1 with the economy growing 0.7% q/q (vs BoE forecast of 0.4%) underpinned by a recovery in real wages. Service inflation remained elevated in Q2 at 5.8% y/y (vs BoE forecast of 5.3%) with underlying momentum still strong. The labour market continues its gradual loosening, but wage growth remains elevated leaving a small upside risk to the BoEs Q2 forecast underpinned by the recent rise in the National Living Wage.

Given the UK general election, communication from the MPC has been very limited over the past months. Notably, Pill delivered hawkish commentary noting that “services price inflation and wage growth continue to point to an uncomfortable strength in those underlying inflation dynamics” and that indicators “have hinted towards some upside risk to my assessment of inflation persistence“. In a notoriously divided committee, Bailey and Pill have voted in unison at every meeting since Pill joined the MPC in 2021.

BoE call. We expect the BoE to deliver the first cut of 25bp in September. Subsequently, we expect quarterly cuts through 2024 and 2025. Markets are pricing 50bp for the remainder of the year with the first 25bp cut fully priced by November.

FX. In our base case of a dovish “unchanged” decision, we expect EUR/GBP to drop upon announcement but that the dovish communication in the statement and press conference will limit the downside potential. We expect EUR/GBP to continue its recent move lower driven by indicators pointing to a continued (modest) rebound in the global manufacturing cycle, tight credit spreads and low FX volatility. The key risk is policy action from the BoE.