- We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 5.25% on 21 March, which is in line with consensus and current market pricing.

- Overall, we expect the MPC to repeat its previous communication relying on a data dependent approach.

- We expect a muted reaction in EUR/GBP with risks tilted to the topside.

We expect the Bank of England (BoE) to keep the Bank Rate unchanged at 5.25% on 21 March, which is in line with consensus and current market pricing. We expect the vote split to be 7-1-1, with the majority voting for an unchanged decision, Mann voting for a hike and Dhingra voting for a cut. Note, this meeting will include neither updated projections nor a press conference following the release of the statement.

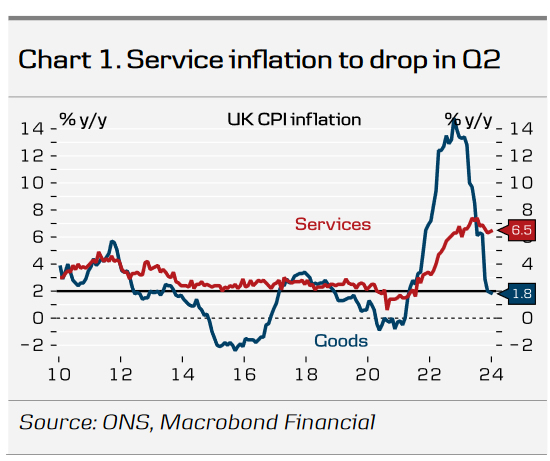

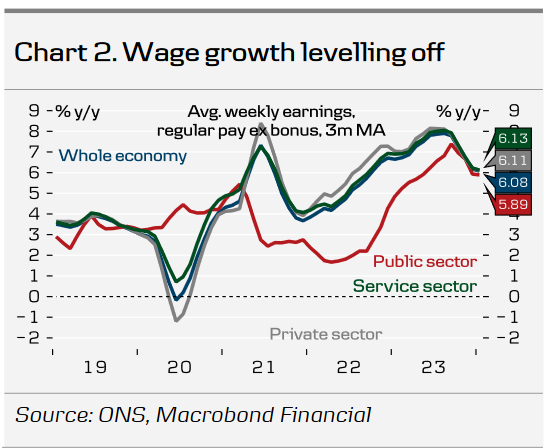

Overall, we expect the MPC to retain much of the same communication as from the February meeting, relying on a data dependent approach. Likewise, we think the BoE will be cautious in being too optimistic on the inflation outlook to prevent premature easing of financial conditions. Since the last monetary policy decision in February, data releases have overall pointed to more muted price and wage pressures. January inflation data surprised slightly to the downside and delivered a broad-based decline in inflationary momentum driven by both food and core inflation. While inflation for February is released the day before the meeting, we do not expect the print to change the outcome of this meeting. Large base effects from energy prices last spring are set to bring headline inflation back to 2% during the coming months. As previously flagged, we do not see inflation developing materially different in the UK compared to elsewhere, a call that is increasingly gaining momentum. Wage growth continues to edge lower supported by a gradually loosening of the labour market as highlighted by both the official labour market statistics and the KPMG/REC report on UK jobs. The growth backdrop remains a challenge for the MPC, with both composite and service PMIs remaining in expansionary territory pointing to a slight growth rebound in 2024 following a technical recession at the end of 2023.

Fiscal policy. The Chancellors budget included a range of easing measures including a 2pp cut to National Insurance. However, the measures are also largely set to boost the supply side, which minimises the potential upward pressure on inflation. Overall, we do not see the Spring Budget altering our long-held view of the MPC delivering its first cut in June.

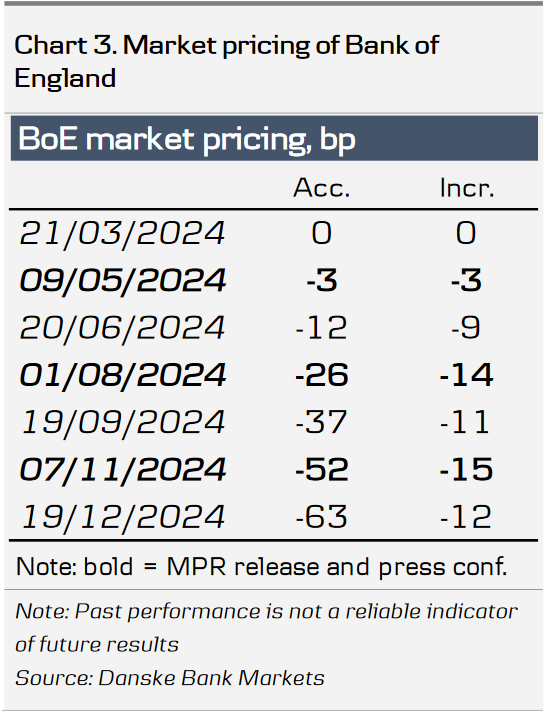

BoE call. We expect the BoE to prime markets for a rate cut at the May meeting which includes updated projections, delivering the first cut of 25bp in June. Importantly, we note that the BoE the past years traditionally has used small meetings to deliver important policy shifts: the first hike in December 2021, 50bp hike in June 2023 and unchanged decision in September 2023. We subsequently expect 25bp cuts in the following quarters, totalling 75bp of cuts for 2024. Markets are pricing 63bp for the remainder of the year with the first 25bp cut fully priced by August (chart 3).

FX. In our base case we expect a muted reaction in EUR/GBP with the MPC likely to give little away in terms of guidance. Overall, we see relative rates as a negative for GBP and see current levels as attractive levels to sell GBP. We forecast EUR/GBP towards 0.88 and stay short GBP/USD.