- At today’s monetary policy meeting the BoE left the Bank Rate unchanged at 5.25% as widely expected.

- As we expected, the BoE retained much of its previous guidance but delivered a slight dovish twist, laying the groundwork for an August cut.

- Gilt yields tracked lower and EUR/GBP moved higher on the dovish twist, but overall the market reaction has been fairly muted.

As expected, the Bank of England (BoE) decided to keep the Bank Rate unchanged at 5.25%. The vote split was unchanged since the May meeting with 7 members voting for an unchanged decision and Dhingra and Ramsden voting for a cut.

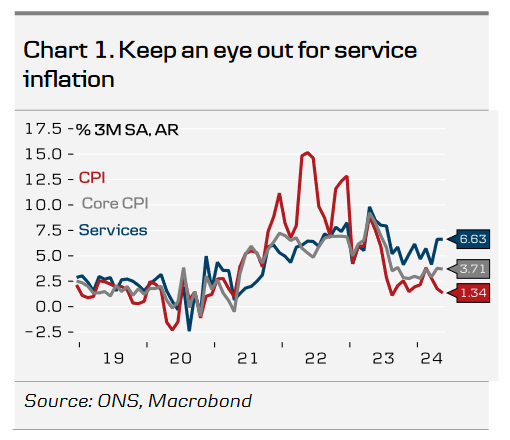

The BoE stuck to its previous guidance in its statement noting that “monetary policy could remain restrictive even if Bank Rate were to be reduced, given that it was starting from an already restrictive level” and “the Committee will keep under review for how long Bank Rate should be maintained at its current level“. The BoE downplayed the recent topside surprise to service inflation noting that it was partly due to annual price adjustments and volatile components. Likewise, the division in the “unchanged” camp has become more evident. The hawkish members noted that “more evidence of diminishing inflation persistence was needed before reducing the degree of monetary policy restrictiveness” whereas the other members noted that “the policy decision at this meeting was finely balanced”. We think this opens the door for a shift towards a majority voting for a cut at the August meeting.

Before the next meeting on 1 August, we get a limited amount of data. Namely one jobs report for May/June and the inflation report for June. We expect the data releases to show further signs easing inflationary pressures and wage growth to level off, leaving the BoE comfortable enough to opt for a rate cut at the August meeting. Risks are however to a later start to the cutting cycle if we get a topside surprise to especially service inflation.

Rates. 2Y Gilt yields moved lower on the statement but overall, the reaction in rates markets was fairly muted. Markets shifted towards a front-loading of cuts with 16bp now priced for the August meeting.

FX. Following the release of the statement, EUR/GBP moved higher on the dovish twist from the statement. Overall, we see relative rates as a negative for GBP but note with risks to both growth and inflation tilted to the topside, this leaves a more challenging backdrop for an impending BoE cutting cycle. By extension and combined with the political uncertainty in France, this also acts as a downside risk to our EUR/GBP forecast of 0.88 in 6-12 months.

Our call. We continue to expect the BoE to deliver the first cut of 25bp in August with risks skewed towards a later start to a cutting cycle. We subsequently expect a 25bp cut in November, totalling 50bp of cuts for 2024. Markets are pricing 50bp for the remainder of the year with the first 25bp cut fully priced by September.