- At today’s monetary policy meeting the BoE left the Bank Rate unchanged at 5.25% as widely expected.

- The BoE delivered a dovish twist to its forward guidance and general communication. This marks an important first step to an eventual cutting cycle.

- EUR/GBP moved slightly higher on the dovish vote split and communication.

As expected, the Bank of England (BoE) decided to keep the Bank Rate unchanged at 5.25%. The vote split indicated a continued split committee but to a much lesser extent than previously. At this meeting, 8 members voted for an unchanged decision and one member for a 25bp cut compared to a former 6-2-1 split vote split with hawks Haskel and Mann changing their vote from a hike to an unchanged decision.

The BoE struck a dovish tone in its statement today noting that “the Committee recognised that the stance of monetary policy could remain restrictive even if Bank Rate were to be reduced, given that it was starting from an already restrictive level“. We think this is an important first step in signalling that start to an impending cutting cycle. The BoE retained much of its wording in terms of forward guidance, repeating “Monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target” and “the Committee will keep under review for how long Bank Rate should be maintained at its current level“.

Before the next meeting on 9 May, which will include updated projections, it is limited what we get of data. Namely one inflation report for March and the labour market report for February/March. While we expect the UK economy to show further signs of weakness and inflation and wage growth to level off, we do not believe that the BoE will feel comfortable enough to opt for a rate cut at the May meeting. We believe that we would have to see significant downside surprises across both inflation and labour market data for this to be the case.

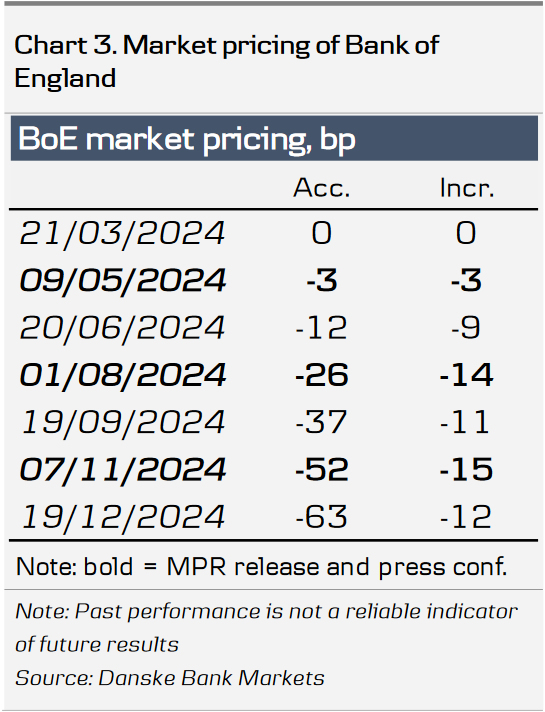

Rates. The reaction in rates markets was muted. 2Y Gilt yields moved slightly lower on the statement but fully retraced the move during the afternoon. Markets stick to expecting the first 25bp cut in August but increased the probability for an earlier move.

FX. Following the release of the statement, EUR/GBP moved higher on both the dovish vote split and guidance from the statement. Overall, we see relative rates as a negative for GBP and see current levels as attractive levels to sell GBP. We forecast EUR/GBP towards 0.88 and stay short GBP/USD.

Our call. We continue to expect the BoE to prime markets for a rate cut at the May meeting, which includes updated projections, delivering the first cut of 25bp in June. We think today’s meeting supports that notion. We subsequently expect 25bp cuts in the following quarters, totalling 75bp of cuts for 2024. Markets are pricing 77bp for the remainder of the year with the first 25bp cut fully priced by August.