In a notable trend, mutual funds’ debt exposure to Non-Banking Financial Companies (NBFCs), including Commercial Papers (CPs) and Corporate Debt, remained above the ₹2 lakh crore mark for the second consecutive month, touching ₹2.09 lakh crore in May 2024. This marks an impressive year-on-year increase of 22.0% and a slight sequential growth of 0.5%.

Commercial Papers (CPs) have consistently remained above the ₹1 lakh crore mark for six consecutive months, standing at ₹1.15 lakh crore. This level was last witnessed in May 2019, nearly five years ago, indicating a strong resurgence in CP exposure, data from the CareEdge report showed

Banks’ Growing Credit Exposure to NBFCs

For nearly six years, the credit extended by banks to NBFCs has exhibited a consistent upward trend, accelerating further with the phased reopening of economies post-COVID-19 pandemic. This growth is primarily attributed to the expansion in the Assets Under Management (AuM) of NBFCs.

According to the ratings agency, In May 2024, the credit exposure of banks to NBFCs stood at ₹15.68 lakh crore, indicating a 16.0% year-on-year growth. Excluding the reclassified exposures of HDFC, the growth rate would have been higher at 26.0%. This adjustment offers a clearer picture of the underlying growth trend.

Despite this growth, the proportion of NBFC exposure in relation to aggregate credit has reduced from 9.6% in May 2023 to 9.3% in May 2024. Additionally, the growth rate of advances to NBFCs has been below the overall bank credit growth since December 2023, due to regulatory actions, base effect, and capital market borrowings.

Bank Loans and Mutual Funds NBFC Debt Exposure: Comparative Study

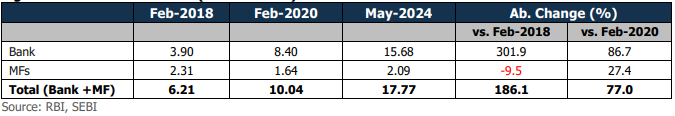

When comparing the figures from February 2018, absolute bank lending to NBFCs has quadrupled, demonstrating significant growth over the years. Conversely, mutual fund exposure has reduced by 9.5% over six years. CP outstanding remained strong at ₹1.15 lakh crore, above the one lakh crore mark for six consecutive months.

Additionally, mutual funds’ exposure to NBFCs as a share of Debt Assets Under Management (AuM) has decreased from nearly 20% in the latter part of 2018 to around 13% by May 2024. On the other hand, the share of banks’ advances to NBFCs as a proportion of aggregate advances has doubled from around 4.5% in February 2018 to 9.3% in May 2024, the report highlighted.

Three-Year G-Sec Yield Trends

The spread between domestic and US and EU government securities yields has been broadly trending downward. May saw a significant surge in Certificate of Deposits issuances, increasing by 195% compared to the previous month and doubling from the same period last year.

Corporate Bond and CP Issuances

For FYTD25, corporate bond issuances reached ₹1.2 lakh crore, marking an 81% rise year-on-year. Meanwhile, CP issuances also saw a notable increase of 59% month-on-month in May, though they showed a slight 13% increase from last year. However, FYTD25 CP issuances totaled ₹2.2 lakh crore, reflecting a modest decline of 5% year-on-year.

Corporate bond issuances experienced robust 84% monthly growth in May but witnessed a significant 19% drop compared to last year.

Investments in NBFC Corporate Debt

The report further added that the investment in corporate debt of NBFCs increased by 19.2% year-on-year and 4.8% month-on-month to ₹0.94 lakh crore in May 2024. Meanwhile, the share of total corporate debt to NBFCs inched up to 4.6% in May 2024 from 4.3% in May 2023.

CP Outstanding Trends

The outstanding investments in CPs of NBFCs have stayed above the ₹1 lakh crore mark for six months, increasing by 24.4% year-on-year to ₹1.15 lakh crore in May 2024. CPs (less than 90 days) rose by 20.9% year-on-year to ₹0.73 lakh crore in May 2024. However, CPs (90 days to 182 days) fell by 20.1% to ₹0.07 lakh crore, and CPs (more than six months) increased by 53.8% to ₹0.33 lakh crore in the reporting period.

This increase comes against the backdrop of RBI increasing the risk weights on higher-rated NBFCs for borrowings from the banking system.

Total Debt Funds Deployed in NBFCs via CPs and Corporate Debt

The percentage share of funds deployed by mutual funds in CPs as a percentage of banks’ exposure to NBFCs stood at 7.3% in May 2024, increasing by over 50 bps year-on-year. The proportion of CPs (less than 90 days) deployed in NBFCs as a percentage of aggregate funds deployed for less than 90 days reached 8.9% in May 2024 compared to 8.1% over a year ago period.

CPs (90 days to 182 days) fell marginally to 8.3% from 8.4% over a year ago, and CPs (greater than six months) increased to 11.9% in May 2024 compared to 9.7% over a year ago.