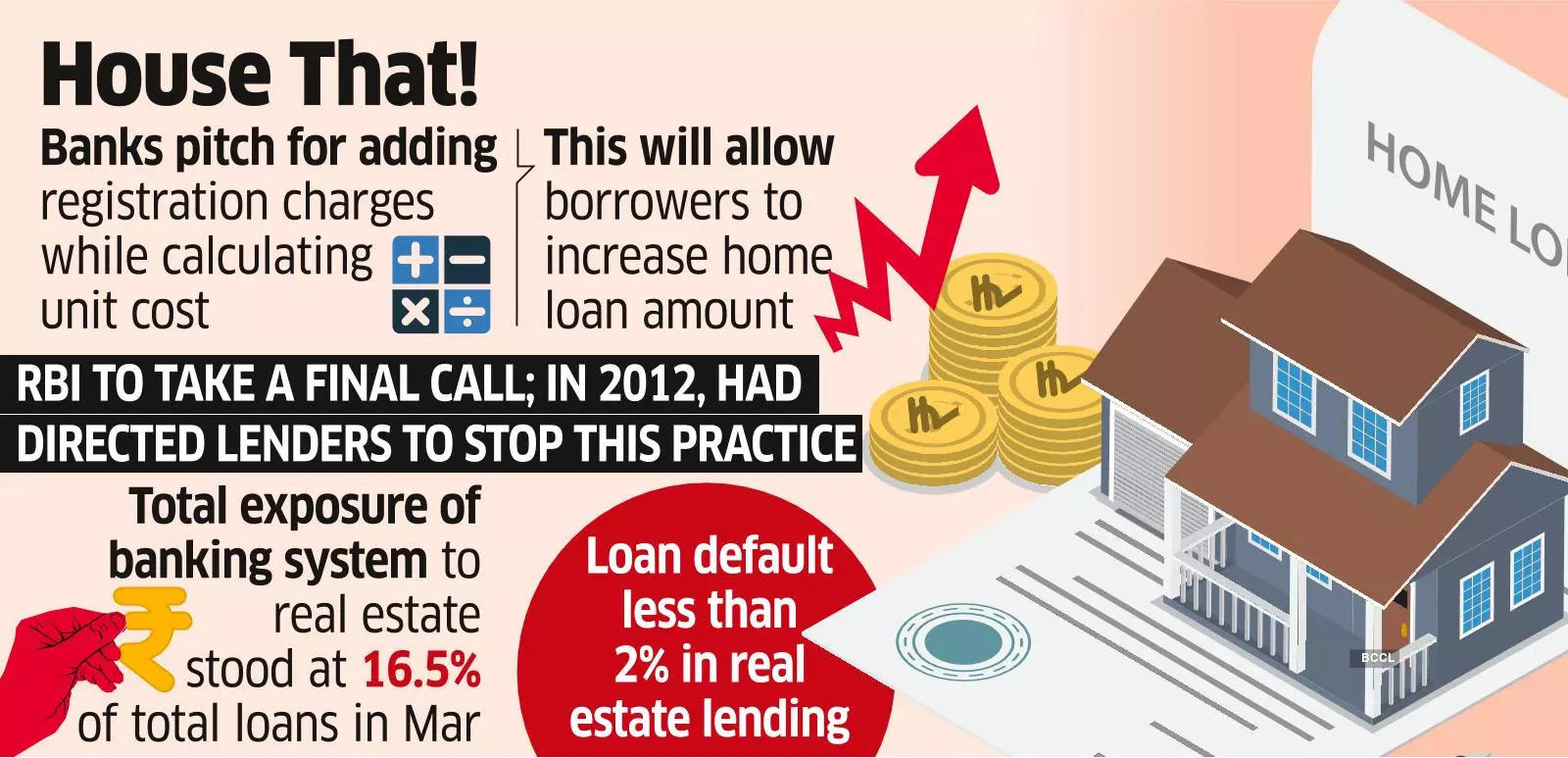

Home loan seekers may be eligible to get larger financing if the banking sector regulator approves a proposal submitted by banks to include stamp duty and other registration charges in the project cost, said people with knowledge of the matter.

Lenders reached out to the Reserve Bank of India (RBI) after internal deliberations in a meeting held last month, they said.

At present, such charges are not covered in the home loan amount.

“We are hoping that the RBI will take a favourable decision, and this will increase the loan amount to an individual. Since the housing loan is backed by collateral, it will not add to any undue risk,” said a senior bank executive, who did not wish to be identified.

If the RBI approves the proposal, for a project costing ₹1 crore, including stamp duty and registration charges of ₹20 lakh, a borrower will be eligible for a loan of ₹75 lakh, against ₹60 lakh under the existing loan-to-value (LTV) ratios prescribed by the RBI. The LTV ratio is the percentage of the property value that a lender can lend to a property buyer.

As per existing guidelines, the home loan LTV ratio stands at 75-90% of the property value. If the loan amount is more than ₹75 lakh, the LTV ratio cannot exceed 75%.

Almost a decade ago, the central bank had directed lenders not to include stamp duty or registration charges in the total value of a home so that the effectiveness of loan-to-value norms is not diluted. Adding such charges overstates the realisable value of the property as stamp duty, registration and other documentation charges are not realisable and, consequently, the stipulated margin gets diluted, said an RBI circular of February 2012.

“It is for the regulator to take a final decision. If they deem fit, they can also put up a limit, like the stamp duty and other administrative charges should not exceed 10% of the project cost,” another executive said on condition of anonymity.

In 2015, the RBI allowed banks to include stamp duty and registration charges in the cost of a unit for home loans up to ₹10 lakh with a view to encouraging affordable housing for such borrowers.

As per the Reserve Bank’s latest Financial Stability Report, the share of residential housing loans in total advances increased to 14.2% in March 2023 from 8.6% in March 2012.

“Total exposure of the banking system to real estate stood at 16.5% of total loans in March 2023. Given the secured nature of these loans and loan-to-value ratio regulations, loan defaults remain less than 2%,” said the RBI report.