Do you think interest rates are very high right now? Amit Goel certainly feels so. That’s why the Delhi-based finance professional is gorging on long-duration debt funds. “I started buying long-term debt funds last year, when bond yields were close to 7.5%,” he says. Goel’s investments in long-duration funds have earned close to 9% returns till now, and he expects them to do even better when interest rates decline.

Experts believe that the RBI will cut interest rates this year, but are not sure about the extent of cuts or even the timing. “We are at, or close to, the peak interest rate cycle in India, but I don’t expect any imminent cut in the next 3-4 months,” says Vishal Goenka, Co-founder of Indiabonds. com. “Rate cuts will happen this year, but very gradually,” says Pankaj Pathak, Senior Fund Manager for Fixed Income in Quantum Mutual Fund.

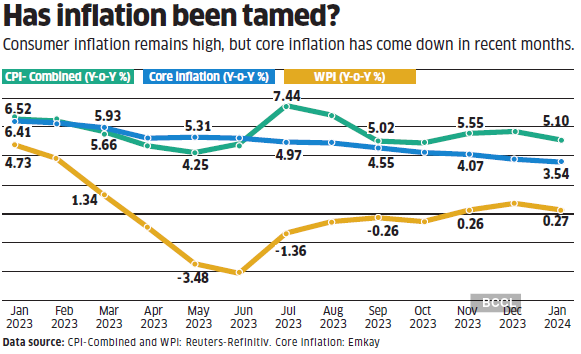

Much depends on how inflation pans out in the next few months. Though consumer inflation has remained high, this is largely due to the spike in food prices. Wholesale inflation has been very low, and core inflation, which does not include food items, has also remained low (see chart). If consumer inflation declines, the RBI may be inclined to cut rates, which in turn will boost the bond prices.

How the yield curve changed in the past one year

Short-term rates rose due to liquidity pressure in the banking system, but long-term rates declined.

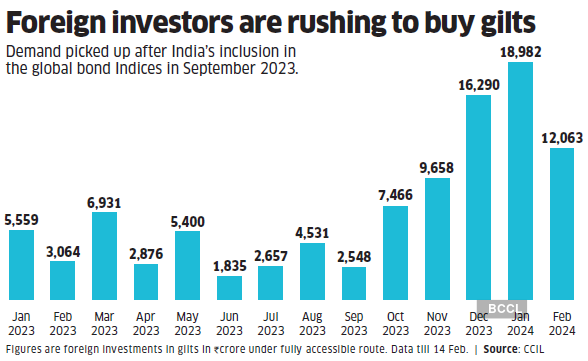

The demand for gilts shot up after it was announced in September 2023 that Indian government bonds would be included in the JP Morgan GBI EM index. From June this year, Indian bonds will get a 1% weightage in the index, which will be increased by 1% every month till it reaches 10%. Encouraged by this, foreign portfolio investors (FPIs) have bought gilts worth over Rs.65,000 crore under the fully accessible route in the past five months (see chart).

Foreign investors are rushing to buy gilts

Demand picked up after India’s inclusion in the global bond Indices in September 2023.

Has inflation been tamed?

Consumer inflation remains high, but core inflation has come down in recent months.

What should investors do?

The consensus among experts is that the debt markets will do well in 2024. To gain from the high yields that government bonds are offering right now, one can buy gilts directly from a brokerage house or investing platforms. “The process is very simple. We do a KYC check, which is paperless, and then you can buy any listed bond,” says Goenka of Indiabonds.com.Last year’s Budget had changed the tax rules for debt funds. Long- and short-term gains will now be taxed at the slab rate of the individual. However, capital gains from listed bonds, if held for more than a year, are taxed only at 10%.

At the same time, liquidity is a big problem when you want to sell small holdings in a market where deals are usually in crores of rupees. Debt funds make more sense for the small investor, though one is subjected to a higher tax rate and also pays fund management charges.

Choosing the right debt fund is a challenge. There are more than 15 categories of debt funds, each serving a different purpose and investor need. We identified the best funds on the basis of investors’ needs.

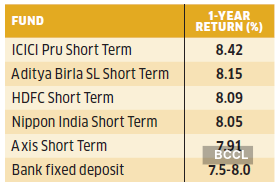

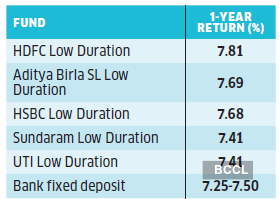

IF LOOKING TO PARK MONEY FOR 3-12 MONTHS IN A SAFE OPTION

Investors looking to park money in a safe option for less than one year should go for short duration funds. These schemes invest in very short-term government bonds and, therefore, the credit risk is nil while the interest rate risk is negligible. An investor planning to buy a house or pay for his child’s education fees in the next few months should not be concerned about how much the money can earn till then. The focus should be on safety. It is another matter that in the past year, the top performing funds in this category have delivered decent returns of close to 7.5%. Bank deposits can also give similar returns, but they are not as liquid and flexible.

IF YOU NEED THE MONEY AFTER 12-15 MONTHS

Short-term debt funds have given good returns in the past one year, beating fixed deposits by almost 50-60 basis points. “The short end of the yield curve is looking attractive. Right now, the yields are high because of tight liquidity, but this could change if government spending injects liquidity in the system,” says Manish Banthia, CIO for Fixed Income at ICICI Prudential Mutual Fund. Even if yields don’t decline, short-term debt funds will continue to give stable returns of 7-7.5%.

FDs offer similar returns, but as pointed out earlier, they are not as liquid and flexible. An investor can make partial withdrawals from a debt fund, but fixed deposits have to be closed if you need the money earlier. What’s more, banks give a lower rate of interest for premature closures.

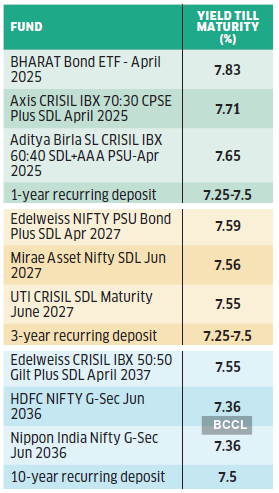

WANT TO SAVE MONEY REGULARLY TILL SPECIFIC DATE

Recurring deposits are very popular with investors saving for their children’s goals. You can do the same by starting an SIP in debt funds, but there is no assurance of returns. However, in recent years, fund houses have launched target date funds that have a specific maturity. If held till maturity, these funds deliver returns equal to the yield of the bonds in their portfolios after deducting their expenses.

When investing in a target date fund, be sure that the maturity aligns with your goal date. Ideally, it should be a few weeks before you need the money.

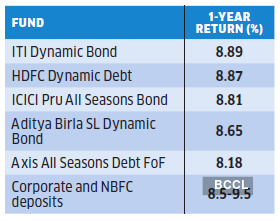

WANT TO EARN MORE THAN A BANK DEPOSIT

As per their mandates, mutual funds are required to invest in bonds of certain tenures, but dynamic bond funds have the flexibility to alter the average maturity profile of their portfolios as per the reading of the fund manager. Dynamic bond funds have performed very well in the past year. This year too, the interest rate scenario is expected to be volatile. “Dynamic bond funds are best positioned to capture this opportunity with the flexibility to change if things don’t pan out as expected,” says Pathak of Quantum Mutual Fund.

Dynamic bound funds also suit investors who may want to park some portion of their retirement savings in an option that is more lucrative and tax-efficient than a fixed deposit. Though gains from debt funds are taxed at the same rate, the monthly withdrawals from a debt fund will be a mix of principal and capital gains. Only the gains are taxable, so the tax liability is significantly lower.

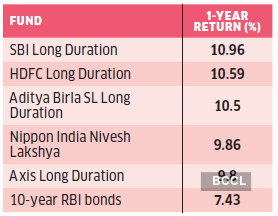

WANT TO GAIN FROM THE DECLINE

IN INTEREST RATES Investors like Goel are bullish on long-term bonds because they expect rates to go down. Long-term bond yields have declined barely 30 basis points in the past year, but that was enough for the best performing long-term bond funds to deliver nearly double-digit returns. The market is expecting long-term yields to drop to around 6.75% by the end of this year. This will be a bonanza for those invested in long-term funds. At the same time, these funds are very sensitive to interest rates. If rates don’t fall as expected, these funds could give very low returns or even negative returns.

All data on funds as on 21 Feb 2024. Source: Value Research