What was considered a bold bet, setting the fiscal deficit target of 5.1 per cent for FY25 during Interim Budget 2024 announcement, has further been trimmed to 4.9 per cent on Tuesday as Sitharaman presented the full Union Budget of 2024, the surplus RBI dividend, increased income tax collections provided the fiscal space.

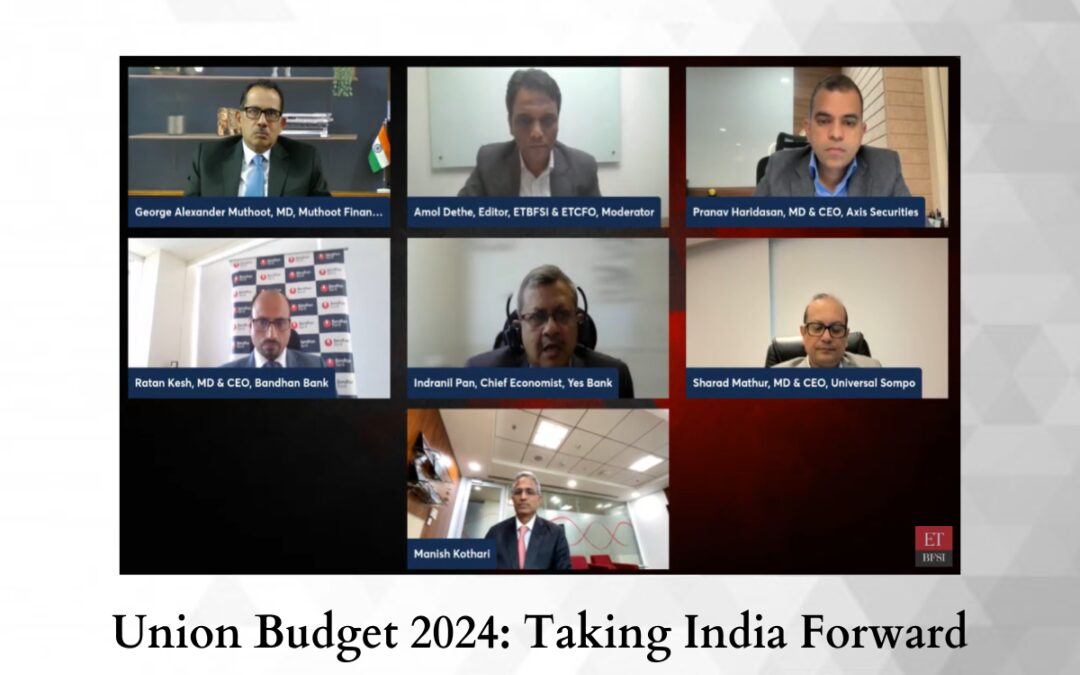

ETBFSI convened a panel of BFSI leaders to decode the Union Budget 2024.

The government has acknowledged the need for productivity growth across various segments, with particular emphasis on agriculture.

“The general direction they have provided is for productivity growth. Despite being the highest-producing nation in agriculture, our productivity levels remain relatively poor compared to global standards. To address this issue, the government has initiated a comprehensive master plan. This plan encompasses several key areas, including research and development (R&D) and climate change mitigation strategies,” remarked Indranil Pan, Chief Economist, Yes Bank.

George Alexander Muthoot, MD of Muthoot Finance, emphasised the importance of rural demand in driving economic growth. “Rural demand and purchasing power are crucial for driving economic growth. Despite an abundance of goods, purchasing power remains insufficient. Gold loans are an effective way to empower rural consumers and stimulate demand,” he said.

Government’s Capex Maintenance and Fiscal Consolidation

“A big thumbs up to the government for achieving fiscal consolidation strategy and targeting a fiscal deficit of 4.9%. This is a robust move in terms of fiscal consolidation, aiming for 4.5% by FY26,” said Indranil Pan of Yes Bank.

He added that the government is trying to manage borrowings in a way that reduces the economy’s debt from a sovereign perspective.

Ratan Kesh, MD & CEO of Bandhan Bank, spoke on capital expenditure, noting, “Capex has gone up from 13% in 2019 to 23% this year, creating the right ambiance for private expenditure to kick in.”

Skill Training and Mapping for Future Growth

“The government laid down the blueprint for future growth strategy with an emphasis on skill mapping, especially in the manufacturing and services sector. This will improve employability,” emphasised Indranil Pan of Yes Bank.

He also stated, “Without formal sector opportunities, India’s per capita cannot be addressed, which is crucial for boosting consumption.”

Policy Continuity and Private Investment

“While the 15-20% rise in short-term capital gains will take a few days to digest, the Union Budget 2024 has maintained policy continuity, and I don’t see anything that should disappoint investors,” said Pranav Haridasan, MD & CEO of Axis Securities.

He also noted parity in asset classes and added, “Despite healthy balance sheets, investors are hesitant due to a perceived lack of demand.”

Haridasan highlighted the importance of accelerating FDIs with China, stating, “China is a crucial supply chain partner, and there is a need for us to work closely with all of these countries.”

Manish Kothari, President & Head of Commercial Banking at Kotak Mahindra Bank, emphasised key factors driving economic progress, including increased consumption, sustained capital expenditures with a multiplier effect, and boosted exports. “Additionally, infrastructure and tourism sectors will witness significant investment,” he said.

Sharad Mathur of Universal Sompo General Insurance added that the simplification of investment-related conditions will foster a more dynamic investing environment.

What did the Insurance sector expect?

Sharad Mathur, MD & CEO of Universal Sompo General Insurance, viewed the budget as progressive and supportive of the insurance sector. He welcomed the increase in the standard deduction in the new tax regime from Rs 50,000 to Rs 75,000, benefiting the middle class.

“The industry was looking for a waiver in GST, which would have boosted health insurance uptake. Since we are aiming for insurance inclusion by 2047, social security is also a focus,” he said.

Mathur also highlighted the need for health subsidies given the ongoing challenges and the critical nature of premiums growing post-COVID recovery.