Happy Monday! Flipkart cofounder Binny Bansal is doubling down on his investments in new ventures, including his own startup OppDoor. This and more in today’s ETtech Morning Dispatch.

Also in this letter:

■ What’s next for national mobility cards

■ Startup Mahakumbh begins today

■ ONDC and its trajectory

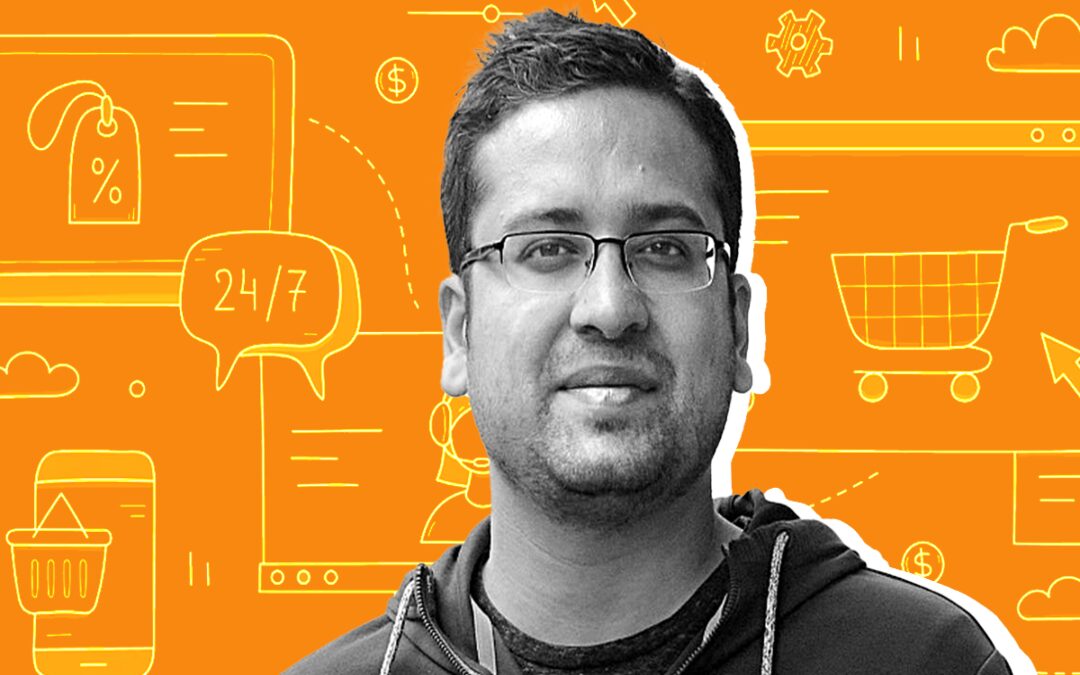

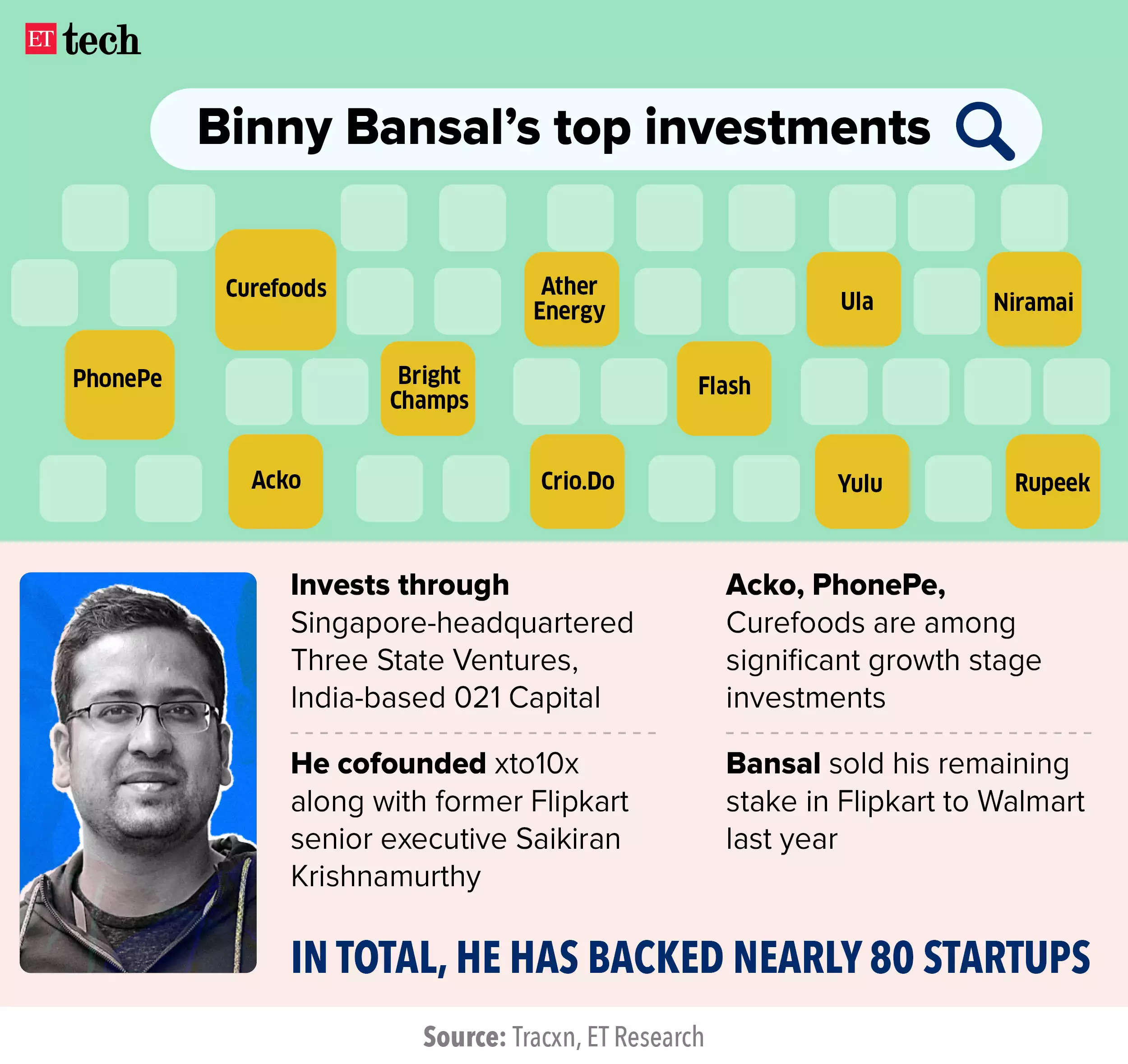

Binny Bansal eyes big game again post Flipkart exit

Flipkart cofounder Binny Bansal exited the Flipkart board in January, but he’s been busy making investments and giving shape to his new startup as well as portfolio companies. Let’s get right into it.Driving the news: Bansal has increased his stake to around 18% in Curefoods as part of an additional investment of $25 million. The cloud kitchen startup now has closed the round with $60 million in total funding, including a secondary share sale.

Hunt for top executives: Bansal — who set up OppDoor and infused personal capital in it — is looking to hire a CEO for his startup and for his offshore legal services business, people aware of his plans said, adding he has allocated significant capital for the new ventures.

Zoom in: Clearly, Bansal wants to have a material role in startups he has backed, and is working closely with founders and CEOs in these companies.

Tell me more: According to people aware of Bansal’s plan and schedule, he has identified a few select bets where he will have a significant stake and play a strategic role with the founders.

“More than a week in a month is kept for board meetings only and then he is spending one full day with founders to work on long-term plans and execution ideas,” one of the people said. Thus, he doesn’t want to make several investments as a financial investor only.

IT services companies may roll out 8.4-9% salary hikes this year

IT professionals will get average salary appraisals of around 8.4-9% in 2024, close to the average of 8.5-9.1% in 2023, according to data from hiring firm Teamlease Digital.Word for word: Most companies are likely to defer increments to the end of the first quarter of FY25, Munira Loliwala, AVP – strategy and growth, Teamlease Digital, told ET. “The focus in the IT sector now is on stabilising headcount,” she said, remarking the sector will possibly register flat or negative growth in headcount this year as well.

Appraisal trend: Increments in the IT sector grew to 9.7% in 2022 from 8.8% in 2021 before dipping to the 8.5-9.1% average last year, data suggests.

Last year, companies like Infosys, Wipro, and HCLTech skipped or deferred increments by several months, or rolled them out selectively depending on employees’ tenure. For instance, in December, Infosys offered hikes averaging less than 10% effective November, with some employees even receiving low-single-digit increments.

Growth pangs: IT companies have been hit by a near-decadal low in revenue growth and declining headcount over the past few quarters. Consequently, IT bellwethers such as TCS and Infosys gave campus hiring a miss last year.

However, Loliwala said that “in most pockets, IT has the largest disbursement (of hikes) as compared to any other sector today.” She noted that global capability centres (GCCs) are now also playing a significant role. GCCs, which have mushroomed in India in recent years, will likely see average salary hikes of 10-10.1%.

Also read | IT’s 2030 staff doubling target looks distant on slump, GenAI

RBI eases rules for centre’s mobility card after limited success

Unlike other National Payments Corporation of India (NPCI)-run payment networks, the National Common Mobility Card (NCMC) has seen a limited uptick. While banks have issued around 200 million such cards, most of them are being used as debit cards only, with very few being used for transit transactions. But regulatory changes and the recent action on Paytm Payments Bank (PPBL) could change that.

Background check: NCMC cards are open-loop prepaid cards that are issued by banks and Rupay. Unlike other closed-loop cards used in only specific metro services, these cards can be used across metro services in different cities.

PPBL, State Bank of India, and RBL Bank are among the few banks that run these payment services for public transportation in places like Kochi, Bengaluru, Delhi, Gujarat, and others.

What’s the news? Now, with PPBL stopping these services, industry insiders feel some other lenders may be needed to take up this market. The NCMC facility will also have to be promoted to ensure that more people shift from using closed-loop cards to open-loop NCMC ones.

Additionally, the recent RBI order relaxing KYC requirements for such cards could help bring more fintechs into the picture, helping in distribution.

RBI diktat: The regulator in a notification on February 23 said banks and prepaid issuers can issue NCMC cards up to Rs 3,000 without any KYC verification. These cards will have limited use for transit payments only. Once a customer completes the KYC, he or she can start using the card for other merchant payments too.

Startup Mahakumbh: Centre eyes innovation ranking boost

Startup Mahakumbh organising committee members with senior DPIIT officials

The three-day Startup Mahakumbh begins today. In a presser on Sunday, RK Singh, secretary of the Department for Promotion of Industry and Internal Trade (DPIIT), said the government hopes the event will provide a booster for its aim to improve India’s global ranking in terms of innovation.

Quote, unquote: “India ranks at 40 in terms of innovation and our goal is to move up from this. Our aim is to make Startup Mahakumbh not just a big event, but also an annual event, which can further propel the growth of the Indian startup ecosystem. The event aims to unite innovators nationwide and transform it into the largest global event of its kind,” Singh said.

Key areas in focus: Startup Mahakumbh is expected to attract thousands of startups and investors across ten key focus areas – artificial intelligence and software-as-a-service (SaaS), agritech, B2B and manufacturing, biotech and pharmaceuticals, climate tech, deeptech, direct-to-consumer, gaming and esports, fintech, and incubators and accelerators.

Larger corporates in play: As startups look for a diverse set of sources for funding, Info Edge India’s Sanjeev Bikhchandani said India needs a higher contribution of investment from corporates and business conglomerates into new ventures.

Accel’s Prashanth Prakash highlighted that each of the ten pavilions at the event will have an underlying theme of AI, and how it could be used to accelerate growth.

Other Top Stories By Our Reporters

Is ONDC’s gamble paying off? When Open Network for Digital Commerce (ONDC) was conceptualised around three years ago, and launched in January last year, it was meant to break the stranglehold of ecommerce giants — Amazon, Flipkart, Zomato, Swiggy, and their peers. A year down the line, some milestones have been achieved. And a lot is riding on its success.

IBM disagrees with closed LLM approach adopted by Big Tech: IBM does not agree with a closed large-language model approach several global companies such as Open AI, Microsoft, Google, and others have adopted, the company’s chief privacy and trust officer Christina Montgomery said.

India’s startup landscape: Funding winter continues as investment plummets | India’s startups have been grappling with a ‘funding winter’. Only two startups attained unicorn status last year. A new report brings out the continuing downward trend in funding, as investors remain more cautious and selective, even as India remained the fourth largest venture market in the world in 2023.

Global Picks We Are Reading

■ Mike Lynch goes on trial in US over Silicon Valley’s ‘largest fraud’ (FT)

■ Sam Bankman-Fried should get 40 to 50 years in prison, prosecutors say (NYT)

■ As AI tools get smarter, they’re growing more covertly racist, experts find (The Guardian)