Bitcoin (BTC) prices dropped below their 120-day range on July 3rd, reaching $53,219, as the market reacted to fears of potential selling by both the German government and Mt. Gox creditors, according to Bitfinex Alpha. However, recent market data suggests that a potential local bottom might be in sight.

Market Reactions and Volatility

The market has started to contextualize the large nominal value of BTC transferred to exchanges by the German government as relatively small compared to the total Bitcoin bought and sold since 2023. This realization has helped stabilize some of the initial fears.

Additionally, volatility metrics have shown a narrowing spread between implied volatility and historical volatility, indicating that the market expects more stability and less severe declines. This suggests that BTC could range at current levels or experience less dramatic drops.

Short Liquidations and Market Positioning

High short liquidations have been observed, indicating a significant number of ‘late shorters’ on lower time frames and potentially a lack of clear market direction. This market positioning shows a degree of complacency with shorts, as seen in the recent rebounds.

Long-term Bitcoin holders continue to realize significant profits on their spot holdings, while short-term holder selling might be nearing exhaustion. The Spent Output Profit Ratio (SOPR) for short-term holders is at 0.97, indicating that this cohort is now selling at a loss. Historically, when the SOPR has been at this level, prices have rebounded as selling pressure eased.

Funding Rates and Market Sentiment

The funding rate across BTC perpetual contracts has turned negative for the first time since the May 1st bottom. While this might indicate increased bearish sentiment, it also suggests that BTC might be stabilizing or nearing a potential bottom as the balance of buying and selling pressures evolves.

Periods of negative funding rates combined with low short-term SOPR values have often marked the bottom of price corrections. Negative funding rates suggest that selling pressure is high or sellers are dominating the market, but it can also indicate that the market is oversold.

Macro Economic Indicators

The Federal Reserve minutes show that officials remain highly cautious about cutting rates, despite supportive labor market data and easing inflation. The unemployment rate has risen to 4.1 percent, the highest since November 2021, signaling an economy adjusting to long-term growth and hiring trends.

There has been a notable slowdown in payroll growth, with 111,000 fewer jobs created in April and May than previously estimated. The median duration of unemployment rose from 8.9 months in May to 9.8 months in June, indicating longer job search periods. The number of job openings per unemployed person held steady at 1.22, and the quit rate remained unchanged at 2.2 percent, suggesting no additional wage pressure from workers quitting.

The Institute for Supply Management’s Manufacturing Purchasing Managers Index contracted in June, dropping to 48.5, its lowest since February. Sub-indices for production, new orders, and inventories all declined, reflecting reduced demand and sentiment. Employment in manufacturing also fell. Similarly, the non-manufacturing PMI fell to 48.8, its lowest in four years, indicating contraction in the services sector.

While a rate cut is not expected at the next policy meeting scheduled for July 30-31, there is hope for a potential cut in September.

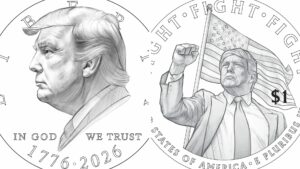

Image source: Shutterstock