(Bloomberg) –The Bank of England hinted that more officials may be close to backing interest-rate cuts, keeping alive hopes of a policy easing by the end of the summer.

The UK central bank this week kept its benchmark lending rate at a 16-year high of 5.25%. But minutes of the meeting said the decision not to cut rates was “finely balanced” for some of the nine members of the Monetary Policy Committee.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

Europe

Investors priced in more than a 50% chance of a move by the BOE in August, the first time in more than a month they’ve been so certain. Governor Andrew Bailey said it was “good news” that inflation fell back to its 2% target for the first time in almost three years but that officials wanted to be sure that pressure on prices is subdued before acting.

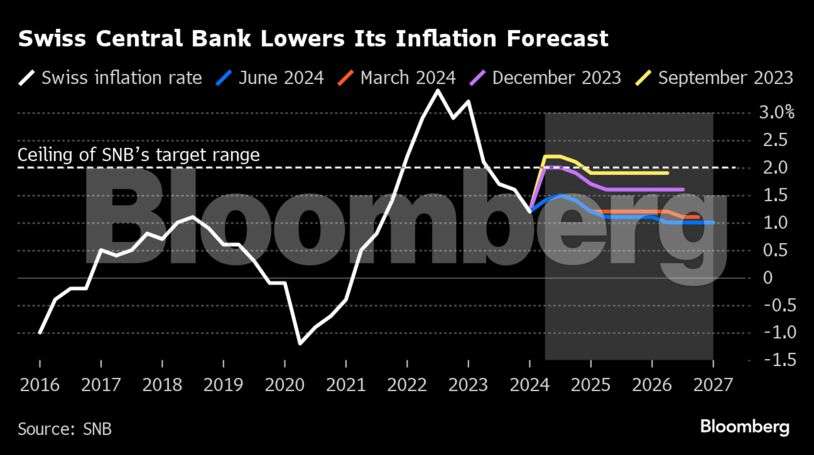

The Swiss National Bank lowered borrowing costs at a second straight meeting, keeping it at the forefront of global interest-rate cuts as it battles low inflation and a strengthening franc. Policymakers also lowered their inflation projections, seeing it at 1% in 2026.

Asia

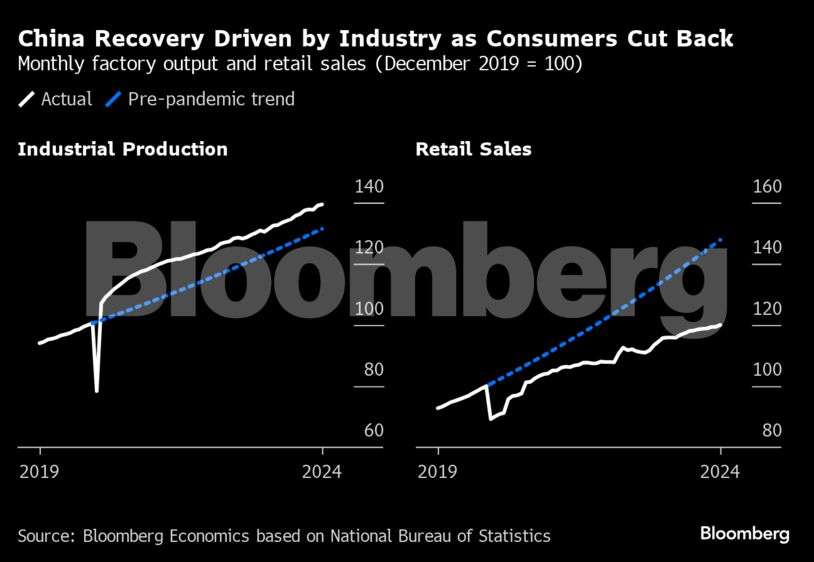

China’s housing slump deepened in May and triggered new calls for the government to pump cash and credit into the economy, while industrial output — which has kept growth on track — fell short of forecasts. Retail sales offered some encouragement, picking up more than expected, but Chinese shoppers remain far from recovering their pre-pandemic mojo.

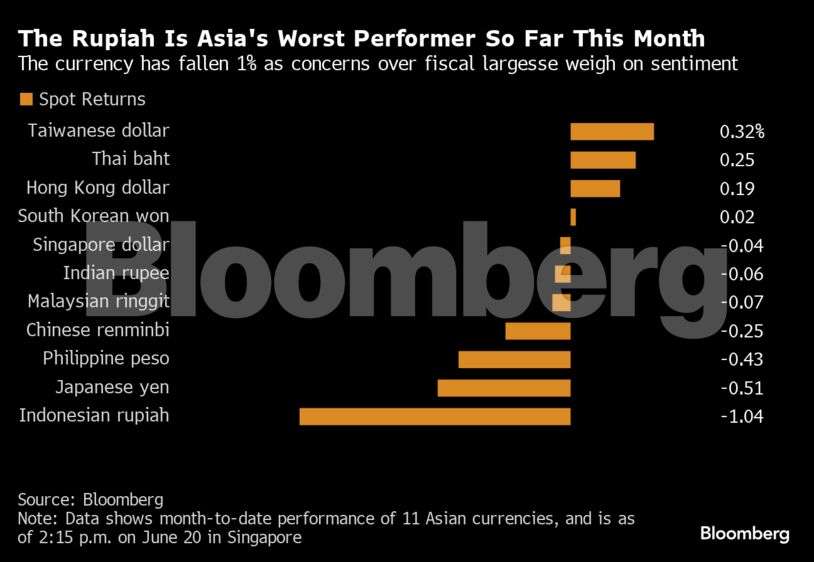

Indonesia’s central bank left its benchmark interest rate unchanged for a second straight meeting, while pledging further intervention to anchor the rupiah in the face of domestic and foreign pressures. While it stood pat, Governor Perry Warjiyo said in a briefing that the policy rate is “supported by strengthening monetary operations to bolster the effectiveness of rupiah stabilization and the inflow of foreign capital.”

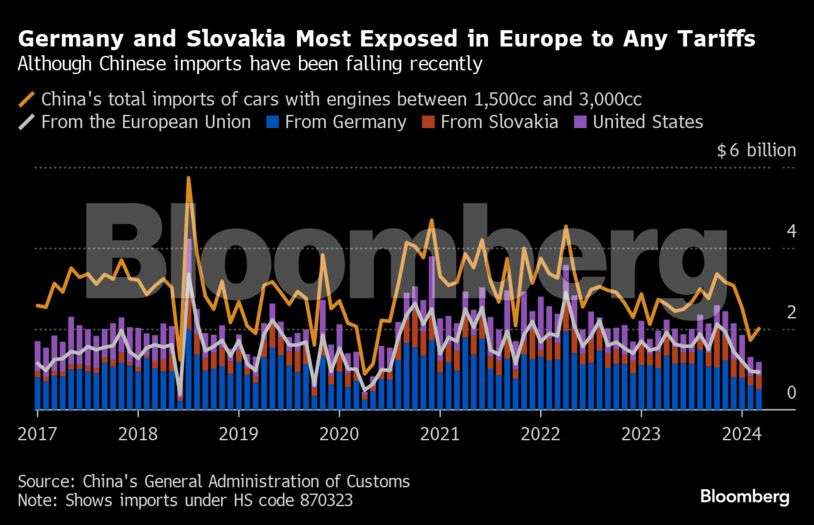

As in past disputes, China looks to be readying a series of actions to punish the European Union for its proposed tariffs on electric cars. Beijing’s targeted playbook looks more like the one it deployed against Australia a few years ago — with the government and state media already publicly identifying specific products that could be about to get taxed.

Emerging Markets

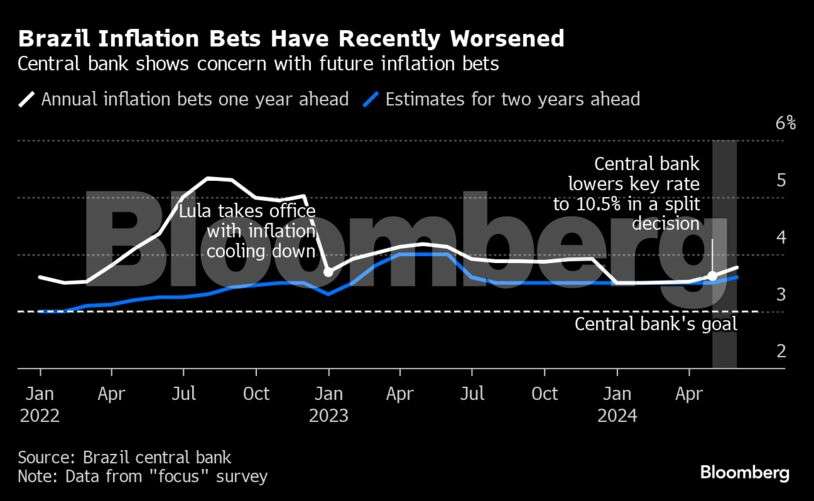

Brazil’s central bank is facing an emergency of its own making that threatens to sabotage years of deft policymaking and credibility gains. Inflation forecasts are above the 3% target into the foreseeable future and confidence is crumbling as markets question whether the central bank — or the presidency — is commanding monetary policy.

US

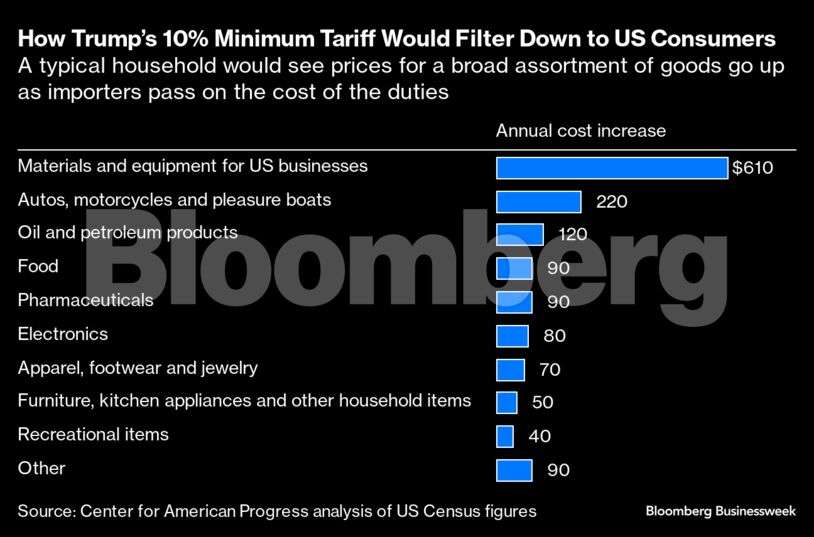

If he returns to the White House, Donald Trump has pledged to enact a 10% across-the-board tariff on imports that he says will raise billions of dollars in revenue to pay for more tax cuts. Yet mainstream economists say the GOP candidate’s second-term trade agenda, which also calls for increasing duties on Chinese-made goods to 60% or more, would essentially amount to a tax increase for American households.

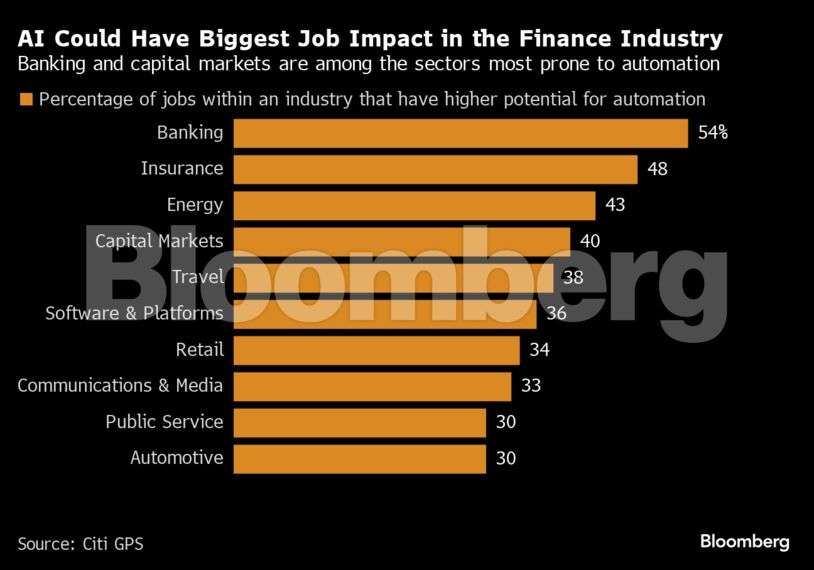

Citigroup Inc. said artificial intelligence is likely to displace more jobs across the banking industry than in any other sector as the technology is poised to upend consumer finance and makes workers more productive. About 54% of jobs across banking have a high potential to be automated, and an additional 12% of roles across the industry could be augmented with the technology, Citigroup found.

World

Outside of the BOE, Indonesia, Georgia, Namibia, Brazil, Norway, Paraguay and Tunisia left them unchanged, as did Chinese banks. Australia also held but discussed the case to hike. Switzerland, Hungary and Chile cut rates.

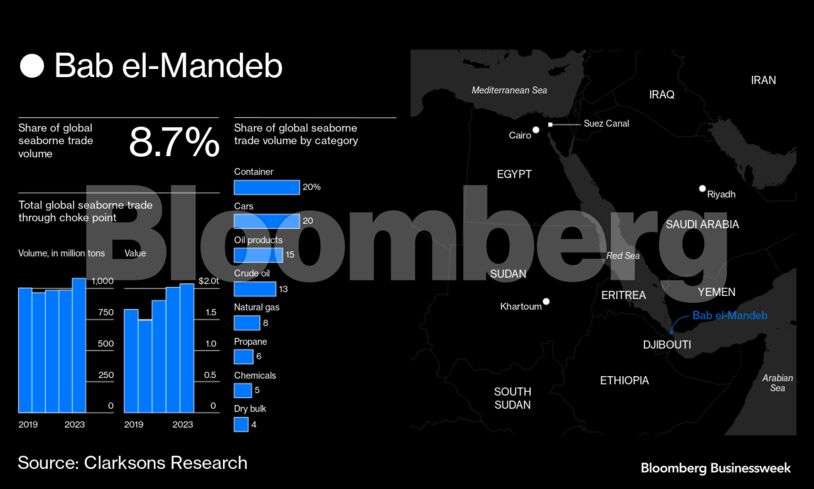

The sinking of a coal-carrier by a sea drone has boosted the risk of navigating the vital Bab el-Mandeb chokepoint to a new level and is driving a fresh surge in insurance costs.

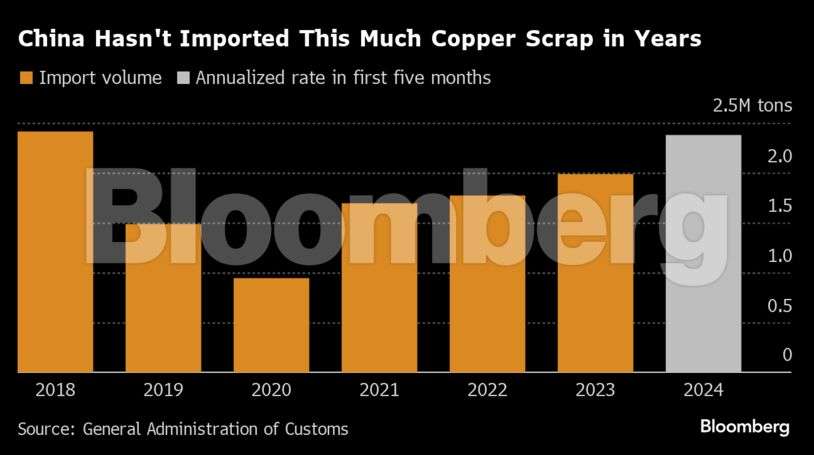

China has ramped up imports of copper scrap as smelters seek alternative raw materials to offset tight supplies of mined ore. The world’s biggest refined copper producer took in nearly 1 million tons of scrap in 2024’s first five months, putting imports on pace for the strongest year since 2018.