A Comprehensive Assessment of Gemini: A Leading Cryptocurrency Brokerage

Introduction

In the dynamic landscape of cryptocurrency trading, the selection of a reliable and reputable platform is paramount. Among the plethora of options, Gemini emerges as a prominent contender. This exhaustive review endeavors to dissect the pivotal features and facets of Gemini, providing an unbiased analysis of its strengths, weaknesses, and overall suitability for cryptocurrency traders and investors.

Trading platform and user experience:

Founded in 2014 by the Winklevoss twins, Cameron and Tyler, Gemini stands as a New York-based cryptocurrency exchange and custodian. As an early entrant into the crypto arena, Gemini has meticulously cultivated its reputation, prioritizing security, regulatory compliance, and user-friendly functionality.

Security and Regulatory Adherence:

Security forms the bedrock of concerns in the cryptocurrency domain, and Gemini ardently addresses this apprehension. The platform operates under the aegis of the New York State Department of Financial Services (NYDFS), thereby adhering to the most exacting standards of security and regulatory compliance. Gemini further augments user confidence by extending insurance coverage for digital assets held within its custody.

User-Friendly interface:

Asset diversity:

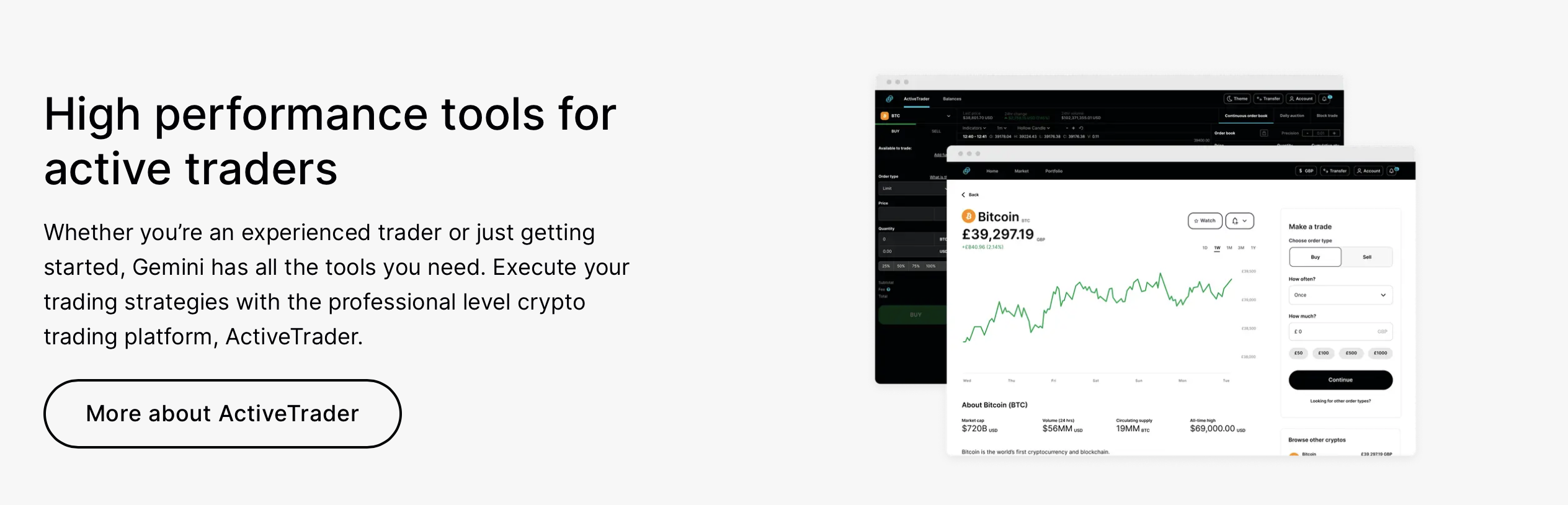

Trading options:

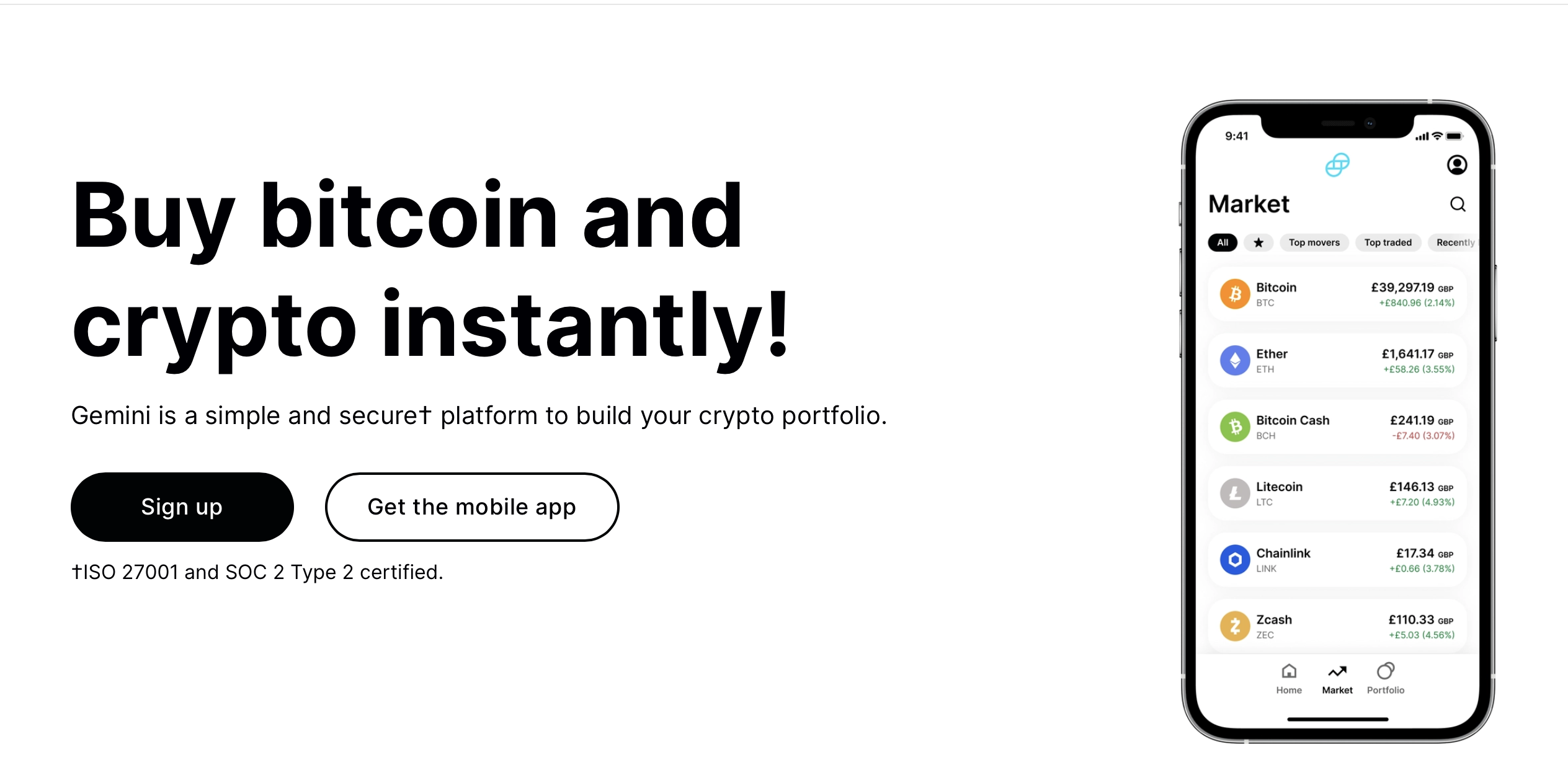

Mobile app:

Gemini’s mobile applications, available on both iOS and Android platforms, seamlessly facilitate cryptocurrency trading. Users can execute trades, oversee portfolios, and access market data while on the go. These mobile applications are distinguished by their well-conceived design, responsiveness, and assurance of security parity with the web-based platform.

Fee Structure:

Gemini’s fee structure is transparent and competitively structured. Adopting the maker-taker fee model, trading fees range from 0.25% to 1.49%, contingent upon the trader’s volume of activity. Furthermore, the platform extends a fee reduction program, incentivizing high-volume traders and stimulating active participation in the cryptocurrency market.

Gemini ears:

Gemini introduces “Gemini Earn,” a feature that allows users to garner interest from their cryptocurrency holdings. This feature, particularly attractive to long-term investors seeking passive income, presents users with an array of interest-earning avenues, including fixed-term accounts and flexible savings.

Institutional Services

Gemini’s ambit extends beyond individual traders to encompass institutional investors. The platform extends a suite of services encompassing custody, trading, and clearing for its institutional clienteles. This institutional-grade infrastructure underscores Gemini’s commitment to catering to a diverse array of market participants.

Weakness Gemini

While Gemini excels in several domains, it is imperative to illuminate certain areas where the platform exhibits room for improvement:Limited Geographical Reach: Gemini’s services are currently accessible in a restricted number of countries. Expansion of its geographical footprint could significantly enhance its accessibility on a global scale.Limited Payment Options: The platform predominantly accommodates bank transfers and cryptocurrency deposits. The incorporation of a more expansive array of payment methods, such as credit card transactions, could augment user convenience. Advanced Trading Attributes: While Gemini’s advanced trading interface is well-suited for a broad spectrum of traders, it is noteworthy that certain advanced features, including futures and options trading, remain conspicuously absent. Diversifying these offerings may attract a more sophisticated trading demographic.

Conclusion:

In summation, Gemini emerges as a formidable contender in the cryptocurrency brokerage sphere, proffering a secure, user-friendly, and comprehensive platform for both traders and investors. Distinguished by its unwavering commitment to regulatory compliance, insurance coverage, and an extensive selection of supported assets, Gemini constitutes a viable choice for those seeking a trustworthy ally in their cryptocurrency voyage.

While it admittedly harbors potential for growth in areas such as geographical expansion, payment methods, and advanced trading features, Gemini’s dedication to enhancing user experiences and staying ahead of industry developments remains unequivocal. Whether you are a neophyte venturing into the cryptocurrency realm for the first time or an institutional investor in pursuit of a dependable custodian, Gemini stands poised to fulfill your cryptocurrency requisites