Fusions Markets Review: A Comprehensive Assessment of a Forex Brokerage

Introduction

In an increasingly competitive landscape, Fusions Markets emerges as a notable entrant in the forex trading arena. Our evaluation endeavors to provide a dispassionate and extensive analysis of the brokerage’s offerings, assessing its merits and demerits to aid prospective traders in their decision-making process. This review aims to appraise the fundamental aspects of Fusions Markets as a forex broker.

Trading platform and user experience:

distinguishes itself with a platform that prioritizes user-friendliness. Both novice and experienced traders will appreciate the intuitive interface that facilitates navigation. This platform is accessible through desktop and mobile devices, fostering convenience and flexibility for traders seeking on-the-go solutions.

Diverse Tradable Instruments:

While forex remains the core focus, Fusions Markets extends its repertoire to encompass Contracts for Difference (CFDs) on commodities, indices, and cryptocurrencies. Nevertheless, it is worth noting that the brokerage’s asset selection does not rival the extensive offerings of more established industry peers.

Educational resources:

The brokerage strives to empower traders through educational resources, including webinars and tutorials. While commendable, the offering of research and analysis tools could be more comprehensive to enhance traders’ capacity for well-informed decision-making.

Educational resources:

The brokerage strives to empower traders through educational resources, including webinars and tutorials. While commendable, the offering of research and analysis tools could be more comprehensive to enhance traders’ capacity for well-informed decision-making.

Costomers Support:

Security and Regulation:

In the realm of financial services, security is non-negotiable. Fusions Markets upholds the sanctity of client funds and sensitive information through robust security measures. These measures encompass data encryption technology and the segregation of client funds within well-regarded banking institutions.

Different Offers:

Fusions Markets accommodates diverse trader preferences with a selection of account types. Ranging from standard accounts with modest minimum deposit requirements to ECN accounts designed for seasoned traders, the brokerage caters to a broad spectrum of trading styles.

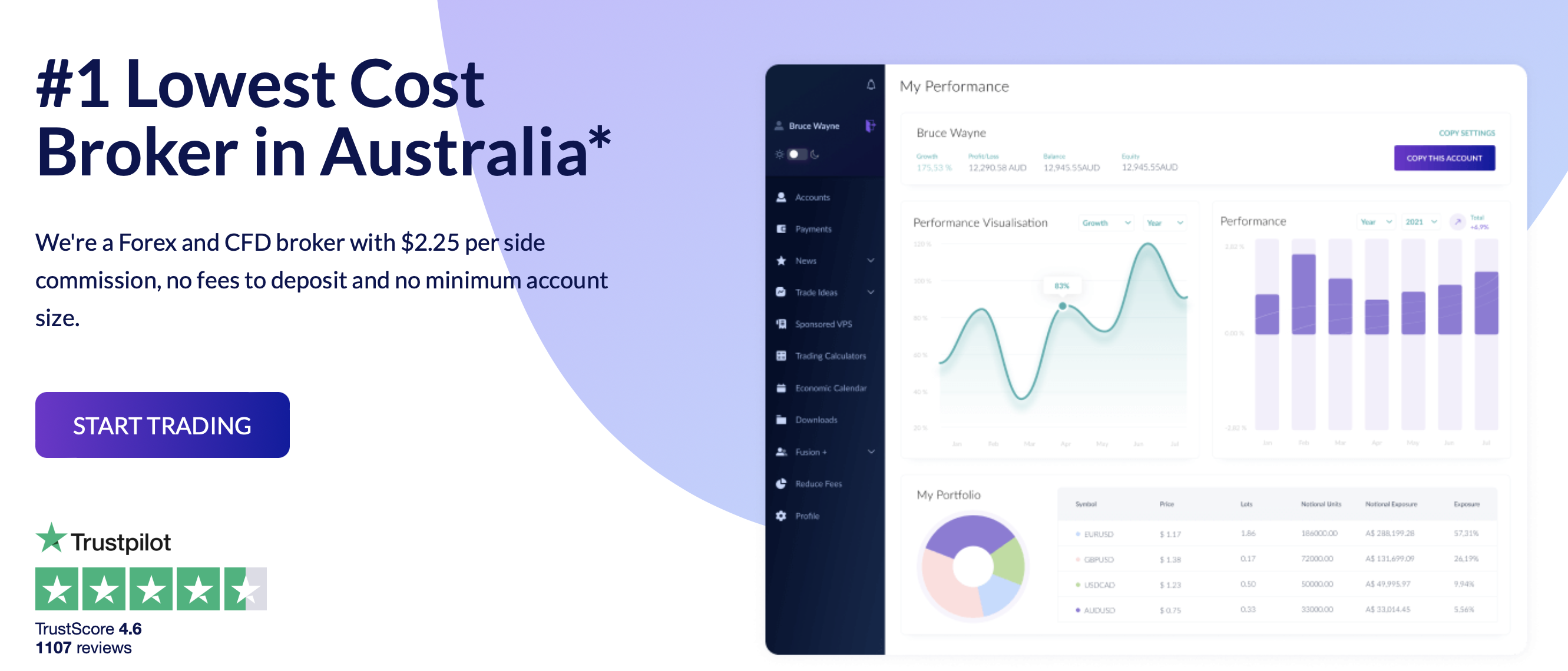

Competitive Spread:

A paramount consideration for any trader, Fusions Markets merits attention for its competitive spreads, particularly on major currency pairs. These spreads can exert a significant influence on trading costs, which renders the brokerage particularly appealing to high-frequency traders seeking to optimize profit margins.

Regulatory Compliance and Trustworthiness:

Fusions Markets adheres to regulatory oversight by the Australian Securities and Investments Commission (ASIC). This regulatory imprimatur lends credibility to the brokerage and affords traders a measure of assurance regarding its legitimacy.

Conclusion:

In summary, Fusions Markets emerges as a prospective contender within the forex brokerage sphere. The brokerage’s strengths include its user-friendly platform, competitive spreads, and sterling customer support. Despite its merits, room for growth exists concerning asset variety and research tools. However, its unwavering commitment to security and regulatory compliance augurs well for those seeking a reputable broker. As with all financial endeavors, it is incumbent upon the investor to conduct due diligence. Nevertheless, Fusions Markets warrants careful consideration for those in pursuit of forex trading services.