“Merrill Edge Options Broker Review: A Comprehensive Evaluation”

Introduction

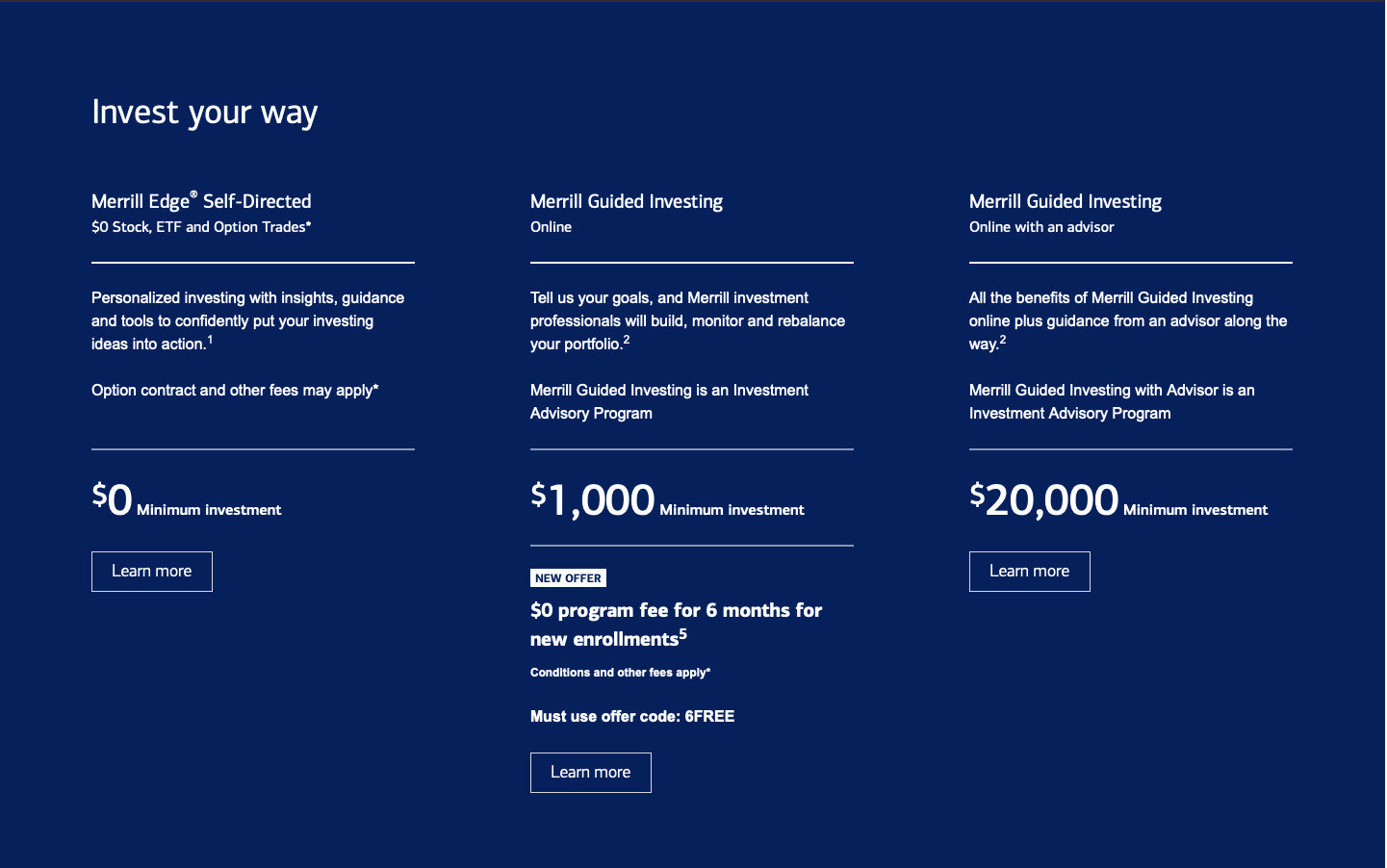

Merrill Edge, as the brokerage arm of Bank of America, stands as a prominent player in the investment services landscape. This review aims to provide an in-depth assessment of Merrill Edge’s options trading capabilities, encompassing critical facets such as platform functionality, pricing structures, usability, research tools, and customer support, all examined in a neutral and professional manner.

Trading platform and user experience:

Merrill Edge presents an options trading platform of notable quality, adept at catering to traders of varied expertise levels. Characterized by its user-friendliness, the interface promotes effortless navigation. While it may not encompass the full spectrum of features found in specialized options trading platforms, it does provide essential components such as customizable options chains, advanced order types, and real-time market data.

Option research tools:

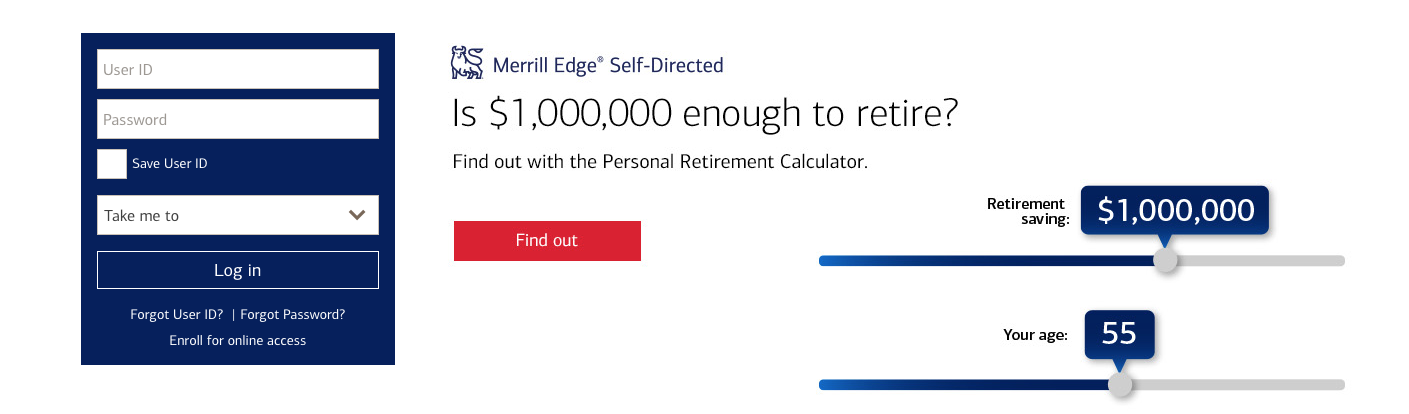

Merrill Edge distinguishes itself with its array of options-specific research tools and resources. Traders can avail themselves of probability calculators, profit and loss graphs, and historical options data—a resourceful ensemble for the crafting and optimization of options strategies. However, traders seeking advanced analytics may opt for specialized options platforms tailored to their specific requirements.

Reaserch and Analysis Tools:

Pricing and Fees:

Option Level Approval:

Costumer Support:

Merrill Edge’s customer support framework demonstrates responsiveness, with communication channels spanning phone, email, and live chat during standard business hours. The support personnel exhibit proficiency in addressing inquiries, although some users have reported prolonged wait times during peak trading periods. Extending the hours of customer support availability could serve to enhance the overall service offering.

Mobile Trading:

The Merrill Edge mobile application boasts an astute design and serves as a convenient tool for options traders to manage their portfolios on-the-go. It grants access to vital trading features, real-time data streams, and account management tools. Despite the mobile app’s commendable functionality, it may not encompass the same depth of options analytics as the desktop platform, a consideration for traders with more intricate needs.

Conclusion:

Conclusion

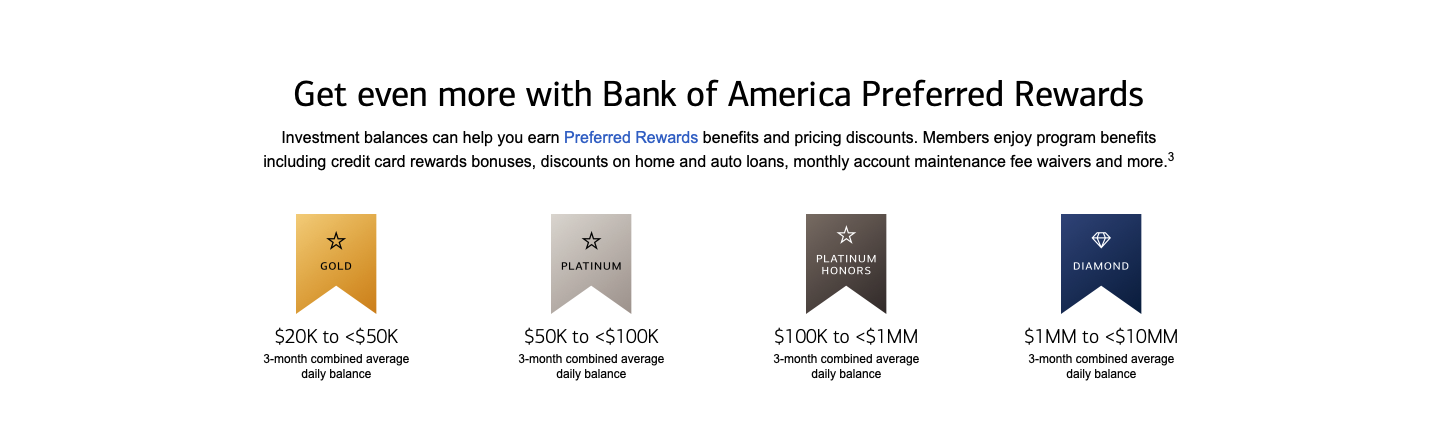

Merrill Edge’s options trading platform emerges as a dependable and feature-rich environment for the execution of options strategies. Its user-friendly interface, competitive pricing, extensive research tools, and comprehensive educational offerings collectively position it as a robust choice for options traders. While cost-effectiveness may be a concern for high-frequency traders, Merrill Edge caters adeptly to a broad spectrum of investors seeking to engage in options trading within the framework of a comprehensive brokerage service.

In conclusion, the options trading platform provided by Merrill Edge offers a reliable and feature-rich environment for traders to execute options strategies. Nevertheless, the choice of a brokerage ultimately hinges upon individual preferences and trading styles. Prior to reaching a decision, a prudent evaluation of one’s specific needs as an options trader, coupled with a comparative analysis of Merrill Edge vis-à-vis other options brokers, is imperative in determining the most suitable fit for one’s trading objectives.