Comprehensive Review of Exness PAMM: A Professional Investment Management Solution

Introduction

In the ever-evolving landscape of online trading, Exness has emerged as a prominent entity, offering a wide spectrum of services to a global clientele. Among its suite of offerings, the Percentage Allocation Management Module (PAMM) service stands as a notable asset, distinguished by its professional orientation and investor-centric attributes.

Trading platform

Exness has garnered acclaim for its PAMM service through its commitment to providing an accessible and user-friendly platform. This platform has been meticulously designed to facilitate effortless navigation, ensuring that investors can swiftly access vital information. The registration and onboarding processes are streamlined, allowing investors to promptly engage with PAMM accounts.

Diverse Array of fund Managers:

A defining characteristic of Exness’ PAMM service lies in its diverse and highly skilled pool of fund managers. This diversity empowers investors to select from a multitude of investment strategies and risk profiles. Whether one seeks a conservative, balanced, or assertive investment approach, Exness offers a broad spectrum of managers to cater to diverse preferences.

Investment flexibility:

Comprehensive Manager Analysis Tools:

Costone support

Emphasis security

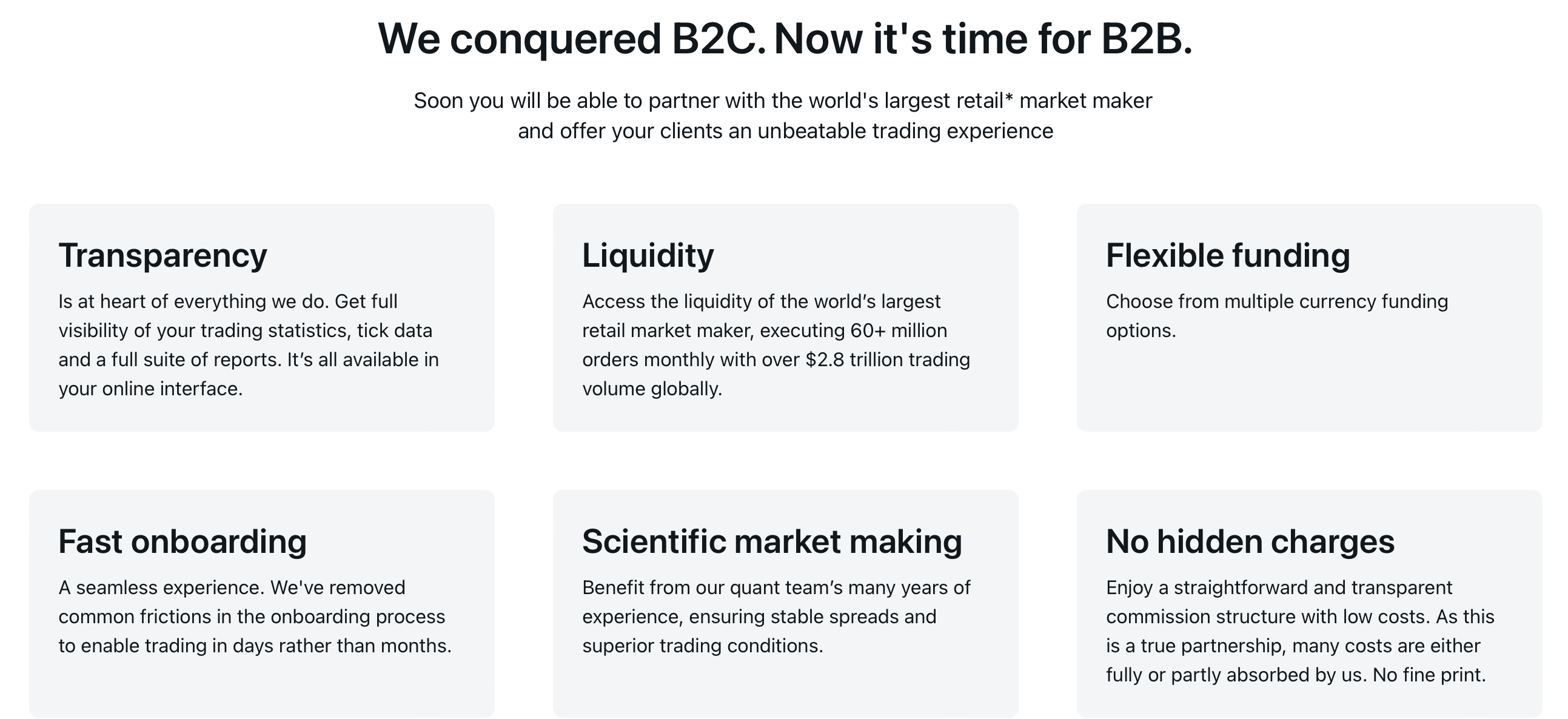

Security and transparency are the bedrock principles underpinning PAMM investing, and Exness demonstrates a profound commitment to these principles. Robust security measures are in place to safeguard investor funds, bolstering confidence and peace of mind. Furthermore, Exness’ dedication to transparency is reflected in the extensive data provided on manager performance, fee structures, and comprehensive trading histories.

Automated Profit Distribution:

A noteworthy hallmark of Exness’ PAMM service is its automated profit distribution system. This mechanism meticulously ensures that profits are distributed among investors and managers in strict adherence to predetermined terms and conditions. This automated approach alleviates the complexities associated with manual profit calculations, enhancing overall operational efficiency.

Conclusion:

In summation, Exness’ PAMM service embodies professionalism and a relentless focus on investor-centric solutions. With a user-centric platform, an expansive cadre of accomplished fund managers, a commitment to transparency, and robust security measures, Exness has etched itself as a premier choice for PAMM investing. Whether one is a neophyte trader in pursuit of diversification or a seasoned investor seeking a dependable platform, Exness’ PAMM service warrants earnest consideration. In unequivocal terms, I wholeheartedly endorse Exness to all individuals interested in exploring the realm of PAMM investing through the auspices of a trusted and professionally managed brokerage.