“Ally Invest Comprehensive Review: A Deep Dive into Stock Trading Services”

Introduction

This comprehensive review delves into the offerings of Ally Invest, a prominent brokerage platform catering to the stock trading community. Our objective is to provide a meticulous evaluation of the platform’s attributes, pricing models, analytical tools, and overall suitability for an array of stock traders, spanning from novices to seasoned professionals.

Trading platform and user experience:

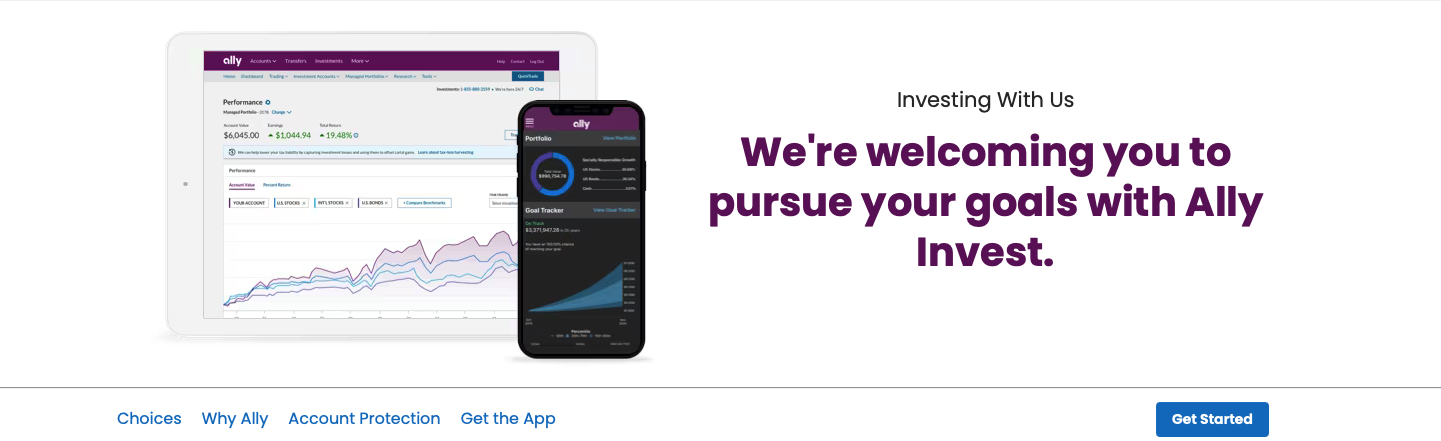

Ally Invest presents a user-centric and resilient trading platform, purposefully designed to accommodate a diverse spectrum of stock traders. The platform’s intuitive interface effectively simplifies the intricacies associated with stock trading, rendering it accessible to a broad audience. The user experience is smooth and uncluttered, enabling traders to channel their focus toward crafting and executing strategies, rather than wrestling with the intricacies of the trading platform. However, acknowledging the relative complexity of stock trading, newcomers to the field may find a brief period of acclimatization to be necessary.

STOCK selection and availability :

A prominent strength within Ally Invest’s repertoire lies in the plethora of stocks offered for trading. The platform grants access to a wide array of stocks, encompassing equities, exchange-traded funds (ETFs), and mutual funds. This extensive selection caters to investors possessing varying preferences and risk appetites. Complementing the extensive array of stock offerings is Ally Invest’s formidable suite of research tools. Traders are endowed with real-time market data, comprehensive technical and fundamental analysis tools, and versatile stock screening capabilities. This abundant wealth of resources empowers traders with the information necessary for making judicious investment decisions, facilitating the effective execution of their chosen strategies.

Commission and Fees:

Research and Analysis Tools:

Costumer Support:

Ally Invest’s customer support stands as a responsive and generally well-informed service channel. Clients can access support via telephone, email, or live chat, and find their inquiries and issues addressed with due diligence. The support team exhibits commendable knowledge and an inclination for prompt responsiveness, underscoring the broker’s commitment to ensuring customer satisfaction. That said, an extension of support availability to encompass non-standard trading hours would further enhance the user experience, acknowledging the diverse trading schedules and global clientele served by the platform.

Mobile app:

Ally Invest’s mobile application furnishes traders with the versatility to manage their portfolios and execute trades while on the move. The app’s design is both functional and intuitive, offering an array of features akin to its desktop counterpart. It serves as an invaluable tool for those who prefer tracking and controlling their investments via mobile devices. However, it is essential to note that new users may necessitate an orientation period to fully acquaint themselves with the app. Enhanced user-friendliness through added features would further optimize the mobile experience.

Security:

Security emerges as a paramount concern in the realm of online trading, and Ally Invest exhibits a commendable commitment to ensuring the safeguarding of user accounts and sensitive data. The platform rigorously implements industry-standard security measures, including two-factor authentication (2FA), robust encryption protocols, and continuous surveillance to fortify defenses against unauthorized access and data breaches. While it is vital to recognize that no system is entirely impervious to security risks, Ally Invest’s steadfast dedication to preserving user security is praiseworthy.

Conclusion:

In summary, Ally Invest stands as a reputable stock trading platform featuring an accessible interface, an extensive array of stocks, and a comprehensive toolkit of research resources. The competitive fee structure renders Ally Invest an appealing choice for traders seeking cost-effective stock trading solutions. The fortifications in security and the responsiveness of customer support further underscore the platform’s standing as a dependable option for stock traders. Prospective clients, however, are advised to conduct a rigorous self-assessment to ascertain the extent to which Ally Invest aligns with their individualized trading goals and aspirations.

It is imperative to underscore that stock trading intrinsically carries a measure of risk, and thus, we strongly endorse thorough research and the engagement of professional counsel before partaking in stock trading activities.