“E*TRADE Broker Review: A Comprehensive Evaluation of a Leading Equities Trading Platform”

Introduction

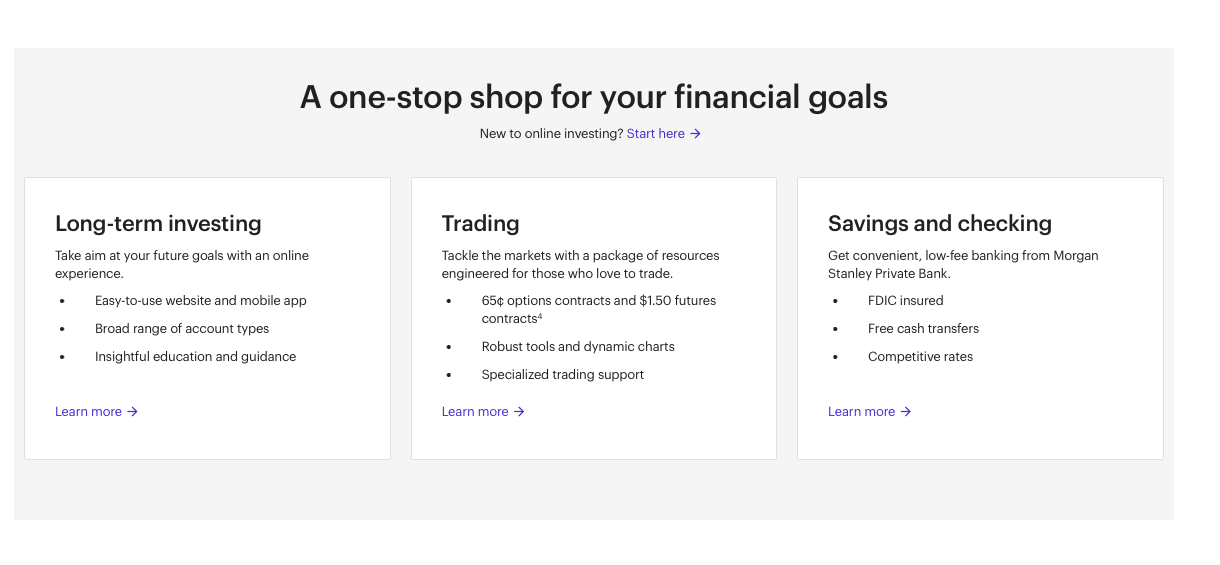

ETRADE, an established name in the world of brokerage services, has garnered recognition for its position as a preferred platform for equities traders. This in-depth review aspires to deliver a comprehensive analysis of ETRADE’s platform, the array of features it offers, its pricing structure, and the overall suitability it holds for investors seeking to partake in stock trading.

Trading platform and user experience:

ETRADE’s platform stands as a meticulously designed instrument tailored to cater to the multifarious needs of traders. The user experience is inherently intuitive, offering an unimpeded and user-friendly interface that accommodates investors across all levels of experience. The platform’s navigation is notably straightforward, ensuring seamless access to indispensable tools and resources. This simplistic design minimizes the burden of platform-related complexities, thus enabling traders to channel their energies toward their trading strategies. ETRADE distinguishes itself by virtue of its user-friendliness, rendering it an optimal choice for both neophyte and veteran investors.

STOCK selection and availability :

ETRADE grants access to an extensive spectrum of equities, spanning diverse industry sectors. This breadth of options empowers investors to cultivate diversified portfolios congruent with their preferences and risk tolerances. Furthermore, ETRADE provides a rich assortment of research tools encompassing market analysis, stock screening functionalities, and stock-specific data. These tools serve as valuable assets, fostering well-informed decision-making and equipping investors with the necessary resources for real-time market trend monitoring and stock performance analysis. Nonetheless, some traders may find that the inclusion of more comprehensive research resources, such as company reports or third-party research, would augment their trading experience.

Commission and Fees:

Research and Analysis Tools:

Mobile app:

E*TRADE’s mobile application represents a well-constructed tool that endows traders with the flexibility to manage their portfolios while on the move. The application impeccably mirrors the user-friendly design of the desktop platform, thereby delivering most of the features available in the web-based version. This mobile application emerges as an indispensable resource for traders who prefer tracking and executing trades via their mobile devices. However, akin to the learning curve associated with any mobile application, newcomers may necessitate some time to acclimate themselves, and the integration of user-friendly features could enhance the mobile trading experience.

Security:

Security occupies an eminent position of concern in the realm of brokerage services, and ETRADE demonstrates unwavering commitment to this vital aspect. The platform deploys stringent security measures that encompass two-factor authentication (2FA) and data encryption, thereby serving to fortify the defenses shielding user accounts and sensitive information. While it is indispensable to acknowledge that no online platform is entirely impervious to security risks, ETRADE’s dedication to preserving the sanctity of user data remains admirable.

Conclusion:

In summation, ETRADE stands as a respected equities trading platform that proffers a user-friendly interface, a plethora of equities, and an expansive repertoire of research tools. Its recent shift to commission-free online trading endows it with a competitive edge, while the user-friendly mobile application contributes further to its allure. Furthermore, ETRADE’s allegiance to the cause of user data security assures investors who entrust their assets to the platform. It emerges as a commendable choice for equities traders who seek a reliable and user-friendly trading environment. However, prudent investors are advised to conduct a thorough assessment of their specific prerequisites and predilections to ascertain the degree of alignment with their investment objectives.

It is imperative to bear in mind that equities trading carries inherent risks, necessitating investors to undertake comprehensive research and seek professional counsel prior to engaging in stock market activities.