“Merrill Edge Review: A Thorough Evaluation of Stock Trading Services”

Introduction

Merrill Edge, an esteemed presence in the domain of online brokerage, has garnered recognition for its stock trading services. In this extensive review, we embark upon an in-depth assessment of Merrill Edge’s trading platform, tools, pricing structure, and overall compatibility with the requirements of stock traders.

Trading platform and user experience:

The trading platform proffered by Merrill Edge embodies user-friendliness and is tailored to cater to investors spanning the spectrum of experience. Navigational facets of the platform are characterized by intuitive design, fostering effortless access to indispensable tools and resources. The platform’s aesthetic exudes an organized simplicity that eases the process of acclimatization for traders. It is, however, worth noting that neophytes may experience a mild learning curve when confronted with the plenitude of available features. Once accustomed, users are bound to appreciate the platform’s manifold analytical tools, research capabilities, and the comprehensive reservoir of educational materials at their disposal.

STOCK selection and availability :

Merrill Edge lays claim to a superlative feature that distinguishes it, which is the comprehensive array of stock offerings. This encompasses a wide spectrum, encapsulating equities, ETFs, and mutual funds. Additionally, the platform equips investors with an abundance of research and analytical tools, functioning as a compass in the labyrinth of market decisions. Investors inclined towards diversification of their portfolios will undoubtedly derive significant value from the profusion of investment alternatives available through Merrill Edge.

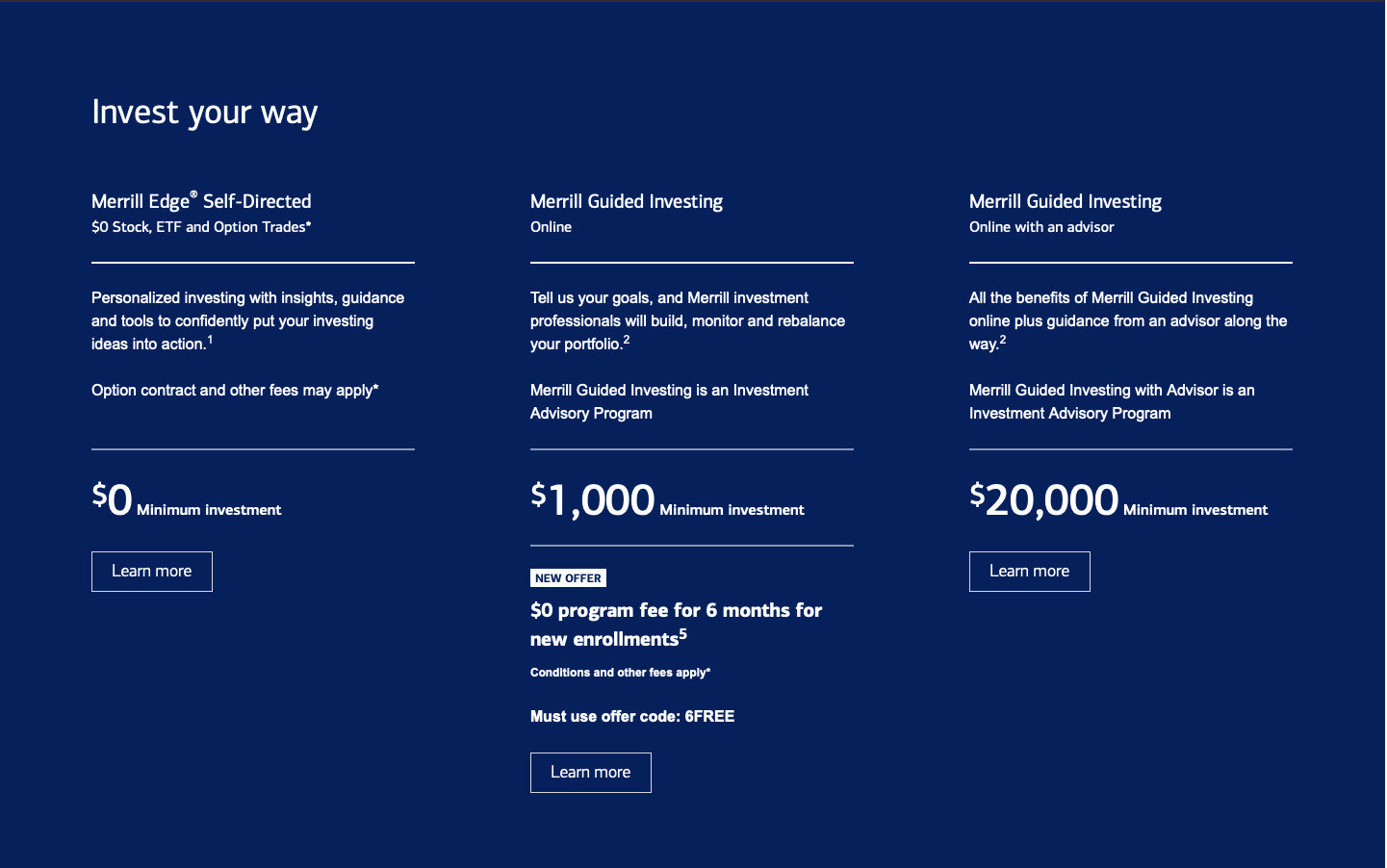

Commission and Fees:

Research and Analysis Tools:

Costumer Support:

Merrill Edge vouchsafes responsive customer support channels, inclusive of telephone, electronic mail, and live chat. Their support cadre is, on the whole, well-informed and eager to provide resolution to inquiries and grievances. A segment of traders may harbor the inclination for 24/7 accessibility, particularly those engaged in trading activities that transcend standard market hours. Merrill Edge’s customer support services merit commendation, though opportunities for augmentation exist to cater to a global audience necessitating round-the-clock assistance.

Mobile app:

Merrill Edge’s mobile application assumes a pivotal role in furnishing traders with portability and flexibility. The adroitly designed application mirrors most of the features available on the desktop platform, thereby enabling traders to vigilantly oversee their portfolios and execute trades while on the move. The acquisition of proficiency in app usage is incumbent upon a brief learning curve, a characteristic commonly attributed to many mobile applications. User-friendliness enhancements could further elevate the mobile user experience.

Security:

Security is an incontestable priority in the realm of online brokerage, and Merrill Edge manifests an unequivocal dedication to preserving the sanctity of user data and assets. Stringent security measures, inclusive of encryption technology and multi-factor authentication (MFA), are intrinsic to the platform’s architecture. These facets serve as the bulwark against potential security breaches, assiduously fortifying the protection of user accounts and sensitive data. Though no platform can claim invulnerability to security risks, Merrill Edge’s proactive stance on security merits applause.

Conclusion:

Merrill Edge emerges as a credible stock trading platform that imparts an interface characterized by user-friendliness, a spectrum of stocks embracing diversification, and a repository of research and analysis tools. While the fee structure may not uniformly cater to the proclivities of all trader profiles, Merrill Edge’s ethos of fee transparency stands commendable.

Further, Merrill Edge’s commitment to education and trader support is discernible, rendering it an invaluable choice for investors. It is incumbent upon traders to scrutinize their idiosyncratic needs, trading frequency, and strategies to determine the extent to which Merrill Edge harmonizes with their stock trading objectives. An unequivocal truism warrants restating: participation in the stock market entails inherent risks. It is imperative for investors to engage in meticulous research and, when necessary, solicit professional guidance prior to embarking upon stock trading activities.