“In-Depth Review of Plus500: A Comprehensive Analysis of a Stock Brokerage Platform”

Introduction

This comprehensive review offers a detailed evaluation of Plus500, a well-established presence in the stock brokerage industry. We examine the platform’s features, cost structure, trading experience, and its overall suitability for investors, delivering an impartial and professional assessment.

Trading platform and user experience:

Plus500 introduces a well-crafted and user-centric stock trading platform designed to cater to a broad spectrum of investors, from novices to seasoned traders. Navigating the platform is intuitive, characterized by a clean and accessible design. It provides users with a robust toolkit and resources, ensuring an environment that emphasizes operational efficiency. However, it is essential to acknowledge that individuals entirely new to stock trading may require a brief acclimatization period to fully grasp the intricacies of the platform’s features.

STOCK selection and availability :

Where Plus500 particularly distinguishes itself is in the breadth of stock assets it offers. The platform provides access to a wide selection of global stocks, spanning diverse industries and sectors. This extensive array of assets empowers investors to diversify their portfolios with ease, aligning their strategies with prevailing market trends. Plus500’s commitment to asset diversity is indeed a substantial advantage, affording investors the opportunity to construct well-rounded investment portfolios.

Commission and Fees:

Research and Analysis Tools:

Costumer Support:

Plus500’s customer support services are generally responsive and proficient. Traders can solicit assistance through channels such as email and phone. The support team exhibits competence in addressing inquiries and resolving issues. However, enhancing support accessibility to cater to traders operating beyond conventional market hours would be a prudent enhancement, ensuring 24/7 assistance and accommodating a global user base more effectively.

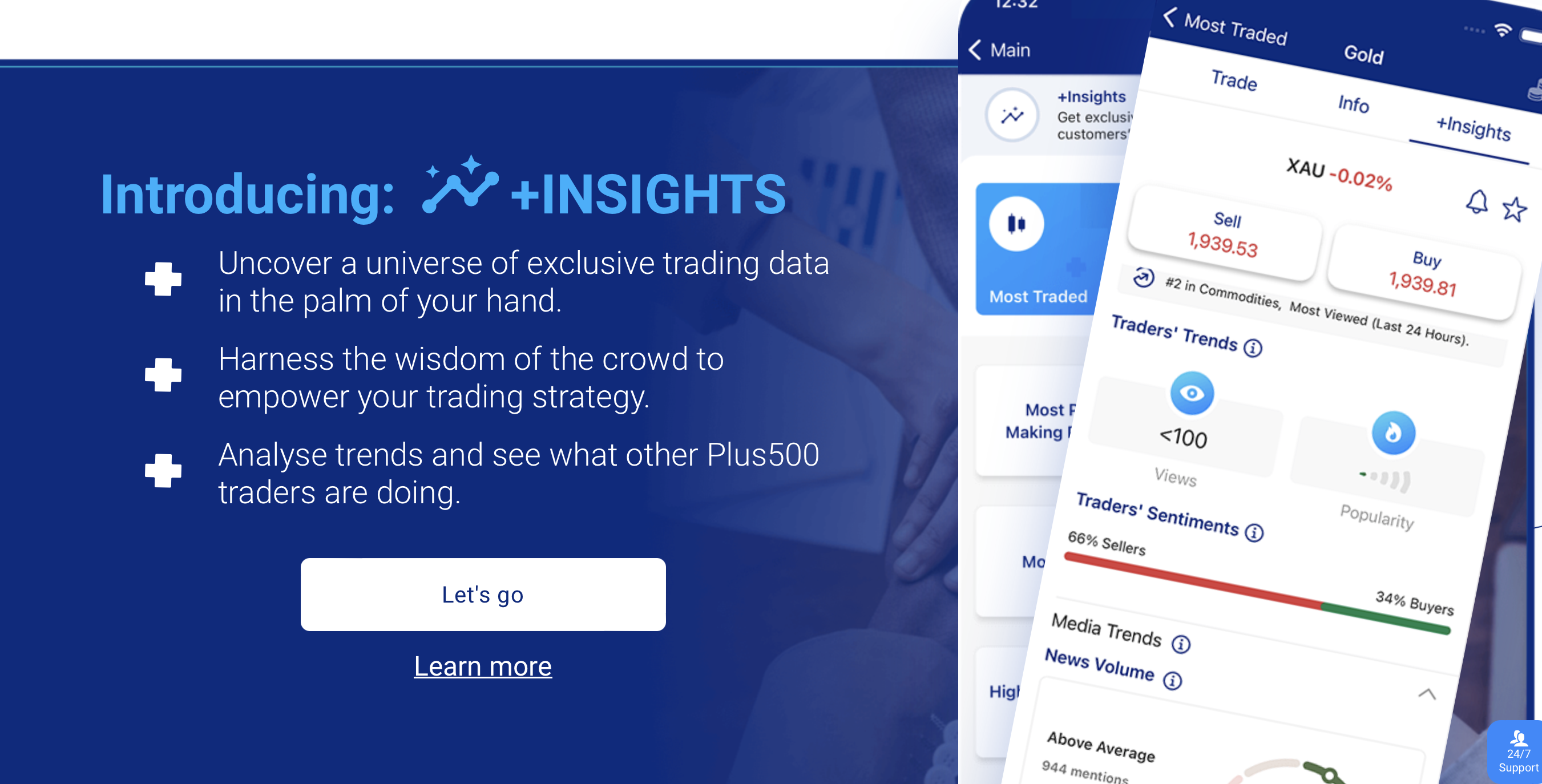

Mobile app:

Plus500 furnishes a mobile application, affording users the flexibility to oversee their stock portfolios on the move. The application’s design is commendable, mirroring the desktop platform to ensure a seamless transition between devices. Mobile trading enthusiasts stand to gain from the convenience offered by this app. Nevertheless, individuals unacquainted with the desktop platform may experience a short learning curve when acclimating to the mobile app.

Security:

Security constitutes a paramount concern in the realm of online trading, and Plus500 exhibits a strong commitment to the protection of user accounts and data. The brokerage firm deploys advanced security protocols, including robust encryption technology and two-factor authentication (2FA). While recognizing that no system is entirely invulnerable to risks, Plus500’s resolute dedication to heightening user security is commendable.

Conclusion:

In summation, Plus500 stands as a reputable stock brokerage platform celebrated for its user-friendly interface and the impressive diversity of stock assets it offers. The commission-free trading model, coupled with a pronounced emphasis on security, positions Plus500 as an attractive option for investors. However, an exhaustive examination of the fee structure is indispensable for traders, and the research and analysis tools might warrant further enrichment to cater to the more analytically inclined investor.

Ultimately, Plus500 is well-suited for investors who value a user-centric interface and access to a broad spectrum of stocks to fortify their investment portfolios. Nonetheless, individual inclinations and investment goals should be contemplated to determine the congruence of Plus500 with one’s specific requirements.