Trading in the Asian session has been quiet today and is expected to remain so during the European session, given the empty economic calendar. However, Yen continues to be a significant focus among market participants. Discussions are emerging about the possibility of USD/JPY surging through the 160 level, which is currently perceived as the intervention threshold for Japanese authorities, reaching 170 in a rapid manner.

The primary driver behind this speculation is the substantial interest rate gap between the US and Japan, which is unlikely to narrow significantly anytime soon. Today’s data from Japan, showing a further slowdown in business-to-business service inflation in May, does not bolster the case for BoJ to hike rates again in July. Additionally, intervention alone, without substantial market participation in buying Yen, is considered insufficient to reverse the currency’s course.

Attention will also turn to Canadian Dollar later in the day with the release of Canadian CPI data. BoC Governor Tiff Macklem has stated that he does not want to ease monetary policy “too quickly,” aligning with the expectation that BoC will not deliver back-to-back rate cuts in July. Stronger-than-expected inflation readings today would likely prompt BoC to maintain its current stance for longer before considering the second rate cut in this cycle.

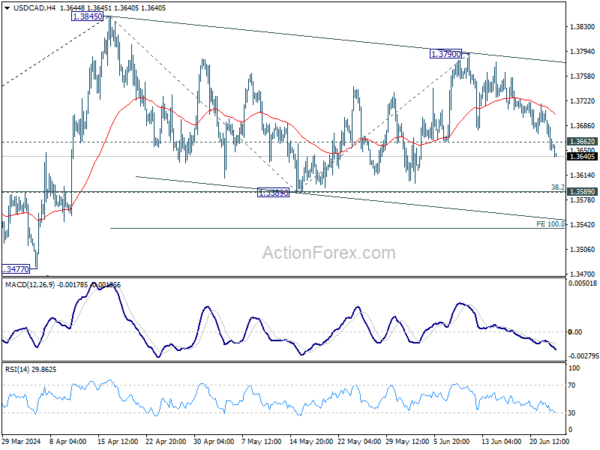

Technically, USD/CAD’s extended fall from 1.3790 suggests that rebound from 1.3589 has completed. Corrective pattern from 1.3845 is now extending with the third leg. Deeper fall would be seen to 1.3589 support, or even further to 100% projection of 1.3845 to 1.3589 from 1.3790 at 1.3534.

In Asia, at the time of writing, Nikkei is up 0.72%. Hong Kong HSI is up 0.41%. China Shanghai SSE is down -0.10%. Singapore Strait Times is up 0.25%. Japan 10-year JGB yield is up 0.0099 at 1.001. Overnight, DOW rose 0.67%. S&P 500 fell -0.31%. NASDAQ fell -1.09%. 10-year yield fell -0.009 to 4.248.

Fed’s Daly: We have two goals, one tool, and a lot of uncertainty

San Francisco Fed President Mary Daly, in a speech last night, discussed the ongoing challenges with inflation and the labor market. Daly remarked that the inconsistent inflation data this year has not built confidence. While recent figures are promising, it remains uncertain if the path to sustainable price stability is secure.

While, the labor market has been slow to adjust, with only a slight increase in the unemployment rate, Daly warned that “we are getting nearer to a point where that benign outcome could be less likely. ”

Emphasizing Fed’s situation with “two goals, one tool, and a lot of uncertainty,” and Daly stressed that “policy has to be conditional” and policymakers have to “think in scenarios.”

Daly outlined the possible policy responses to different economic scenarios. “If inflation turns out to fall more slowly than projected, then holding the federal funds rate higher for longer would be appropriate.”

Conversely, “If inflation falls rapidly, or the labor market softens more than expected, then lowering the policy rate would be necessary.”

Daly also addressed a middle-ground scenario, saying, “If we continue to see gradual declines in inflation and a slow rebalancing in the labor market, then we can normalize policy over time, as many expect.”

BoC’s Macklem monitoring wage growth for further moderation

BoC Governor Tiff Macklem emphasized overnight that the central bank doesn’t want monetary to be “more restrictive than it has to be,”. Yet he also cautioned against lowering borrowing costs “too quickly” as it could undermine progress on controlling inflation.

Macklem pointed out that although wage growth remains above pre-pandemic levels, there are signs that the labor market is rebalancing and inflation is moderating, which could reduce compensation pressures.

“Wages tend to lag adjustments in employment,” he explained, adding, “Going forward, we will be looking for wage growth to moderate further.”

Australia’s Westpac consumer sentiment ticks up but still deeply pessimistic

Australia’s Westpac Consumer Sentiment rose 1.7% mom to 83.6 in June. However, the index remains deeply pessimistic, well below neutral level of 100. Although assessments of personal finances and buyer sentiment have become less negative, concerns about inflation, interest rates, and economic growth continue to weigh heavily on consumers.

The sub-index tracking the ‘economic outlook for the next 12 months’ fell -5.7% mom to 78.5, marking its lowest level since last October. In contrast, the ‘economic outlook for the next 5 years’ sub-index saw a slight improvement, rising 2.1% mom to 94.1.

Regarding RBA monetary policy, Westpac noted that the upcoming Q2 CPI data, due on July 31, will be crucial. Westpac expects the update to confirm that weak demand is still exerting disinflationary pressure. This should provide RBA with sufficient confidence that upside risks are not materializing, reducing the likelihood of a rate hike.

Looking ahead

The economic calendar is empty in Europen session. Canada CPI is the main focus later in the day. US will relase house price index and consumer confidence.

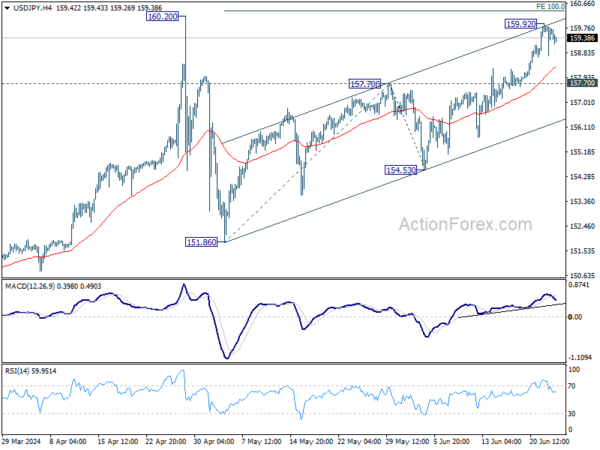

USD/JPY Daily Outlook

Daily Pivots: (S1) 158.95; (P) 159.43; (R1) 160.11; More…

A temporary top should be formed at 159.92 in USD/JPY and intraday bias is turned neutral first. Further rise will remain in favor as long as 157.70 resistance turned support holds. Sustained break of 106.20 and 100% projection of 151.86 to 157.70 from 154.53 at 160.37 will confirm long term up trend resumption, and pave the way to 161.8% projection at 163.97. Nevertheless, firm break of 157.70 will turn bias back to the downside for channel support (now at 156.23) first.

In the bigger picture, there is no sign of long term trend reversal yet. Further rally is expected as long as 150.87 resistance turned support holds. Decisive break of 160.02 will target 100% projection of 127.20 to 151.89 from 140.25 at 164.94.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y May | 2.50% | 2.80% | 2.70% | |

| 00:30 | AUD | Westpac Consumer Confidence Jun | 1.70% | -0.30% | ||

| 12:30 | CAD | CPI M/M May | 0.30% | 0.50% | ||

| 12:30 | CAD | CPI Y/Y May | 2.60% | 2.70% | ||

| 12:30 | CAD | CPI Core M/M May | 0.20% | 0.20% | ||

| 12:30 | CAD | CPI Media Y/Y May | 2.60% | 2.60% | ||

| 12:30 | CAD | CPI Trimmed Y/Y May | 2.80% | 2.90% | ||

| 12:30 | CAD | CPI Common Y/Y May | 2.60% | 2.60% | ||

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Apr | 7.00% | 7.40% | ||

| 13:00 | USD | Housing Price Index M/M Apr | 0.50% | 0.10% | ||

| 14:00 | USD | Consumer Confidence Jun | 100.2 | 102 |