Canadian Dollar surges in early US session after much stronger than expected job data that blew past market expectations. The Loonie is taking over Sterling’s position as the best performer of the day, with the latter lifted slightly by strong UK GDP data. At the same time, Dollar is also strengthening slightly against others, but the next move would depend on market reactions to U of Michigan consumer sentiment and inflation expectations.

Technically, one immediate focus is on whether USD/CAD would break through 55 D EMA (now at 1.3628) decisively. If that materializes, it would argue that whole rise from 1.3176 has already completed ahead of 1.3897/3976 resistance zone. The sideway pattern from 1.3976 would then be already in another falling leg, heading back towards 1.3176 support.

In Europe, at the time of writing, FTSE is up 0.77%. DAX is up 0.62%. CAC is up 0.71%. UK 10-year yield is up 0.0040 at 4.147. Germany 10-year yield is up 0.008 at 2.506. Earlier in Asia, Nikkei rose 0.41%. Hong Kong HSI rose 2.30%. China Shanghai SSE rose 0.01%. Singapore Strait Times rose 0.76%. Japan 10-year JGB yield fell -0.0036 to 0.909.

Canada’s employment rises 90.4k in Apr, unemployment rate unchanged at 6.1%

Canada’s employment grew strongly by 90.4k in April, well above expectation of 17.5k.

Unemployment rate was unchanged at 6.1%, below expectation of 6.2%. Employment rate was unchanged at 61.4%. Total hours worked rose 0.8% mom.

Average hourly wages rose 4.7% yoy, slowed from March’s 5.1% yoy.

June rate cut plausible, ECB accounts indicate

In the accounts from their April monetary policy meeting, ECB confirmed that it is “plausible” to be in a position to start cutting interest rates as early as June, contingent upon incoming evidence supporting the medium-term inflation forecasts established in March.

ECB members collectively noted that recent data largely upheld the projections made by staff in March, bolstering their “confidence that the disinflationary process was continuing”.

Looking forward, ECB highlighted the importance of upcoming data releases and new staff projections, which are expected before the June meeting. These forthcoming insights will provide a more “comprehensive” basis for decision-making, enabling a fuller assessment of the economic environment and potentially justifying a shift in policy.

BoE’s Pill cautions against overemphasis on June rate cut

BoE Chief Economist Huw Pill today advised against fixating on the possibility of an interest rate cut in the upcoming June meeting, describing such expectations as “probably a little bit ill-advised.”

Pill clarified that a rate reduction next month is not a “fait accompli,” tempering expectations that have been building around BoE’s short-term monetary policy trajectory.

Pill elaborated that the MPC has indeed signaled that the bank rate could be reduced, but only upon receiving sufficient evidence that the persistent components of inflation are on a clear downward path.

UK GDP grows 0.4% mom in Mar, 0.6% qoq in Apr, above expectations

UK GDP grew 0.4% mom in March, well above expectation of 0.1% mom. Services output rose 0.5% mom. Production output rose 0.2% mom while construction output fell -0.4% mom.

For Q1, GDP grew 0.6% qoq, above expectation of 0.4% qoq. Compared with the same quarter a year ago, GDP is estimated to have increased by 0.2% yoy. In output terms, services grew by 0.7% on the quarter with widespread growth across the sector; elsewhere the production sector grew by 0.8% while the construction sector fell by -0.9%.

NZ BNZ manufacturing rises to 48.9, signs of life despite prolonged contraction

New Zealand BusinessNZ Performance of Manufacturing Index rose from 46.8 to 48.9 in April. Despite this improvement, the sector remains in contraction for the 14th consecutive month.

Breaking down the components of the index, there were some positive developments in April. Production notably increased to 50.8 from 46.0, and employment also rose to 50.8 from 46.8, both crossing into expansion territory. However, new orders still lagged behind, albeit with a slight improvement to 45.3 from 44.6, indicating that demand continues to be tepid. Additionally, finished stocks and deliveries edged closer to a neutral stance, registering at 50.4 and 48.4, respectively.

Catherine Beard, BusinessNZ’s Director of Advocacy, , noted slight improvement in April but also increase in negative sentiment among businesses. She highlighted that “the proportion of negative comments again increased to 69%, compared with 65% in March and 62% in February,” with lack of sales and orders being a recurrent concern alongside the broader struggles of the economy.

BNZ Senior Economist Doug Steel provided further insights, stating that “the PMI this year to date is consistent with manufacturing GDP trailing year earlier levels.” He also noted that the details for April were “a bit more mixed,” and they presented a less uniformly weak picture than in recent months.

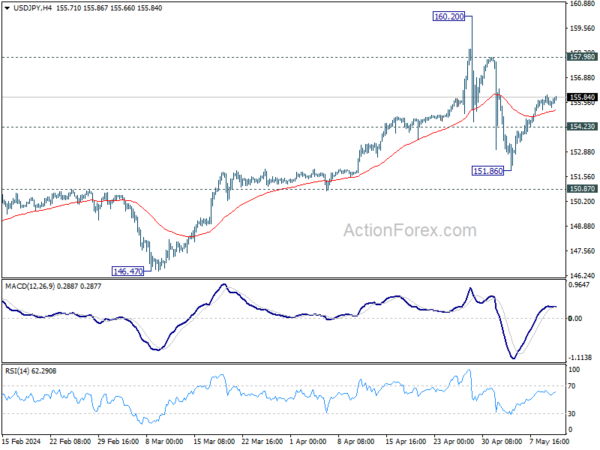

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 155.12; (P) 155.54; (R1) 155.91; More…

No change in USD/JPY’s outlook and intraday bias stays mildly on the upside. Rebound from 151.86 is seen as the second leg of the corrective pattern from 160.20 high. Further rise would be seen to 157.98 resistance. On the downside, below 154.23 minor support will turn intraday bias neutral.

In the bigger picture, a medium term top might be formed at 160.20. But as long as 150.87 resistance turned support holds, fall from there is seen as correcting rise from 150.25 only. However, decisive break of 150.87 will argue that larger correction is possibly underway, and target 146.47 support next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Apr | 48.9 | 47.1 | 46.8 | |

| 23:30 | JPY | Overall Household Spending Y/Y Mar | -1.20% | -2.40% | -0.50% | |

| 23:50 | JPY | Current Account (JPY) Mar | 2.01T | 2.05T | 1.37T | |

| 05:00 | JPY | Eco Watchers Survey: Current Apr | 47.4 | 49.8 | ||

| 06:00 | GBP | GDP M/M Mar | 0.40% | 0.10% | 0.10% | 0.20% |

| 06:00 | GBP | GDP Q/Q Q1 P | 0.60% | 0.40% | -0.30% | |

| 06:00 | GBP | Manufacturing Production M/M Mar | 0.30% | -0.50% | 1.20% | |

| 06:00 | GBP | Manufacturing Production Y/Y Mar | 2.30% | 1.80% | 2.70% | 2.60% |

| 06:00 | GBP | Industrial Production M/M Mar | 0.20% | -0.50% | 1.10% | 1.00% |

| 06:00 | GBP | Industrial Production Y/Y Mar | 0.50% | 0.30% | 1.40% | 1.00% |

| 06:00 | GBP | Goods Trade Balance (GBP) Mar | -14.0B | -14.5B | -14.2B | -14.1B |

| 08:00 | EUR | Italy Industrial Output M/M Mar | -0.50% | 0.30% | 0.10% | 0.00% |

| 11:40 | GBP | NIESR GDP Estimate (3M) Apr | 0.70% | 0.40% | ||

| 12:30 | CAD | Net Change in Employment Apr | 90.4K | 17.5K | -2.2K | |

| 12:30 | CAD | Unemployment Rate Apr | 6.10% | 6.20% | 6.10% | |

| 14:00 | USD | Michigan Consumer Sentiment Index May P | 77 | 77.2 |