Canadian Dollar has come under broad pressure in the early US session following the release of the latest inflation data, which showed a further slowdown in inflation, with headline CPI fell to a 40-month low and core measures also easing. This set of data has strengthened market’s expectation that BoC would deliver its third rate cut of the current cycle at its upcoming September meeting, lowering the key borrowing rate to 4.50%.

The data has shifted the focus to BoC’s future policy path. While the September rate cut seems like a done deal, the trajectory beyond that remains uncertain. Market participants anticipate further policy easing, but the extent and pace of additional rate cuts will be closely tied to incoming economic data.

In the broader currency markets, Dollar is currently the weakest performer for the day. Canadian Dollar follows as second worst, pressured by the dovish implications of its inflation report, while Euro is also underperforming. On the flip side, New Zealand Dollar is leading the gains, followed by Swiss Franc and British Pound. Yen and Australian Dollar are positioned in the middle of the pack.

Technically, Gold’s up trend resumed today after brief consolidations. Further rally is now expected as long as 2483.52 resistance turned support holds. Next target is 61.8% projection of 1984.05 to 2449.83 from 2293.45 at 2581.30. The focus is on whether Gold could lose momentum above 2581.30, or just accelerate to 100% projection at 2759.23. That would very much depend on Dollar’s next move.

In Europe, at the time of writing, FTSE is down -0.87%. DAX is down -0.16%. CAC is down -0.08%. UK 10-year yield is flat at 3.926. Germany 10-year yield is down -0.0223 at 2.229. Earlier in Asia, Nikkei rose 1.80%. Hong Kong HSI fell -0.33%. China Shanghai SSE fell -0.93%. Singapore Strait Times rose 0.44%. Japan 10-year JGB yield rose 0.002 to 0.892.

Bundesbank expects temporary inflation rise, sees modest economic expansion ahead

In its latest monthly report, Bundesbank cautioned that inflation is expected to “temporarily increase” towards the end of the year. This uptick is anticipated as the currently negative inflation rates for energy turn positive, and the depressed profit margins for mineral oil products begin to recover.

Looking ahead, Bundesbank forecasts slight expansion in Germany’s economic output. The report notes that the ongoing weakness in the construction sector and industry—driven largely by weak foreign demand—will likely persist. Despite these challenges, Bundesbank expects growth in private consumption and service sectors during Q3.

The report highlights that with real incomes for private households on the rise, “consumer spending should increase,” though it may do so hesitantly. For instance, GfK Consumer Climate Index for July was above the average of the previous quarter, continuing its upward trend from recent months.

Eurozone CPI finalized at 2.6% in Jul, core CPI at 2.9%

Eurozone CPI was finalized at 2.6% yoy in July, up from June’s 2.5% yoy. CPI Core (ex-energy, food, alcohol & tobacco) was finalized at 2.9% yoy, unchanged from June’s reading. The highest contribution to the annual inflation rate came from services (+1.82 percentage points, pp), followed by food, alcohol & tobacco (+0.45 pp), non-energy industrial goods (+0.19 pp) and energy (+0.12 pp).

EU CPI was finalized at 2.8% yoy, up from June’s 2.6% yoy. The lowest annual rates were registered in Finland (0.5%), Latvia (0.8%) and Denmark (1.0%). The highest annual rates were recorded in Romania (5.8%), Belgium (5.4%) and Hungary (4.1%). Compared with June 2024, annual inflation fell in nine Member States, remained stable in four and rose in fourteen.

RBA Minutes: No near-term rate cut expected, nothing ruled in or out

RBA’s August meeting minutes revealed a thorough discussion on the merits of both a rate hike and a rate hold, ultimately leading to the decision to keep interest rates unchanged at 4.35%. The minutes reiterated that it is “unlikely that the cash rate target would be reduced in the short term.” The minutes also noted that it is “not possible to either rule in or rule out” future changes in the cash rate

The decision to hold rates steady was seen as the best way to “balance the risks” to both inflation and the labor market, especially given the “prevailing uncertainties, market volatility, and market expectations.”

RBA members emphasized the importance of placing “greater-than-usual weight on the flow of data” rather than relying solely on forecasts, due to the uncertainties surrounding the persistence of supply shocks. They noted that the data since the previous meeting had “not been sufficient to warrant a change in the stance of monetary policy.”

Additionally, the minutes suggested that holding the cash rate target steady for a “longer period” than currently implied by market expectations could be enough to bring inflation back to target within a reasonable timeframe. However, the Board acknowledged that this approach would need to be reassessed at future meetings based on incoming data and evolving economic conditions.

New Zealand’s goods export rises 14% yoy in Jul, imports up 8.5% yoy

New Zealand’s goods exports saw a robust increase of 14% yoy in July, reaching NZD 6.1B. Goods imports also rose by 8.5% yoy to NZD 7.1B, leading to a trade deficit of NZD -963m, a stark contrast to the expected surplus of NZD 331m.

Breaking down the export data, the strongest growth came from Australia, with total exports up by 19% (NZD 135m), followed by the EU, where exports surged by 30% (NZD 114m). Exports to China increased by 8.5% (NZD 107m), while exports to the US and Japan rose by 4.7% (NZD 35m) and 5.3% (NZD 17m), respectively.

On the import side, the largest increase was from South Korea, where imports more than doubled, rising by 103% (NZD 480m). Imports from China also saw significant growth, up 18% (NZD 233m). In contrast, imports from the US and the EU declined sharply, with drops of -30% (NZD -255m) and -14% (NZD -147m), respectively. Imports from Australia showed a modest increase of 0.82% (NZD 6.3m).

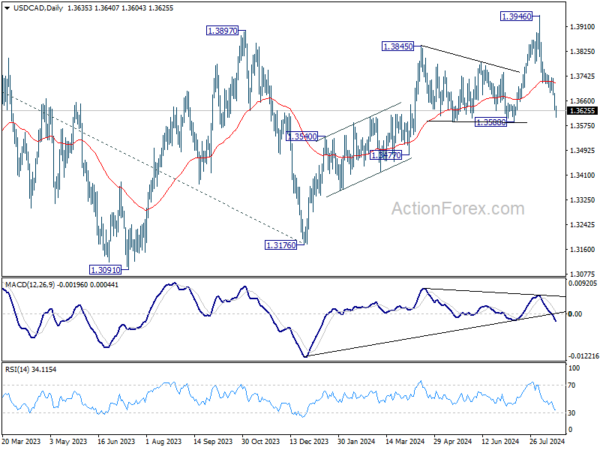

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3614; (P) 1.3650; (R1) 1.3670; More…

USD/CAD’s fall from 1.3946 is still in progress and intraday bias stays on the downside for 1.3588 structural support. Strong support could be seen from there to bring reversal. On the upside, above 1.3684 will turn intraday bias back to the upside for stronger rebound. However, decisive break of 1.3588 will argue that rise from 1.3176 has completed and target 1.3477 support next.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern, that might have completed at 1.3176 (2023 low) already. Firm break of 1.3976 will confirm resumption of whole up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149. This will be the favored case as long as 1.3588 support holds, in case of pullback. However, firm break of 1.3588 will argue that consolidation from 1.3976 is already extending with another falling leg back towards 1.3091/3176 support zone.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Jul | -963M | 331M | 699M | 585M |

| 01:15 | CNY | 1-Y Loan Prime Rate | 3.35% | 3.35% | 3.35% | |

| 01:15 | CNY | 5-Y Loan Prime Rate | 3.85% | 3.85% | 3.85% | |

| 01:30 | AUD | RBA Meeting Minutes | ||||

| 06:00 | CHF | Trade Balance (CHF) Jul | 4.89B | 5.44B | 6.18B | 6.12B |

| 06:00 | EUR | Germany PPI M/M Jul | 0.20% | 0.30% | 0.20% | |

| 06:00 | EUR | Germany PPI Y/Y Jul | -0.80% | -0.80% | -1.60% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Jun | 50.5B | 37.0B | 36.7B | 37.6B |

| 09:00 | EUR | Eurozone CPI Y/Y Jul F | 2.60% | 2.60% | 2.60% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul F | 2.90% | 2.90% | 2.90% | |

| 12:30 | CAD | New Housing Price Index M/M Jul | 0.20% | 0.00% | -0.20% | |

| 12:30 | CAD | CPI M/M Jul | 0.40% | 0.30% | -0.10% | |

| 12:30 | CAD | CPI Y/Y Jul | 2.50% | 2.50% | 2.70% | |

| 12:30 | CAD | CPI Median Y/Y Jul | 2.40% | 2.50% | 2.60% | |

| 12:30 | CAD | CPI Trimmed Y/Y Jul | 2.70% | 2.70% | 2.90% | |

| 12:30 | CAD | CPI Common Y/Y Jul | 2.20% | 2.20% | 2.30% |