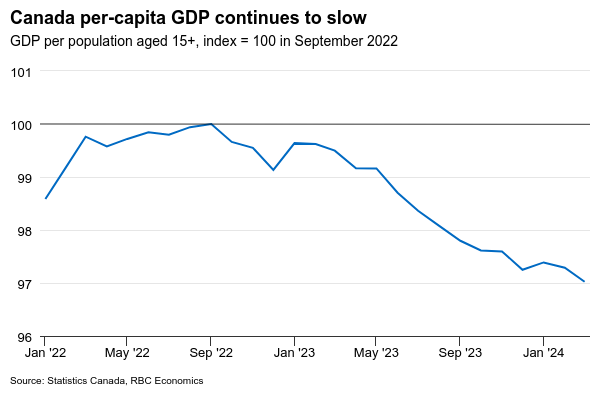

The Canadian economy likely grew more quickly in Q1 2024 based on headline figures, but it was not fast enough yet again to keep up with surging population growth. That means gross domestic product on a per-person basis contracted for a seventh consecutive quarter.

We look for an annualized 2.5% increase in Q1 GDP from the previous quarter, up from 1% in Q4 2023. But, with the population still growing rapidly, output per-capita will be down ~1% (annualized q-o-q rate). Consumer spending is tracking an annualized 1.1% increase in Q1 from the previous quarter and business investment looks to have edged higher with a rise in machinery purchases offsetting slower non-residential construction activity. But higher spending came in part from higher imports rather than domestic Canadian production with net trade on track to subtract slightly from Q1 GDP growth.

Most of the increase in Q1 GDP on a monthly basis was concentrated in a 0.5% jump in January when the end of public sector strikes in Quebec boosted activity in the education sector. GDP growth slowed to 0.2% in February and we are tracking an unchanged reading in March that would be in line with Statistics Canada’s preliminary estimate a month ago. An increase in oil extraction in Alberta and rising oil drilling activity in March will boost output in the mining sector. But manufacturing sale volumes fell by 2% and retail sale volumes edged 0.4% lower. Our card spending data suggested little change in accommodation and food services sales in March.

The initial estimate for April output should look a little better given a 0.8% rise in hours worked in the earlier reported labour market data. Still, the economic backdrop in Canada has continued to soften on a per-capita basis with unemployment drifting higher and wage pressures and inflation showing further signs of easing. We continue to expect the first rate cut from the Bank of Canada in June.

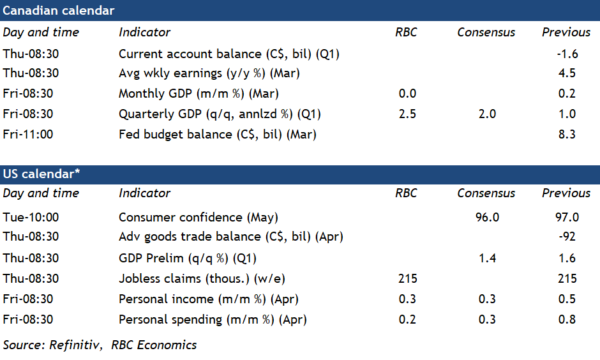

Week ahead data watch

U.S. personal spending growth likely slowed a nominal 0.2% increase in April from 0.8% in the prior month, consistent with flat retail sales. We expect the U.S. personal income to grow at a slower pace (0.2%), down from 0.5% in March in line with moderating wage growth in April.

March Canadian SEPH (payroll employment) data will be monitored for further signs that wage pressures are easing. The number of job openings in the SEPH data edged higher in February but was still down more than 20% from a year ago and 34% from peak levels in 2022 when labour shortages were most acute.