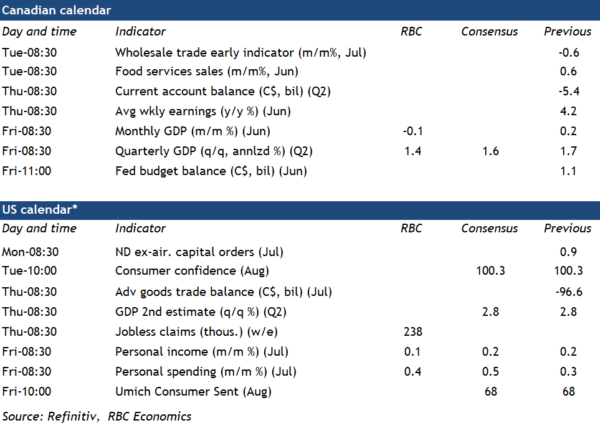

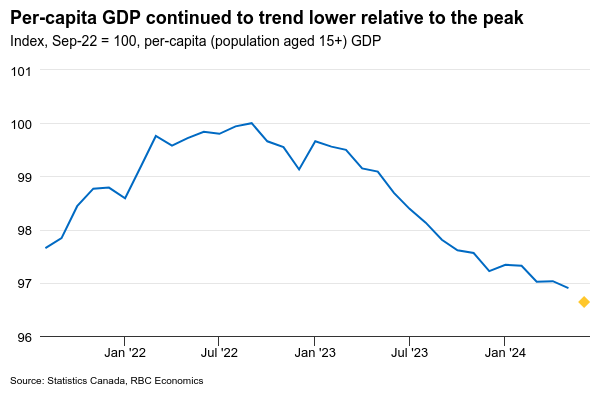

Canada’s GDP report next week is expected to show further weakening in the Canadian economy. We expect a 1.4% (annualized rate) increase in GDP in Q2 – below Statistics Canada’s 2% preliminary estimate a month ago, and marking the 7th of the last 8 quarters of declining output on a per-capita basis.

Growth in GDP in Q2 is expected to have mainly come from personal spending on services, which continued to grow despite signs from our own tracking of card transactions that momentum faded later in the quarter. Spending on goods likely weakened again, consistent with a drop in retail sale volumes in Q2 (-0.3%). Residential investment is expected to fall, largely due to weaker home sales during that quarter. But investment on structures likely saw solid growth, supported by stronger activities in engineering and other construction sector.

We expect growth momentum faded late in the quarter with June output declining 0.1% — weaker than the 0.1% increase in the advance estimate a month ago. A large drop in manufacturing sale volumes (-2.1%) and a drop in oil & gas drilling activity should leave goods production down 0.5%. Meanwhile, we expect output in the service-providing sector remained flat, showing little change from May. Wholesale sale volumes fell by 0.9% in June, a second consecutive monthly decline. Retail sale volumes were little changed (up 0.1% in June) but a 3.4% tick up in home resales will provide some offset.

Overall, the Canadian economy very likely continued to soften on a per-capita basis (both in June and in Q2 as a whole) given still-strong population growth. That should help to reinforce the Bank of Canada’s view that the economy has softened enough to keep inflation on a downward trajectory. We continue to expect the BoC to cut the overnight rate by another 25 bps in September.

Week ahead data watch

June SEPH data will be monitored closely for further signs of weakening in the labour market. We expect the wage growth to slow further, given job openings have been trending lower. Earlier results from business surveys also indicated that hiring demand is slowing in Canada.

U.S. personal consumption likely edged up 0.4% in July, slightly higher than the 0.3% in the prior month, given the robust retail sales. We expect personal income to tick up 0.1% during that month, consistent with the slower wage growth we observed in July payroll report.

The shutdown of Canada’s 2 main railroad companies that started Thursday appears likely to end quickly with the Federal Government taking steps to push the parties back to work and into binding arbitration.