NBFCs have demonstrated strong financial health, similar to the banking sector. As of the end of March 2024, the gross non-performing assets (GNPAs) of both scheduled commercial banks (SCBs) and NBFCs were below 3 per cent of total advances. Provisional data shows that the GNPA ratio for NBFCs stood at 2.5 per cent at the end of March 2024, revealed a latest report by Infomerics Ratings.

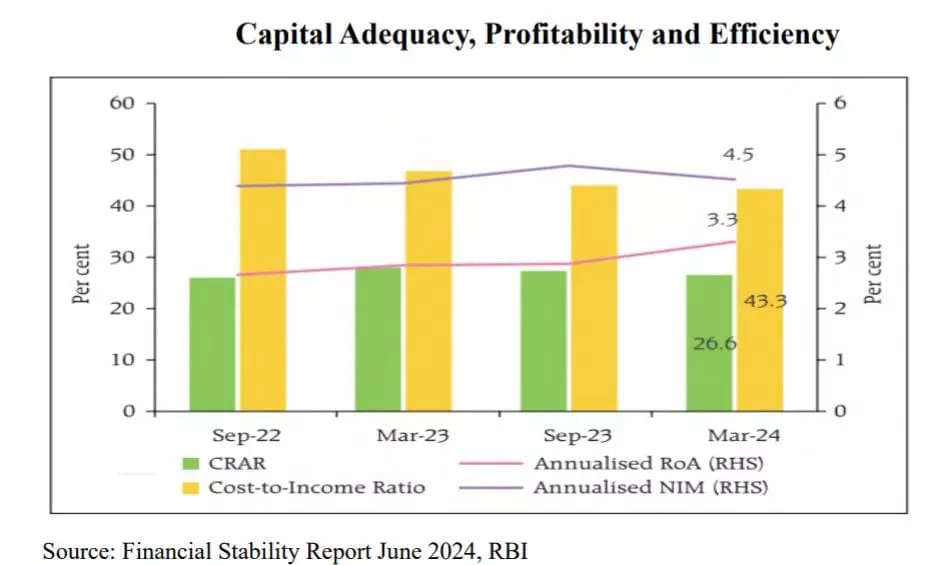

Further, the capital position of NBFCs remains healthy – CRAR stood at 26.6 per cent in March 2024, well above the regulatory minimum requirement.

The RoA ratio has been rising, the cost-to-income ratio has maintained a declining trend in the post-pandemic period and the NIM stood strong during 2023-24, said the report.

Sectoral GNPA ratio & Asset Quality

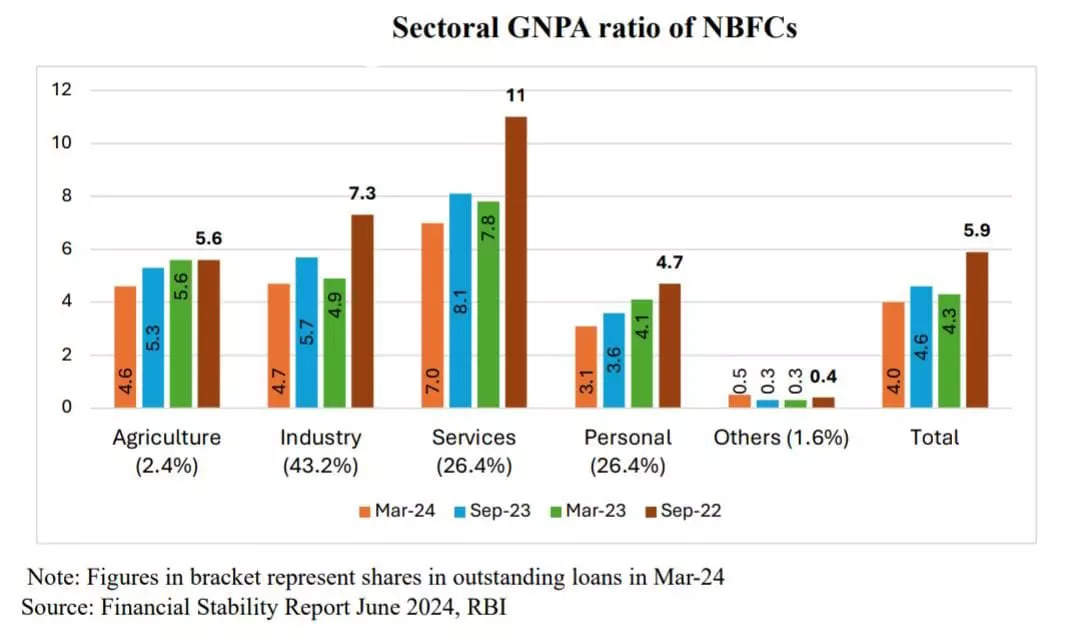

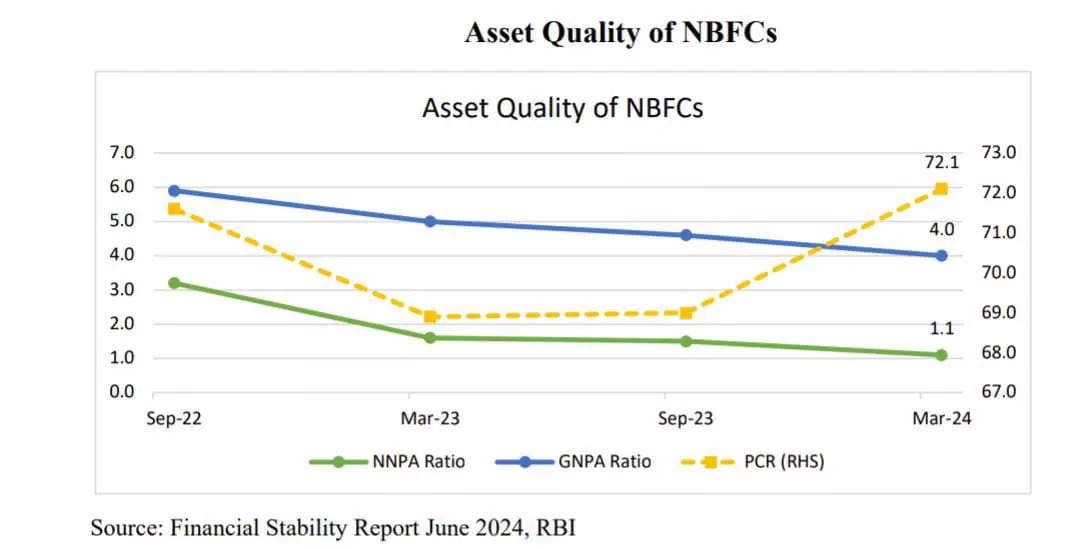

The GNPA ratio of NBFCs (including those under resolution) continued its downward trajectory in the post-pandemic period to reach 4 per cent in March 2024.

Within the retail segment, vehicle/auto loans had the highest GNPA ratio (5 per cent), while other categories of loans had a ratio of below 3 per cent, highlighted the report.

Asset quality improved for both Government and private NBFCs. Private NBFCs’ industrial advances, which account for one-fifth of the overall GNPA stock of the NBFC sector, further moderated as reflected in the GNPA ratio to 10.2 per cent in March 2024.

The aggregate NNPA ratio of NBFCs improved further due to higher PCR and the fall in GNPAs, the report added.

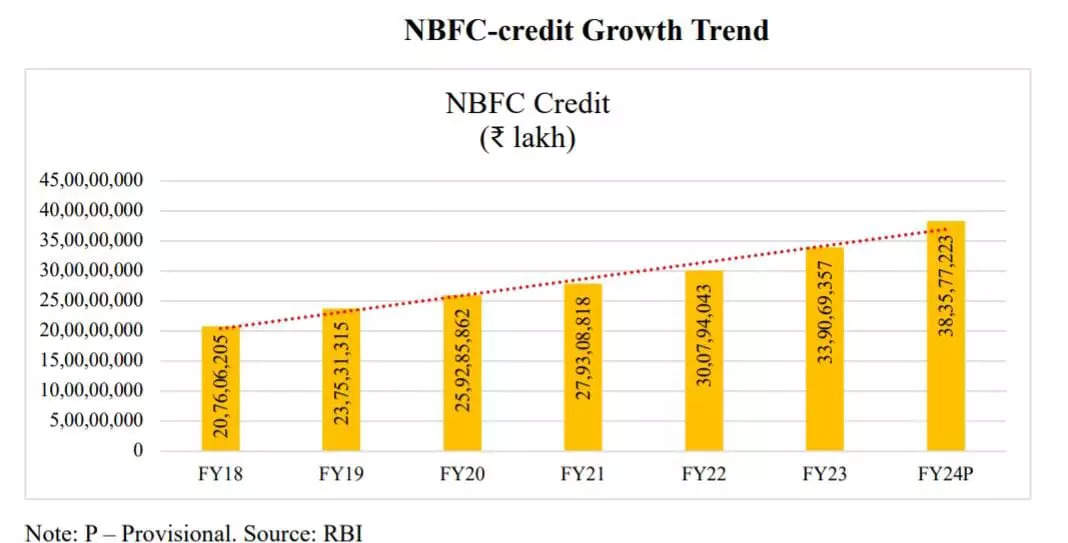

NBFCs’ credit growth

Credit growth in the largest category of NBFCs by activity, investment, and credit companies (NBFC-ICCs), has been accelerating in the post-pandemic period. In contrast, the second largest category, infrastructure finance companies (NBFC-IFCs), experienced a moderation in growth after four successive quarters of double-digit increases, revealed the report.

Between September 2022 and September 2023, the NBFC sector experienced a significant upward trend in credit growth, with gross advances increasing by 20.8 per cent compared to 10.8 per cent the previous year.

This growth was predominantly driven by a substantial rise in personal loans, which grew by 32.5 per cent, and lending to the agriculture industry, which saw a 43.7 per cent increase.

Over the past four years, the personal loans category surged by a compound annual growth rate (CAGR) of 33 per cent, significantly outpacing the overall credit growth of nearly 15 per cent CAGR, the report added.

Recent adjustments in risk weights for certain categories of retail loans are likely to impact the trajectory of credit growth within the sector, both at a general level and more specifically within certain sectors and sub-sectors.

The total GNPA ratio of NBFCs improved to 4.6 per cent in September 2023, down from 5.9 per cent in September 2022. Particularly, the personal loans segment, which experienced rapid growth in recent years, reported the lowest GNPA ratio at 3.6 per cent as of September 2023, said the report.

The increase in capital expenditure should compensate for the reduced growth in bank funding to NBFCs – a key driver of corporate credit – due to the 25 percentage points higher risk weight on lending to higher-rated NBFCs.

In the financial year 2023, the industrial sector was the largest recipient of credit from the NBFC sector, followed by the retail and services sectors. Among the subcategories, large-scale industries received the highest amount of credit, the report further stated.

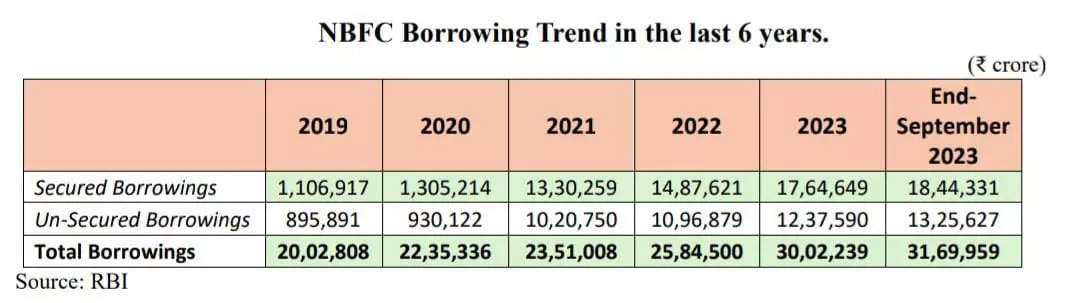

NBFC sector borrowings

NBFCs primarily rely on borrowings from markets and banks to finance their operations. As of March 2024, NBFCs were the largest net borrowers of funds from the financial system, with gross payables amounting to Rs 16.58 lakh crore and gross receivables at Rs 1.61 lakh crore, revealed the report.

The funding mix of NBFCs has shifted significantly with the banks’ share increasing from 47.5 per cent in December 2018 to 55.1 per cent in March 2024. Similarly, long-term funds provided by banks and Alternative Investment Funds (AIFs) have risen from 40.7 per cent to 45.9 per cent in the same period.

The outstanding bank credit to NBFCs stood at Rs 15.54 trillion in April 2024. Bank funding to NBFCs grew by 14.6 per cent on a Y-o-Y basis in April 2024, compared to 29.2 per cent in April 2023, according to the RBI data.

The RBI increased risk weights on unsecured consumer credit and bank credit to NBFCs on November 16, 2023, to pre-empt buildup of any potential risk in these segments.

Consequently, credit growth in unsecured personal loans, such as, ‘credit card outstanding’ declined from 34.2 per cent in November 2023 to 23 per cent in April 2024, while bank credit growth to NBFCs declined from 21.5 per cent in November 2023 to 14.6 per cent in April 2024, the report stated.

Despite the potential systemic risks, the RBI has indicated that the hypothetical failure of the largest NBFC would impact only a small fraction of the banking system’s Tier 1 capital, highlighting the sector’s resilience and the effectiveness of regulatory measures in place.

A breakup of their gross payables reveals that the bulk of funds were sourced from SCBs, followed by AMC-MFs and insurance companies. The choice of instruments in the funding mix of NBFCs shows continued reliance on LT funds. The share of LT debt instruments (held by insurance companies and AMC-MFs) moderated in 2023-24.

By the end of March 2023, bank borrowings surpassed debentures as the largest source of funds for NBFCs. Borrowings from banks continued to show high growth as of the end of September 2023. Approximately two-thirds of NBFCs’ borrowings are payable in more than 12 months. At the end of March 2023, there was a slight increase in short-term borrowings, which are payable within three months or less, the report added.

Funds raised through Mutual Funds

The funds raised by non-banking financial companies (NBFCs) from mutual funds increased by 30 per cent y-o-y to Rs 2.1 trillion in April 2024, highlighted the report.

The MF debt exposure to NBFCs had risen by just 0.2 per cent Y-o-Y to Rs 1.6 trillion in April 2023.

Analysts and NBFC executives said this increase in funding signals MFs’ comfort in taking exposure to better-rated finance firms. The MF debt exposure to NBFCs, including their commercial papers (CPs) and corporate debt, crossed the Rs 2 trillion mark after 55 months, the report further stated.

In August 2019, the exposure to NBFCs was above Rs 2 trillion. The CP outstanding stood at Rs 1.18 trillion. Such a level was witnessed five years ago in May 2019.

The investment in corporate debt of NBFCs increased by 23.5 per cent Y-o-Y and 4 per cent month-on-month to Rs 90,000 crore in April 2024. Meanwhile, the share of total corporate debt to NBFCs inched up to 4.4 per cent in April 2024 from 4.2 per cent in April 2023, it added.