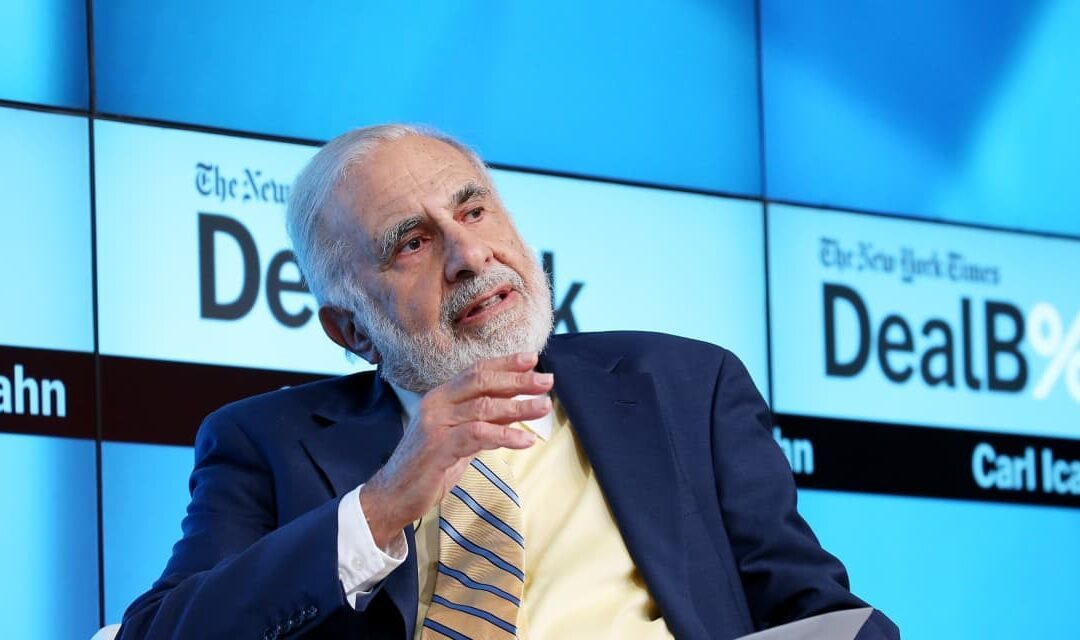

Just four days after Carl Icahn disclosed a 9.9% stake in JetBlue Airways Corp. and signaled his intention to have a say in the company’s future, the activist investor has landed two board seats at the low-cost airline.

JetBlue

JBLU,

said late Friday that two Icahn Enterprises

IEP,

executives, general counsel Jesse Lynn and portfolio manager Steven Miller, will join the airline’s board.

“We appreciate the constructive engagement we have had with JetBlue’s board and leadership team. We very much look forward to working with them in the future,” Icahn said in a statement.

The Wall Street Journal had reported earlier Friday that Icahn and JetBlue were in the late stages of a settlement agreement that would avert a proxy fight. The report cited people familiar with the matter.

Ohio-based utility American Electric Power Co. Inc.

AEP,

earlier this week announced a deal with Icahn to give the activist investor two board seats at the company.

Icahn disclosed his stake on JetBlue late Monday, saying that the airline’s stock was “undervalued and represented an attractive investment opportunity.”

The type of U.S. Securities and Exchange Commission filing, Schedule 13D, reflected some intent to influence the direction of the company, rather than the more commonly seen document, Schedule 13G.

Funds owned by billionaire investor and philanthropist George Soros disclosed new stakes in JetBlue and other low-cost U.S. airlines earlier this week, a bet on continued demand for leisure air travel.

JetBlue is appealing a court ruling blocking its merger with ultra-low-cost Spirit Airlines Inc.

SAVE,

that cited competition concerns.

Also under appeal is an earlier court decision to block JetBlue and American Airlines Group Inc.’s

AAL,

Northeastern Alliance, also on grounds that it would stifle competition.

JetBlue’s board will expand to 13 directors with the additions of Lynn and Miller following its annual meeting, “12 of whom are expected to be independent,” the company said.

Fueled by the recent investments, JetBlue’s stock has soared 17% this week, compared with 1.5% gains for the U.S. Global Jets ETF

JETS

and contrasting with a weekly loss of 0.4% for the S&P 500 index

SPX.

In the past 12 months, however, JetBlue shares are off 19%, versus gains of about 22% for the S&P and roughly 0.2% for the ETF.